Mortgage Rates Today: January 6, 2026 – 30-Year And 15-Year Rates Stand Still

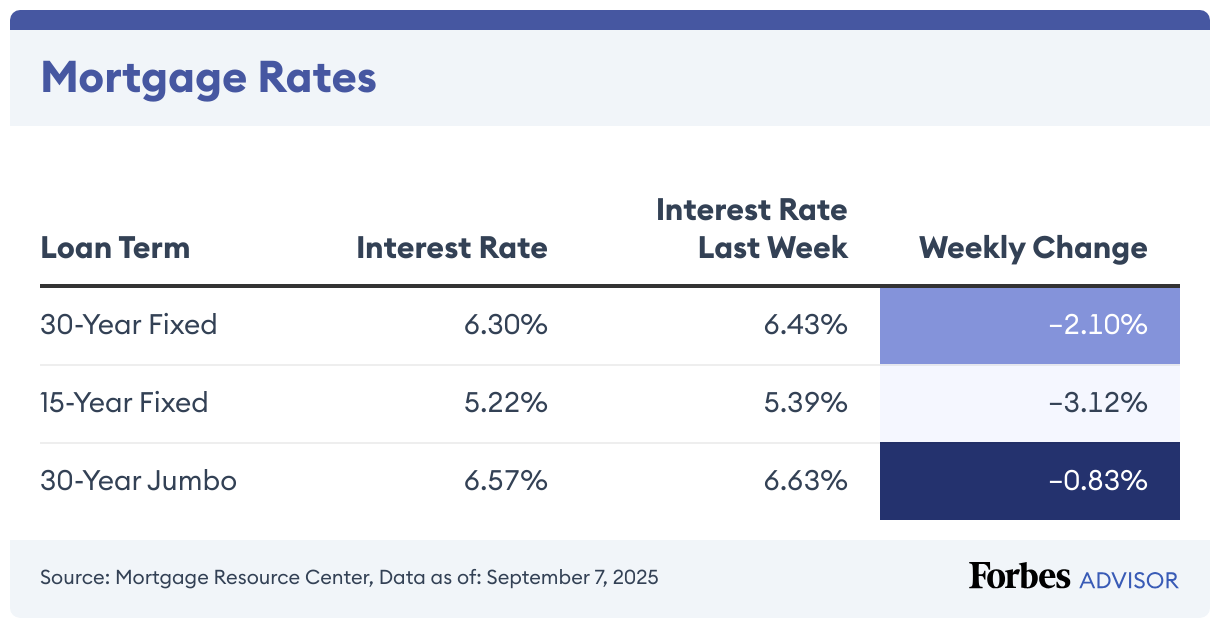

Currently, the average interest rate on a 30-year fixed mortgage is 6.17%, compared to 6.12% a week ago, according to the Mortgage Research Center. For borrowers who want to pay off their home faster, the average rate on a 15-year fixed mortgage is 5.31%, up 0.26% from the previous week. If you’re thinking about refinancing to lock in a lower rate, […]

Mortgage Rates Today: January 5, 2026 – 30-Year And 15-Year Rates Stand Still

The current average mortgage rate on a 30-year fixed mortgage is 6.18%, compared to 6.16% a week earlier, according to the Mortgage Research Center. For borrowers who want a shorter mortgage, the average rate on a 15-year fixed mortgage is 5.32%, up 0.02% from the previous week. If you want to lock in a lower rate by refinancing, compare […]

CD Rates Today: January 5, 2026 – Take Home Up To 4.94%

Key Takeaways Today’s highest CD rate is 4.94% for a jumbo 6-month CD. CD rates from online banks are commonly twice as high as the national average rates. CD ladders let you leverage high rates without locking up all of your money long-term. A CD is a specific type of savings account (known as a time deposit […]

High-Yield Savings Account Rates Today: January 5, 2026 – Rates Are Steady

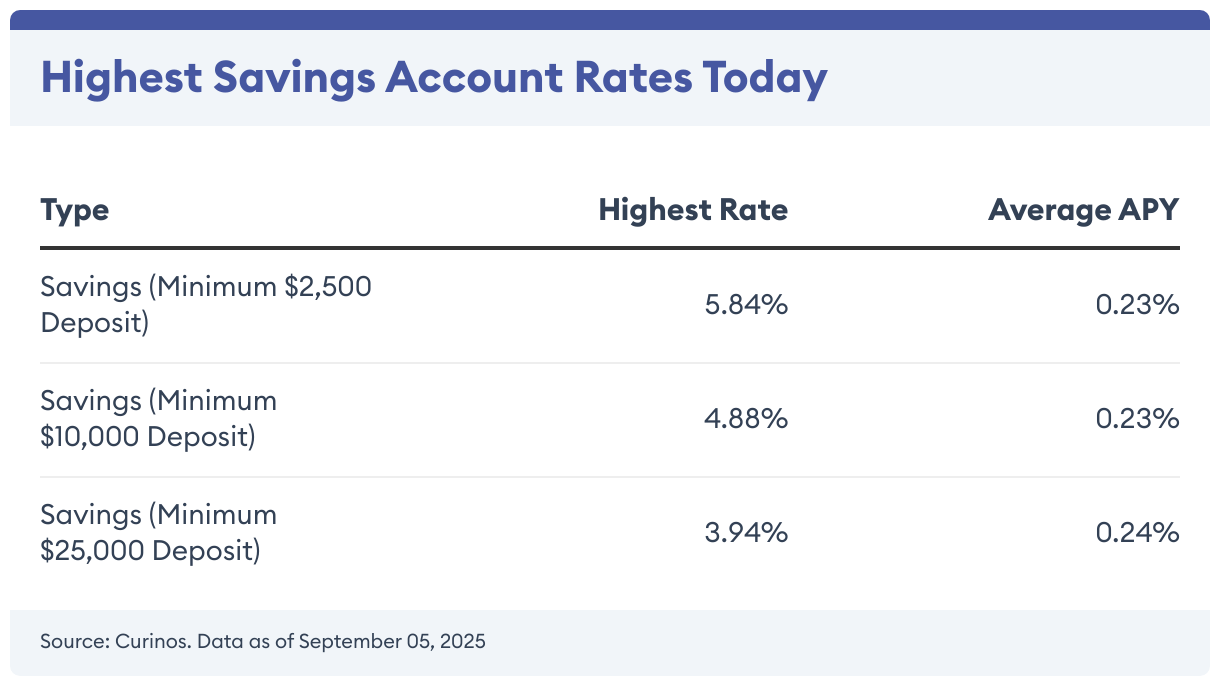

Key Takeaways Savings account yields are much higher than a few years ago Top rates may fall if the Federal Reserve cuts interest rates Online banks tend to offer the best yields available Rates on savings accounts are relatively unchanged from a week ago. You can now earn up to 5.84% on your savings. Searching for an […]

Money Market Interest Rates Today: January 5, 2026 – Rates At 4.22%

Key Takeaways The highest money market account rate available today is 4.22% Changes from the Fed or your bank can quickly change money market rates Online banks typically offer the most competitive yields on the market Current Money Market Rates As of today, the highest money market rate is 4.22%, compared to a national average […]

Here Are Today’s Mortgage Refinance Rates: January 5, 2026 – No Movement On Rates

30-year fixed refinance mortgage rates stayed flat at 6.23% today, according to the Mortgage Research Center. The 15-year, fixed-rate refinance mortgage average rate is 5.28%. For 20-year mortgage refinances, the average rate is 5.99%. Related: Compare Current Refinance Rates !function(){“use strict”;window.addEventListener(“message”,(function(a){if(void 0!==a.data[“datawrapper-height”]){var e=document.querySelectorAll(“iframe”);for(var t in a.data[“datawrapper-height”])for(var r,i=0;r=e[i];i++)if(r.contentWindow===a.source){var d=a.data[“datawrapper-height”][t]+”px”;r.style.height=d}}}))}(); 30-Year Refinance Rates Climb 0.48% Currently, the average rate for a 30-year, […]

Current HELOC & Home Equity Loan Rates: January 5, 2026

Home equity loans and home equity lines of credit (HELOCs) allow homeowners to tap into the value of their homes. A home equity loan is a fixed-rate, lump-sum loan that allows homeowners to borrow up to 85% of their home’s value and pay that amount back in monthly installments. A home equity line of credit is a variable-rate second mortgage that […]

Are Digital Banks The Allies Small Businesses Need Right Now?

Running a business costs money and time, so every fee, slow process or delay can be a direct hit to the potential growth of your small business. Because of this, the game is often no longer about finding a passive place to store money, but about choosing a financial ally that’s built to help you […]

Today’s Top Money Market Account Rates For December 31, 2025 – Rates Hit 4.22%

Key Takeaways The highest money market account rate available today is 4.22% Changes from the Fed or your bank can quickly change money market rates Online banks typically offer the most competitive yields on the market Current Money Market Rates Right now, the average money market rate sits at 0.49%, but the best rate today […]

Mortgage Refinance Rates Today: December 31, 2025 – Rates Move Up

The rate on a 30-year fixed refinance increased to 6.21% today, according to the Mortgage Research Center. For 15-year fixed refinance mortgages, the average rate is 5.29%, and for 20-year mortgages, the average is 5.99%. Related: Compare Current Refinance Rates !function(){“use strict”;window.addEventListener(“message”,(function(a){if(void 0!==a.data[“datawrapper-height”]){var e=document.querySelectorAll(“iframe”);for(var t in a.data[“datawrapper-height”])for(var r,i=0;r=e[i];i++)if(r.contentWindow===a.source){var d=a.data[“datawrapper-height”][t]+”px”;r.style.height=d}}}))}(); 30-Year Refinance Rates Drop 1.97% At 6.21%, the average rate on […]