Today’s HELOC & Home Equity Loan Rates: December 22, 2025

Home equity loans and home equity lines of credit (HELOCs) allow homeowners to tap into the value of their homes. A home equity loan is a fixed-rate, lump-sum loan that allows homeowners to borrow up to 85% of their home’s value and pay that amount back in monthly installments. A home equity line of credit is a variable-rate second mortgage that […]

High-Yield Savings Account Rates Today: December 22, 2025 – Rates Are Steady

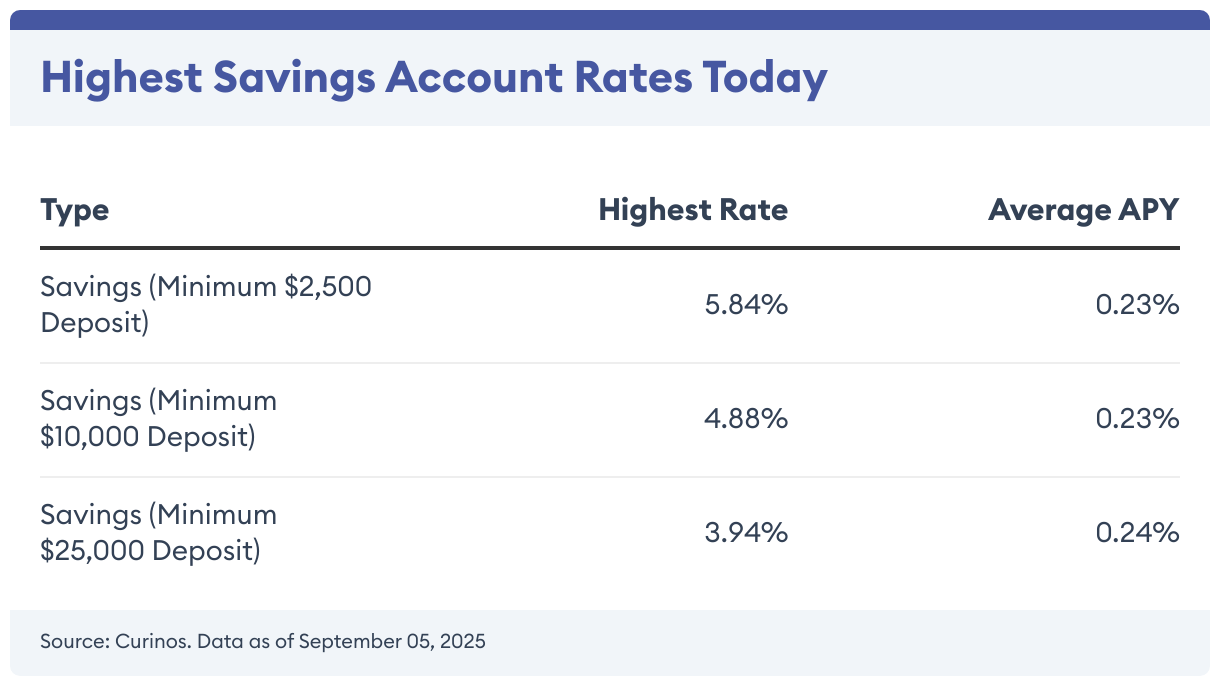

Key Takeaways Savings account yields are much higher than a few years ago Top rates may fall if the Federal Reserve cuts interest rates Online banks tend to offer the best yields available Rates on savings accounts have held steady since last week. You can now earn as much as 5.84% on your savings. Shopping for an […]

Mortgage Refinance Rates Today: December 22, 2025 – No Movement On Rates

30-year fixed refinance mortgage rates didn’t move at 6.26% today, according to the Mortgage Research Center. For 15-year fixed refinance mortgages, the average rate is 5.29%, and for 20-year mortgages, the average is 6.02%. Related: Compare Current Refinance Rates !function(){“use strict”;window.addEventListener(“message”,(function(a){if(void 0!==a.data[“datawrapper-height”]){var e=document.querySelectorAll(“iframe”);for(var t in a.data[“datawrapper-height”])for(var r,i=0;r=e[i];i++)if(r.contentWindow===a.source){var d=a.data[“datawrapper-height”][t]+”px”;r.style.height=d}}}))}(); 30-Year Refinance Rates Drop 1.32% At 6.26%, the average rate on a 30-year fixed-rate […]

Money Market Interest Rates Today: December 22, 2025 – Rates At 4.22%

Key Takeaways The highest money market account rate available today is 4.22% Changes from the Fed or your bank can quickly change money market rates Online banks typically offer the most competitive yields on the market Current Money Market Rates Right now, the average money market rate sits at 0.49%, but the best rate today […]

Which Bank Of America Customized Cash 6% Category Is Right For You? A Quick Look At The Top Picks

If you want to earn high rewards with the opportunity to personalize which purchases earn the most, the Bank of America® Customized Cash Rewards credit card could be what you’re looking for if your spending lines up with its bonus categories. Let’s break those categories down and see why this card’s high earning rates could […]

10 Best High-Yield Savings Accounts: Up to 5.00% APY

If your savings are currently sitting in a low-yield account, you’re missing out on easy earnings. To help you find the right high-yield savings account for you, we compared 370 accounts on factors including interest rates, fees, accessibility and overall trustworthiness. See which high-yield savings accounts performed best and find out the latest news on […]

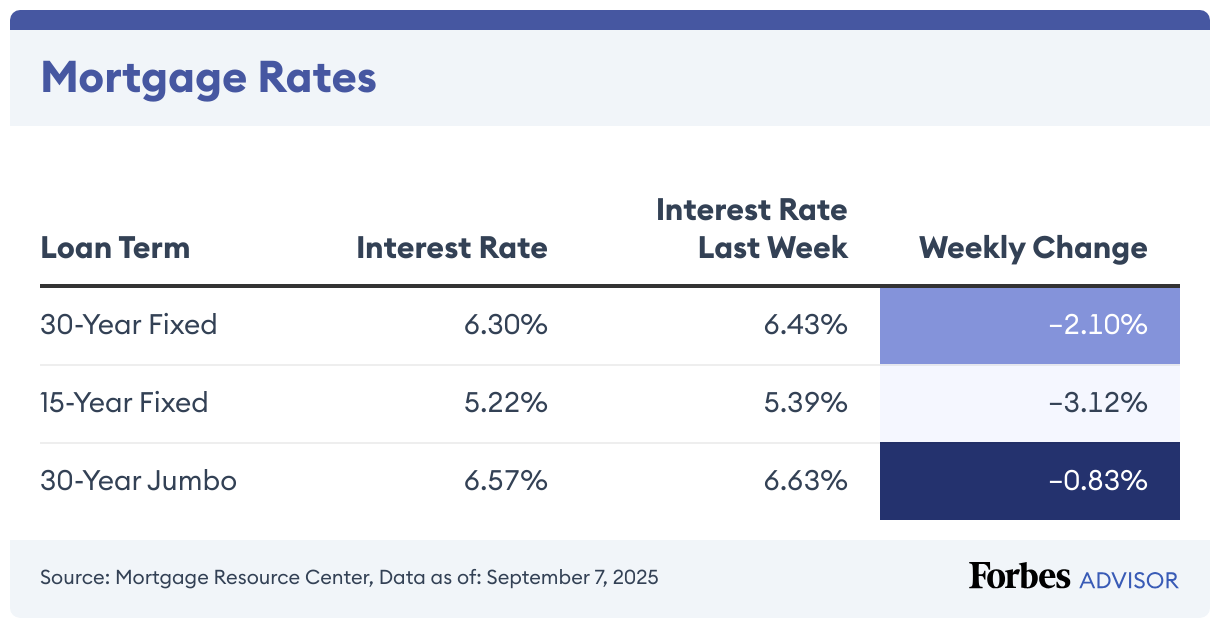

Mortgage Rates Today: December 18, 2025 – Rates Move Lower

The current average mortgage rate on a 30-year fixed mortgage is 6.21%, according to the Mortgage Research Center. The average rate on a 15-year mortgage is 5.37%, while the average rate on a 30-year jumbo mortgage is 6.37%. 30-Year Mortgage Rates Drop 2.22% Borrowers paid an average rate of 6.21% on a 30-year mortgage. This was down from the previous […]

Today’s Mortgage Refinance Rates: December 18, 2025 – Rates Decline

The rate on a 30-year fixed refinance dropped to 6.28% today, according to the Mortgage Research Center. The average rate on a 15-year mortgage refinance is 5.34%. On a 20-year mortgage refinance, the average rate is 6.07%. Related: Compare Current Refinance Rates !function(){“use strict”;window.addEventListener(“message”,(function(a){if(void 0!==a.data[“datawrapper-height”]){var e=document.querySelectorAll(“iframe”);for(var t in a.data[“datawrapper-height”])for(var r,i=0;r=e[i];i++)if(r.contentWindow===a.source){var d=a.data[“datawrapper-height”][t]+”px”;r.style.height=d}}}))}(); 30-Year Fixed Refinance Interest Rates Drop 2.51% The current […]

Mortgage Refinance Rates Today: December 16, 2025 – Rates Drop

The rate on a 30-year fixed refinance fell to 6.31% today, according to the Mortgage Research Center. Rates averaged 5.35% for a 15-year financed mortgage and 6.09% for a 20-year financed mortgage. Related: Compare Current Refinance Rates !function(){“use strict”;window.addEventListener(“message”,(function(a){if(void 0!==a.data[“datawrapper-height”]){var e=document.querySelectorAll(“iframe”);for(var t in a.data[“datawrapper-height”])for(var r,i=0;r=e[i];i++)if(r.contentWindow===a.source){var d=a.data[“datawrapper-height”][t]+”px”;r.style.height=d}}}))}(); 30-Year Fixed-Rate Mortgage Refinance Rates Drop 0.65% Currently, the average rate for a 30-year, fixed-rate mortgage […]

CD Rates Today: December 16, 2025 – Take Home Up To 4.94%

Key Takeaways Today’s highest CD rate is 4.94% for a jumbo 6-month CD. CD rates from online banks are commonly twice as high as the national average rates. CD ladders let you leverage high rates without locking up all of your money long-term. A CD is a particular type of savings account that pays a […]