This Week’s Personal Loan Rates: August 26, 2025—Rates Move Down

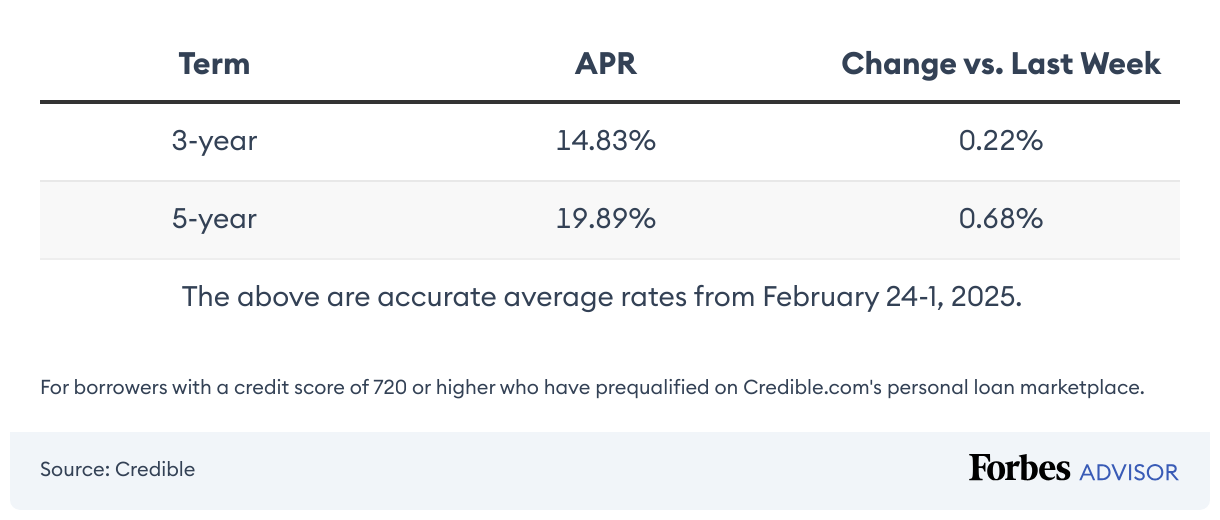

Last week, rates on personal loans decreased. Qualified borrowers can still pick up a decent interest rate, providing the opportunity to finance a project, a purchase or unexpected bills. For borrowers with a credit score of at least 720 who prequalified on Credible.com’s personal loan marketplace, the average interest rate on a three-year personal loan […]

High-Yield Savings Account Rates Today: August 26, 2025 – Rates Are Steady

Key Takeaways Savings account yields are much higher than a few years ago Top rates may fall if the Federal Reserve cuts interest rates Online banks tend to offer the best yields available Rates on savings accounts are the same compared to one week ago. You can now earn as much as 5.84% on your […]

Private Student Loan Rates: August 26, 2025—Loan Rates Start To Increase

The average interest rate on 10-year fixed-rate private student loans moved up last week. For borrowers pursuing private loans to fill in gaps to pay for higher education expenses, rates remain relatively low for borrowers with solid credit. /*! purgecss start ignore */.tns-outer{padding:0!important}.tns-outer [hidden]{display:none!important}.tns-outer [aria-controls],.tns-outer [data-action]{cursor:pointer}.tns-slider{transition:all 0s}.tns-slider>.tns-item{box-sizing:border-box}.tns-horizontal.tns-subpixel{white-space:nowrap}.tns-horizontal.tns-subpixel>.tns-item{display:inline-block;vertical-align:top;white-space:normal}.tns-horizontal.tns-no-subpixel:after{clear:both;content:””;display:table}.tns-horizontal.tns-no-subpixel>.tns-item{float:left}.tns-horizontal.tns-carousel.tns-no-subpixel>.tns-item{margin-right:-100%}.tns-gallery,.tns-no-calc{left:0;position:relative}.tns-gallery{min-height:1px}.tns-gallery>.tns-item{left:-100%;position:absolute;transition:transform 0s,opacity 0s}.tns-gallery>.tns-slide-active{left:auto!important;position:relative}.tns-gallery>.tns-moving{transition:all .25s}.tns-autowidth{display:inline-block}.tns-lazy-img{opacity:.6;transition:opacity .6s}.tns-lazy-img.tns-complete{opacity:1}.tns-ah{transition:height 0s}.tns-ovh{overflow:hidden}.tns-visually-hidden{left:-10000em;position:absolute}.tns-transparent{opacity:0;visibility:hidden}.tns-fadeIn{filter:alpha(opacity=100);opacity:1;z-index:0}.tns-fadeOut,.tns-normal{filter:alpha(opacity=0);opacity:0;z-index:-1}.tns-vpfix{white-space:nowrap}.tns-vpfix>div,.tns-vpfix>li{display:inline-block}.tns-t-subp2{height:10px;margin:0 auto;overflow:hidden;position:relative;width:310px}.tns-t-ct{position:absolute;right:0;width:2333.3333333%;width:2333.33333%;width:2333.3333333333%}.tns-t-ct:after{clear:both;content:””;display:table}.tns-t-ct>div{float:left;height:10px;width:1.4285714%;width:1.42857%;width:1.4285714286%} /*! purgecss […]

Latest HELOC & Home Equity Loan Rates: August 26, 2025

Home equity loans and home equity lines of credit (HELOCs) allow homeowners to tap into the value of their homes. A home equity loan is a fixed-rate, lump-sum loan that allows homeowners to borrow up to 85% of their home’s value and pay that amount back in monthly installments. A home equity line of credit […]

CD Rates Today: August 26, 2025 – Earn As Much As 4.94%

Key Takeaways Today’s highest CD rate is 4.94% for a jumbo 6-month CD. CD rates from online banks are commonly twice as high as the national average rates. CD ladders let you leverage high rates without locking up all of your money long-term. Today’s best interest rates on CDs (certificates of deposit) are as high […]

Today’s Top Money Market Account Rates For August 26, 2025 – Rates Hit 4.35%

Key Takeaways The highest money market account rate available today is 4.35% Changes from the Fed or your bank can quickly change money market rates Online banks typically offer the most competitive yields on the market Current Money Market Rates Right now, the average money market rate sits at 0.52%, but the best rate today […]

Mortgage Refinance Rates Today: August 26, 2025 – Rates Decrease

The rate on a 30-year fixed refinance slipped to 6.56% today, according to the Mortgage Research Center. The average rate on a 15-year mortgage refinance is 5.46%. On a 20-year mortgage refinance, the average rate is 6.33%. Related: Compare Current Refinance Rates !function(){“use strict”;window.addEventListener(“message”,(function(a){if(void 0!==a.data[“datawrapper-height”]){var e=document.querySelectorAll(“iframe”);for(var t in a.data[“datawrapper-height”])for(var r,i=0;r=e[i];i++)if(r.contentWindow===a.source){var d=a.data[“datawrapper-height”][t]+”px”;r.style.height=d}}}))}(); 30-Year Fixed-Rate Mortgage Refinance […]

Mortgage Rates Today: August 26, 2025 – Rates Hold Firm

The current mortgage rate on a 30-year fixed mortgage fell by 0.70% in the last week to 6.48%, according to the Mortgage Research Center. Meanwhile, the APR on a 15-year fixed mortgage dropped 0.04 percentage point during the same period to 5.47%. For existing homeowners, compare your current mortgage rates with today’s refinance rates. !function(){“use […]

Medical Students, Student Loans Cap Shouldn’t Stop You: How To Pay For School

Art can, sometimes unfortunately, mimic life. Of all the hospital shows aired, “Scrubs” may be the most accurate in its depiction of crippling medical debt. Characters J.D. and Turk, both medical interns, embody the real-world plight of American medical students, who will face more headwinds in financing their education starting next year, thanks to new […]

Serve Up VIP Perks: How Your Amex Card Elevates The 2025 U.S. Open

As the U.S. Open swings into action, the real ace off the courts comes courtesy of your wallet—specifically your American Express credit card. This year, American Express isn’t just sponsoring the event. It’s turning it into a full-blown member experience, with lounges, swag and unexpected perks that elevate the tournament from good seats to unforgettable […]