Money Market Interest Rates Today: November 26, 2025 – Earn Up To 4.22%

Key Takeaways The highest money market account rate available today is 4.22% Changes from the Fed or your bank can quickly change money market rates Online banks typically offer the most competitive yields on the market Current Money Market Rates The current average money market rate is 0.5%, while the highest rate is up to […]

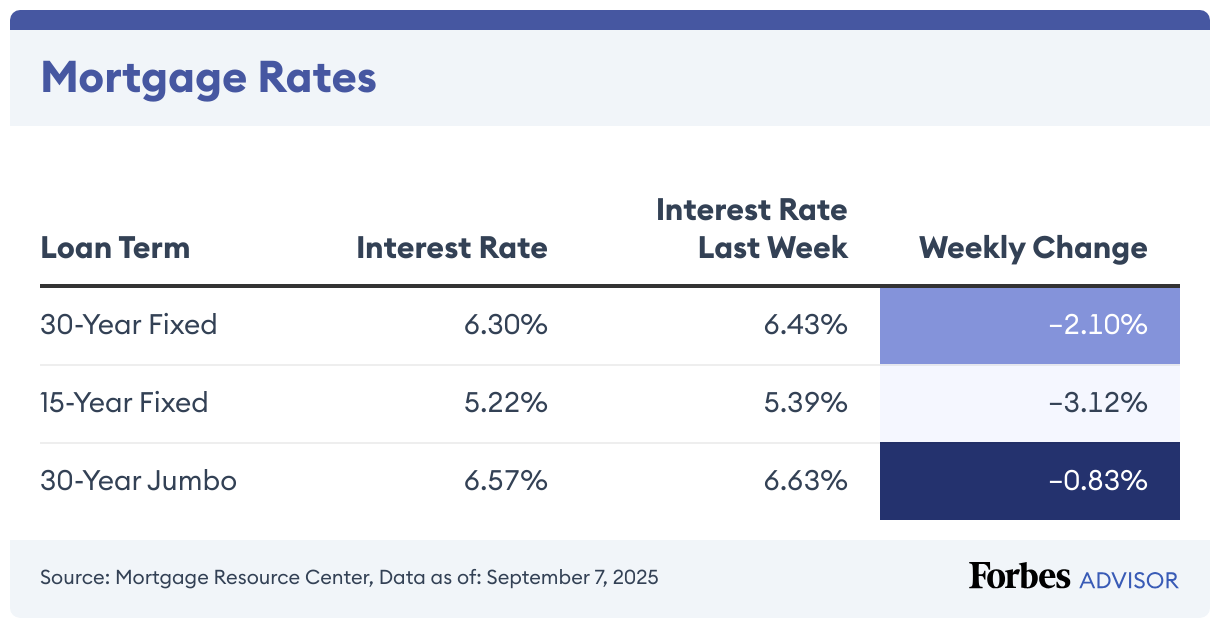

Mortgage Rates Today: November 26, 2025 – Rates Fall For 6th Straight Day

The current average mortgage rate on a 30-year fixed mortgage is 6.21%, according to the Mortgage Research Center. The average rate on a 15-year mortgage is 5.34%, while the average rate on a 30-year jumbo mortgage is 6.77%. 30-Year Mortgage Rates Drop 2.36% Today’s average rate on a 30-year mortgage (fixed-rate) decreased to 6.21% from 6.24% yesterday. Last week, the […]

CD Rates Today: November 26, 2025 – Rates As High As 4.94%

Key Takeaways Today’s highest CD rate is 4.94% for a jumbo 6-month CD. CD rates from online banks are commonly twice as high as the national average rates. CD ladders let you leverage high rates without locking up all of your money long-term. A CD is a kind of savings account with a fixed interest rate for […]

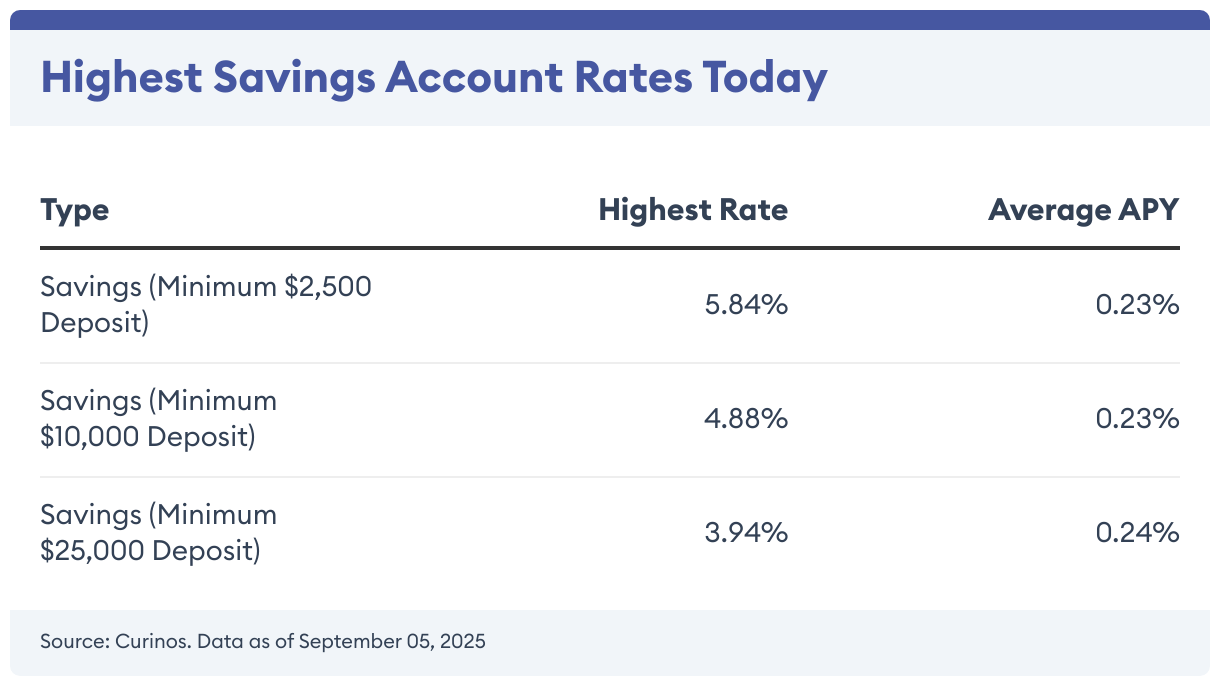

High-Yield Savings Account Rates Today: November 26, 2025 – Rates Are Steady

Key Takeaways Savings account yields are much higher than a few years ago Top rates may fall if the Federal Reserve cuts interest rates Online banks tend to offer the best yields available Rates on savings accounts are about the same compared to last week. You can now earn as much as 5.84% on your […]

Latest HELOC & Home Equity Loan Rates: November 25, 2025

Home equity loans and home equity lines of credit (HELOCs) allow homeowners to tap into the value of their homes. A home equity loan is a fixed-rate, lump-sum loan that allows homeowners to borrow up to 85% of their home’s value and pay that amount back in monthly installments. A home equity line of credit […]

Today’s Mortgage Refinance Rates: November 25, 2025 – Rates Dip

The rate on a 30-year fixed refinance slipped to 6.34% today, according to the Mortgage Research Center. The 15-year, fixed-rate refinance mortgage average rate is 5.36%. For 20-year mortgage refinances, the average rate is 6.03%. Related: Compare Current Refinance Rates !function(){“use strict”;window.addEventListener(“message”,(function(a){if(void 0!==a.data[“datawrapper-height”]){var e=document.querySelectorAll(“iframe”);for(var t in a.data[“datawrapper-height”])for(var r,i=0;r=e[i];i++)if(r.contentWindow===a.source){var d=a.data[“datawrapper-height”][t]+”px”;r.style.height=d}}}))}(); 30-Year Fixed-Rate Mortgage Refinance Rates Drop […]

Mortgage Rates Today: November 25, 2025 – Rates Fall For 5th Straight Day

Today’s average mortgage rate on a 30-year fixed-rate mortgage is 6.24%, down 2.06% from the previous week, according to the Mortgage Research Center. Borrowers may be able to save on interest costs by going with a 15-year fixed mortgage, which will generally have a lower rate than a 30-year, fixed-rate home loan. The average APR on a 15-year fixed mortgage is 5.42%. But […]

Money Market Interest Rates Today: November 25, 2025 – Earn Up To 4.22%

Key Takeaways The highest money market account rate available today is 4.22% Changes from the Fed or your bank can quickly change money market rates Online banks typically offer the most competitive yields on the market Current Money Market Rates Right now, the average money market rate sits at 0.5%, but the best rate today […]

High-Yield Savings Account Rates Today: November 25, 2025 – Rates Are Steady

Key Takeaways Savings account yields are much higher than a few years ago Top rates may fall if the Federal Reserve cuts interest rates Online banks tend to offer the best yields available Rates on savings accounts are about the same since last week. You can now earn as much as 5.84% on your savings. Shopping for an account […]

CD Rates Today: November 25, 2025 Rates As High As 4.94%

Key Takeaways Today’s highest CD rate is 4.94% for a jumbo 6-month CD. CD rates from online banks are commonly twice as high as the national average rates. CD ladders let you leverage high rates without locking up all of your money long-term. A CD is a specific type of savings account (known as a time deposit […]