Best Banks For Small Business Loans Of 2025

Compare the Best Banks for Business Loans of 2025 TD Bank Small Business Loan 5.0 Learn More From participating partners via businessloans.com’s website Loan Amounts $10,000 to $1 million Apr 8% to 16% Minimum Credit Score 615 Chase Small Business Loan 4.2 Get Matched Now Via Forbes Advisor Loan Amounts $5,000 to $500,000 Apr Not […]

Private Student Loan Rates: November 24, 2025—Loan Rates Jump Up

Last week, the average interest rate on 10-year fixed-rate private student loans moved up. /*! purgecss start ignore */.tns-outer{padding:0!important}.tns-outer [hidden]{display:none!important}.tns-outer [aria-controls],.tns-outer [data-action]{cursor:pointer}.tns-slider{transition:all 0s}.tns-slider>.tns-item{box-sizing:border-box}.tns-horizontal.tns-subpixel{white-space:nowrap}.tns-horizontal.tns-subpixel>.tns-item{display:inline-block;vertical-align:top;white-space:normal}.tns-horizontal.tns-no-subpixel:after{clear:both;content:””;display:table}.tns-horizontal.tns-no-subpixel>.tns-item{float:left}.tns-horizontal.tns-carousel.tns-no-subpixel>.tns-item{margin-right:-100%}.tns-gallery,.tns-no-calc{left:0;position:relative}.tns-gallery{min-height:1px}.tns-gallery>.tns-item{left:-100%;position:absolute;transition:transform 0s,opacity 0s}.tns-gallery>.tns-slide-active{left:auto!important;position:relative}.tns-gallery>.tns-moving{transition:all .25s}.tns-autowidth{display:inline-block}.tns-lazy-img{opacity:.6;transition:opacity .6s}.tns-lazy-img.tns-complete{opacity:1}.tns-ah{transition:height 0s}.tns-ovh{overflow:hidden}.tns-visually-hidden{left:-10000em;position:absolute}.tns-transparent{opacity:0;visibility:hidden}.tns-fadeIn{filter:alpha(opacity=100);opacity:1;z-index:0}.tns-fadeOut,.tns-normal{filter:alpha(opacity=0);opacity:0;z-index:-1}.tns-vpfix{white-space:nowrap}.tns-vpfix>div,.tns-vpfix>li{display:inline-block}.tns-t-subp2{height:10px;margin:0 auto;overflow:hidden;position:relative;width:310px}.tns-t-ct{position:absolute;right:0;width:2333.3333333%;width:2333.33333%;width:2333.3333333333%}.tns-t-ct:after{clear:both;content:””;display:table}.tns-t-ct>div{float:left;height:10px;width:1.4285714%;width:1.42857%;width:1.4285714286%} /*! purgecss end ignore */@media (max-width:1023px){.small-card-rating.rate-fees-present{margin-top:-12px}}@media (max-width:370px){.small-card-rating.rate-fees-present{margin-top:0}}.small-card-rating .card-rating{align-items:center;background:#fff;border:1px solid #eee;border-radius:108px;box-shadow:0 4px 2px hsla(45,7%,44%,.04);display:flex;margin-top:15px;max-width:150px;padding:8px 13px;position:relative;z-index:9}.small-card-rating .card-rating.has-tooltip{cursor:pointer}@media (max-width:1023px){.small-card-rating .card-rating{margin-top:0}}.small-card-rating .card-rating .rating-value{color:#333;font-family:EuclidCircularB,sans-serif;font-size:24px;font-weight:600;letter-spacing:-.752688px;line-height:31px}.small-card-rating .card-rating .cc-rating-wrapper{background:url(“data:image/svg+xml;base64,PHN2ZyB3aWR0aD0iMTciIGhlaWdodD0iMTMiIHZpZXdCb3g9IjAgMCAxMyAxMyIgZmlsbD0ibm9uZSIgeG1sbnM9Imh0dHA6Ly93d3cudzMub3JnLzIwMDAvc3ZnIj48ZyBjbGlwLXBhdGg9InVybCgjYSkiPjxwYXRoIGQ9Im02LjM1NCAxLjUzIDEuNTUgMy4xNDEgMy40NjguNTA3LTIuNTA5IDIuNDQ0LjU5MiAzLjQ1Mi0zLjEtMS42My0zLjEwMiAxLjYzLjU5Mi0zLjQ1Mi0yLjUwOS0yLjQ0NCAzLjQ2OC0uNTA3IDEuNTUtMy4xNFoiIHN0cm9rZT0iI0RCREJEQiIgc3Ryb2tlLXdpZHRoPSIuNzUzIiBzdHJva2UtbGluZWNhcD0icm91bmQiIHN0cm9rZS1saW5lam9pbj0icm91bmQiLz48L2c+PGRlZnM+PGNsaXBQYXRoIGlkPSJhIj48cGF0aCBmaWxsPSIjZmZmIiB0cmFuc2Zvcm09InRyYW5zbGF0ZSguMzMzIC41MjYpIiBkPSJNMCAwaDEyLjA0M3YxMi4wNDNIMHoiLz48L2NsaXBQYXRoPjwvZGVmcz48L3N2Zz4=”) repeat-x 0 0;margin-bottom:5px;width:85px}.small-card-rating .card-rating .cc-rating{background:url(“data:image/svg+xml;base64,PHN2ZyB3aWR0aD0iMTciIGhlaWdodD0iMTMiIHZpZXdCb3g9IjAgMCAxMyAxMyIgZmlsbD0ibm9uZSIgeG1sbnM9Imh0dHA6Ly93d3cudzMub3JnLzIwMDAvc3ZnIj48ZyBjbGlwLXBhdGg9InVybCgjYSkiPjxwYXRoIGQ9Im02LjMxMSAxLjUzIDEuNTUgMy4xNDEgMy40NjguNTA3TDguODIgNy42MjJsLjU5MiAzLjQ1Mi0zLjEtMS42My0zLjEwMiAxLjYzLjU5Mi0zLjQ1Mi0yLjUwOS0yLjQ0NCAzLjQ2OC0uNTA3IDEuNTUtMy4xNFoiIGZpbGw9IiNGN0M3NDgiIHN0cm9rZT0iI0Y3Qzk0QSIgc3Ryb2tlLXdpZHRoPSIxLjAyNiIgc3Ryb2tlLWxpbmVjYXA9InJvdW5kIiBzdHJva2UtbGluZWpvaW49InJvdW5kIi8+PC9nPjxkZWZzPjxjbGlwUGF0aCBpZD0iYSI+PHBhdGggZmlsbD0iI2ZmZiIgdHJhbnNmb3JtPSJ0cmFuc2xhdGUoLjI5IC41MjYpIiBkPSJNMCAwaDEyLjA0M3YxMi4wNDNIMHoiLz48L2NsaXBQYXRoPjwvZGVmcz48L3N2Zz4=”);display:block;height:13px;max-width:100%;position:relative;width:0;z-index:2}.small-card-rating […]

Money Market Interest Rates Today: November 24, 2025 – Rates At 4.22%

Key Takeaways The highest money market account rate available today is 4.22% Changes from the Fed or your bank can quickly change money market rates Online banks typically offer the most competitive yields on the market Current Money Market Rates The current average money market rate is 0.5%, while the highest rate is up to […]

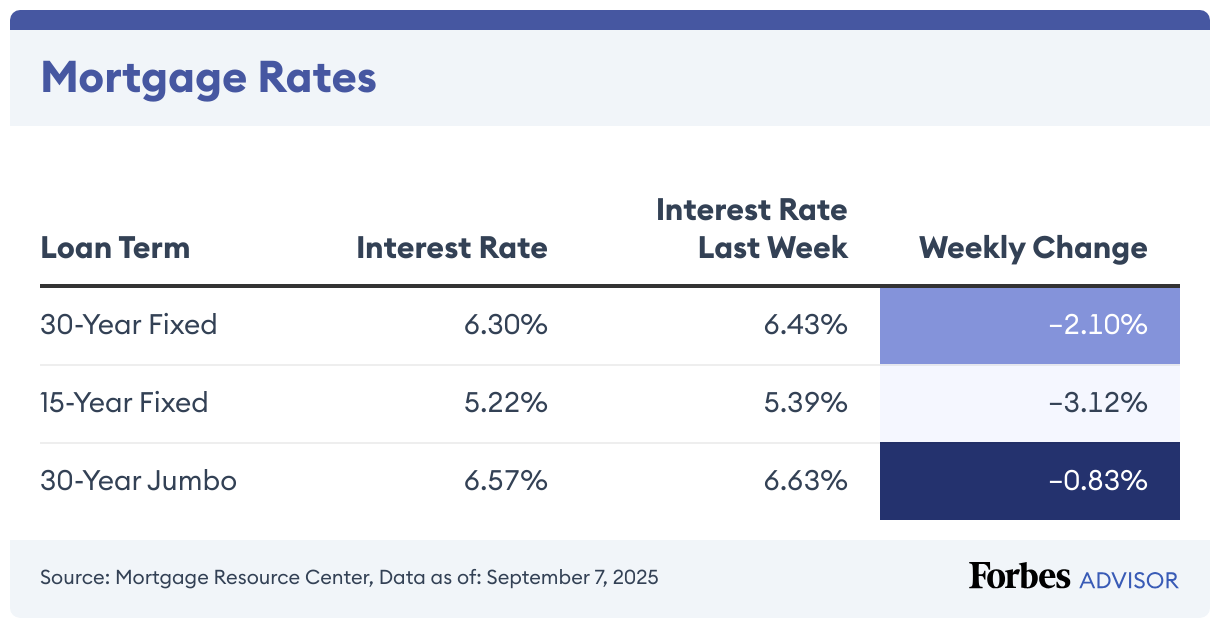

Mortgage Rates Today: November 24, 2025 – Rates Fall For 4th Straight Day

Currently, the average interest rate on a 30-year fixed mortgage is 6.28%, compared to 6.37% a week ago, according to the Mortgage Research Center. For borrowers who want to pay off their home faster, the average rate on a 15-year fixed mortgage is 5.40%, down 1.05% from the previous week. Homeowners who want to lock […]

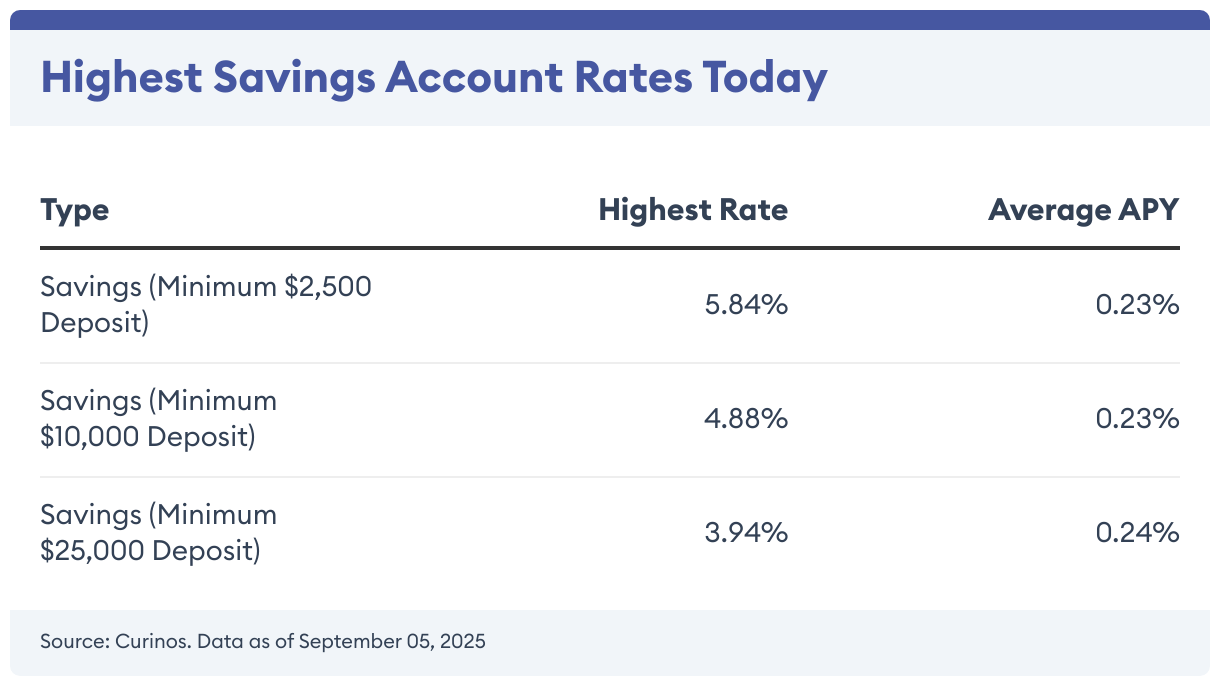

High-Yield Savings Account Rates Today: November 24, 2025 – Rates Are Steady

Key Takeaways Savings account yields are much higher than a few years ago Top rates may fall if the Federal Reserve cuts interest rates Online banks tend to offer the best yields available Rates on savings accounts are about the same compared to a week ago. You can now earn as much as 5.84% on […]

Mortgage Refinance Rates Today: November 24, 2025 – No Movement On Rates

30-year fixed refinance mortgage rates didn’t budge at 6.37% today, according to the Mortgage Research Center. For 15-year fixed refinance mortgages, the average rate is 5.37%, and for 20-year mortgages, the average is 6.08%. Related: Compare Current Refinance Rates !function(){“use strict”;window.addEventListener(“message”,(function(a){if(void 0!==a.data[“datawrapper-height”]){var e=document.querySelectorAll(“iframe”);for(var t in a.data[“datawrapper-height”])for(var r,i=0;r=e[i];i++)if(r.contentWindow===a.source){var d=a.data[“datawrapper-height”][t]+”px”;r.style.height=d}}}))}(); 30-Year Refinance Rates Drop 0.87% Currently, the […]

CD Rates Today: November 24, 2025 – Earn As Much As 4.94%

Key Takeaways Today’s highest CD rate is 4.94% for a jumbo 6-month CD. CD rates from online banks are commonly twice as high as the national average rates. CD ladders let you leverage high rates without locking up all of your money long-term. A CD is a kind of savings account with a fixed interest […]

Latest HELOC & Home Equity Loan Rates: November 24, 2025

Home equity loans and home equity lines of credit (HELOCs) allow homeowners to tap into the value of their homes. A home equity loan is a fixed-rate, lump-sum loan that allows homeowners to borrow up to 85% of their home’s value and pay that amount back in monthly installments. A home equity line of credit […]

Best Business Credit Cards 2026: What’s Ahead For Business Owners?

Whether you’re running a side hustle or a large company, getting one of the best business credit cards in 2026 could save you time and money. Issuers have been rolling out richer benefits, smarter expense tracking tools and more flexible financing options to meet modern business needs. If you’ll be in the market for a […]

Money Market Interest Rates Today: November 20, 2025 – Earn Up To 4.22%

Key Takeaways The highest money market account rate available today is 4.22% Changes from the Fed or your bank can quickly change money market rates Online banks typically offer the most competitive yields on the market Current Money Market Rates Right now, the average money market rate sits at 0.5%, but the best rate today […]