The Best Life Insurance Companies For Seniors Of 2025

Our Picks for the Best Life Insurance for Seniors Why You Can Trust Forbes Advisor Our editors are committed to bringing you unbiased ratings and information. Advertisers do not and cannot influence our ratings. We use data-driven methodologies to evaluate insurance companies, so all companies are measured equally. You can read more about our editorial […]

Private Student Loan Rates: December 8, 2025—Loan Rates Jump Up

Rates on 10-year fixed-rate private student loans jumped last week. Despite the rise, if you’re interested in getting a private student loan, you can still get a relatively low rate. /*! purgecss start ignore */.tns-outer{padding:0!important}.tns-outer [hidden]{display:none!important}.tns-outer [aria-controls],.tns-outer [data-action]{cursor:pointer}.tns-slider{transition:all 0s}.tns-slider>.tns-item{box-sizing:border-box}.tns-horizontal.tns-subpixel{white-space:nowrap}.tns-horizontal.tns-subpixel>.tns-item{display:inline-block;vertical-align:top;white-space:normal}.tns-horizontal.tns-no-subpixel:after{clear:both;content:””;display:table}.tns-horizontal.tns-no-subpixel>.tns-item{float:left}.tns-horizontal.tns-carousel.tns-no-subpixel>.tns-item{margin-right:-100%}.tns-gallery,.tns-no-calc{left:0;position:relative}.tns-gallery{min-height:1px}.tns-gallery>.tns-item{left:-100%;position:absolute;transition:transform 0s,opacity 0s}.tns-gallery>.tns-slide-active{left:auto!important;position:relative}.tns-gallery>.tns-moving{transition:all .25s}.tns-autowidth{display:inline-block}.tns-lazy-img{opacity:.6;transition:opacity .6s}.tns-lazy-img.tns-complete{opacity:1}.tns-ah{transition:height 0s}.tns-ovh{overflow:hidden}.tns-visually-hidden{left:-10000em;position:absolute}.tns-transparent{opacity:0;visibility:hidden}.tns-fadeIn{filter:alpha(opacity=100);opacity:1;z-index:0}.tns-fadeOut,.tns-normal{filter:alpha(opacity=0);opacity:0;z-index:-1}.tns-vpfix{white-space:nowrap}.tns-vpfix>div,.tns-vpfix>li{display:inline-block}.tns-t-subp2{height:10px;margin:0 auto;overflow:hidden;position:relative;width:310px}.tns-t-ct{position:absolute;right:0;width:2333.3333333%;width:2333.33333%;width:2333.3333333333%}.tns-t-ct:after{clear:both;content:””;display:table}.tns-t-ct>div{float:left;height:10px;width:1.4285714%;width:1.42857%;width:1.4285714286%} /*! purgecss end ignore */@media (max-width:1023px){.small-card-rating.rate-fees-present{margin-top:-12px}}@media (max-width:370px){.small-card-rating.rate-fees-present{margin-top:0}}.small-card-rating .card-rating{align-items:center;background:#fff;border:1px solid #eee;border-radius:108px;box-shadow:0 4px 2px hsla(45,7%,44%,.04);display:flex;margin-top:15px;max-width:150px;padding:8px 13px;position:relative;z-index:9}.small-card-rating […]

Today’s Mortgage Refinance Rates: December 8, 2025 – No Movement On Rates

30-year fixed refinance mortgage rates didn’t budge at 6.31% today, according to the Mortgage Research Center. The average rate on a 15-year mortgage refinance is 5.34%. On a 20-year mortgage refinance, the average rate is 6.03%. Related: Compare Current Refinance Rates !function(){“use strict”;window.addEventListener(“message”,(function(a){if(void 0!==a.data[“datawrapper-height”]){var e=document.querySelectorAll(“iframe”);for(var t in a.data[“datawrapper-height”])for(var r,i=0;r=e[i];i++)if(r.contentWindow===a.source){var d=a.data[“datawrapper-height”][t]+”px”;r.style.height=d}}}))}(); 30-Year Refinance Rates Climb 1.17% At […]

CD Rates Today: December 8, 2025 – Rates As High As 4.94%

Key Takeaways Today’s highest CD rate is 4.94% for a jumbo 6-month CD. CD rates from online banks are commonly twice as high as the national average rates. CD ladders let you leverage high rates without locking up all of your money long-term. A CD is a particular type of savings account that pays a fixed interest rate for […]

Latest HELOC & Home Equity Loan Rates: December 8, 2025

Home equity loans and home equity lines of credit (HELOCs) allow homeowners to tap into the value of their homes. A home equity loan is a fixed-rate, lump-sum loan that allows homeowners to borrow up to 85% of their home’s value and pay that amount back in monthly installments. A home equity line of credit is a variable-rate second mortgage that […]

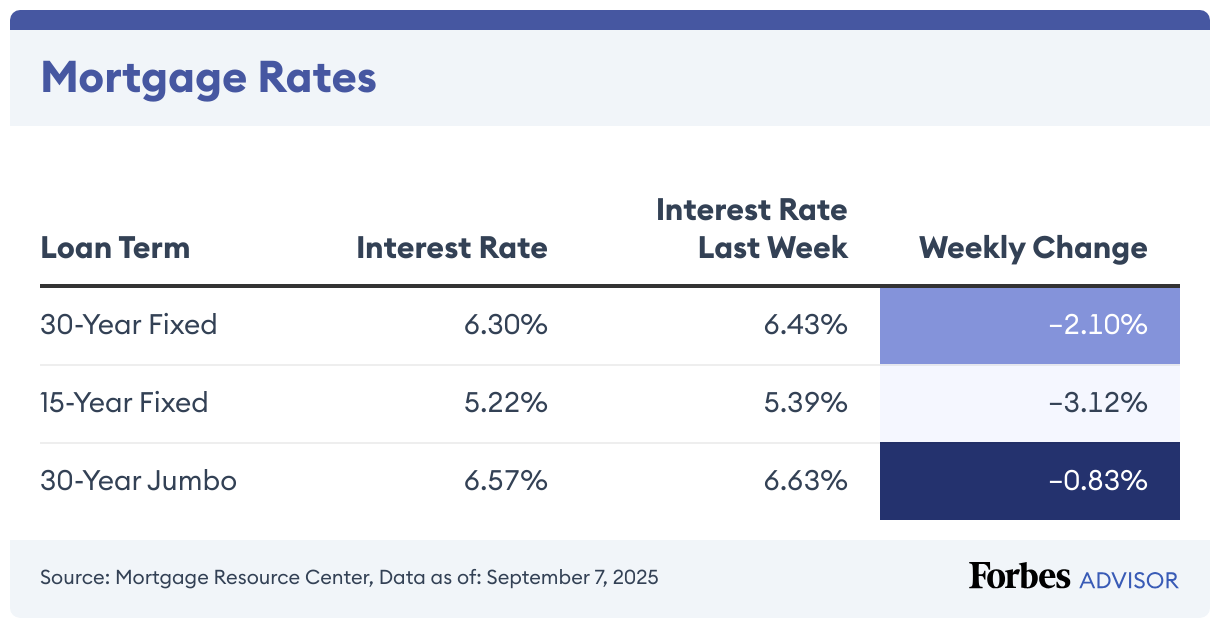

Mortgage Rates Today: December 8, 2025 – 30-Year And 15-Year Rates Hold Steady

The current mortgage rate on a 30-year fixed mortgage rose by 0.57% in the last week to 6.23%, according to the Mortgage Research Center. Meanwhile, the APR on a 15-year fixed mortgage climbed 0.06 percentage point during the same period to 5.37%. For existing homeowners, compare your current mortgage rates with today’s refinance rates. 30-Year Mortgage Rates Climb 0.57% Today’s average rate […]

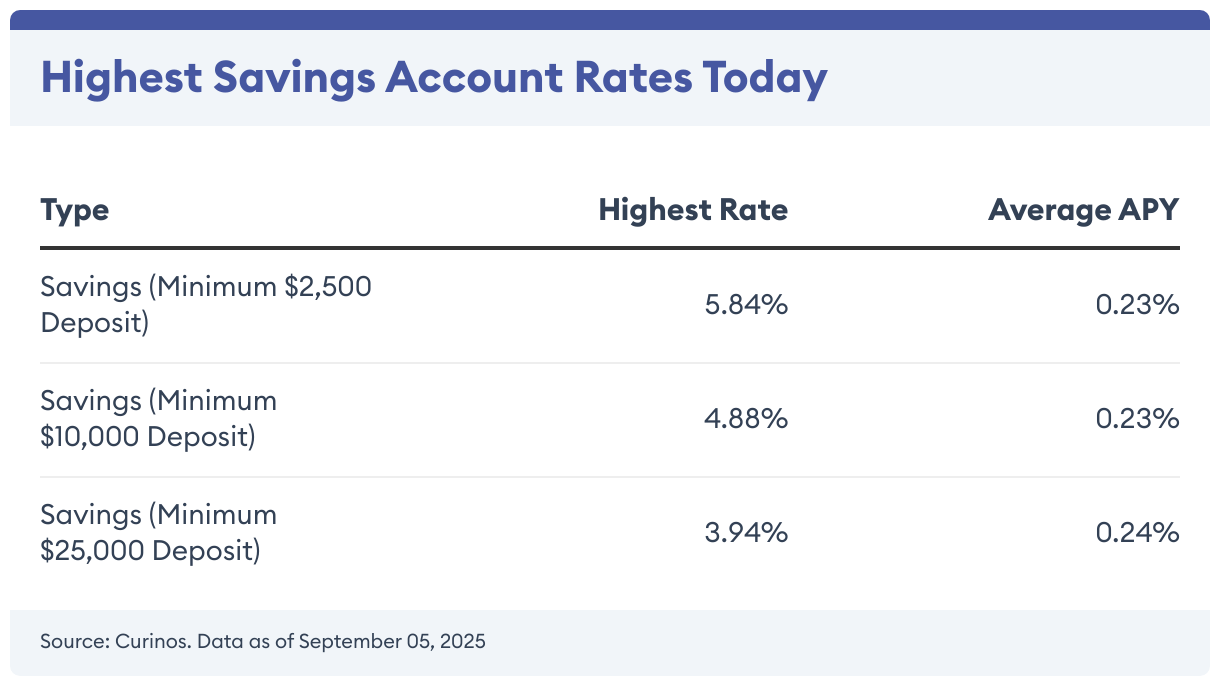

High-Yield Savings Account Rates Today: December 8, 2025 – Rates Are Steady

Key Takeaways Savings account yields are much higher than a few years ago Top rates may fall if the Federal Reserve cuts interest rates Online banks tend to offer the best yields available Rates on savings accounts are relatively unchanged from a week ago. You can now earn up to 5.84% on your savings. Shopping for an account where […]

Money Market Interest Rates Today: December 8, 2025 – Earn Up To 4.22%

Key Takeaways The highest money market account rate available today is 4.22% Changes from the Fed or your bank can quickly change money market rates Online banks typically offer the most competitive yields on the market Right now, the average money market rate sits at 0.5%, but the best rate today is 4.22%, according to Curinos. […]

Cheapest Home Warranty Companies Of 2025

Why you can trust Forbes Advisor We know that dozens of home warranty plans are available to homeowners, and sorting through all the fine print to choose the right one for your home can be frustrating. That’s why we’ve evaluated the top companies with the best plan value and compiled this list of the best […]

CD Rates Today: December 2, 2025 – Rates As High As 4.94%

Key Takeaways Today’s highest CD rate is 4.94% for a jumbo 6-month CD. CD rates from online banks are commonly twice as high as the national average rates. CD ladders let you leverage high rates without locking up all of your money long-term. A CD is a specific type of savings account (known as a time deposit account) that […]