Today’s HELOC & Home Equity Loan Rates: December 26, 2025

Home equity loans and home equity lines of credit (HELOCs) allow homeowners to tap into the value of their homes. A home equity loan is a fixed-rate, lump-sum loan that allows homeowners to borrow up to 85% of their home’s value and pay that amount back in monthly installments. A home equity line of credit is a variable-rate second mortgage that […]

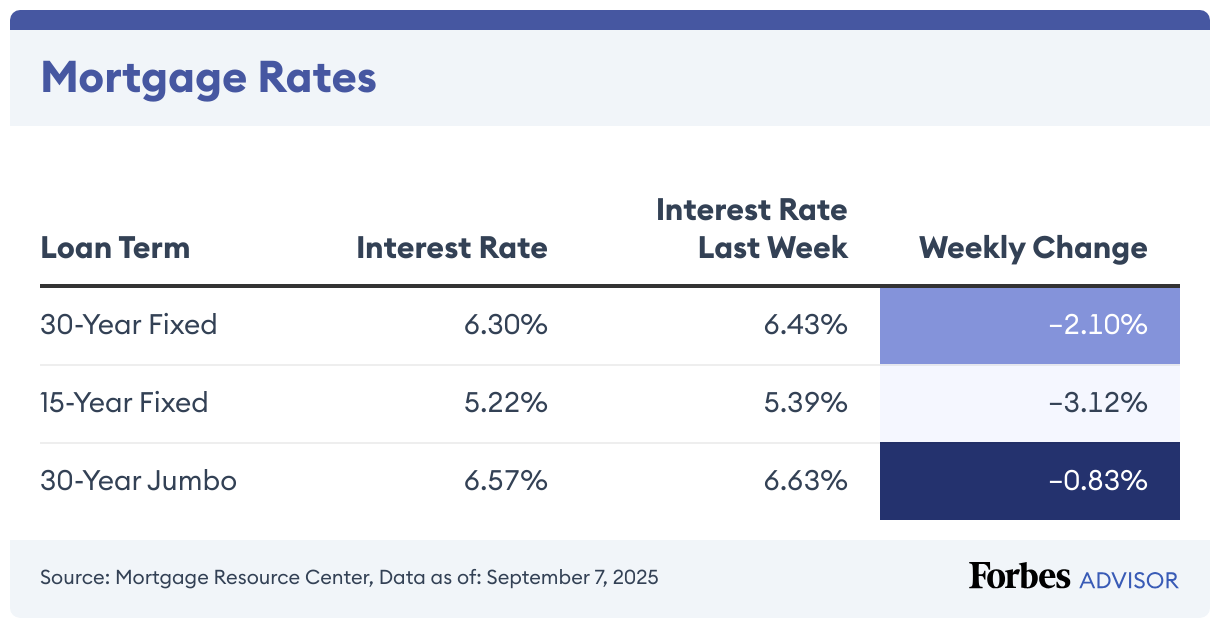

Mortgage Rates Today: December 23, 2025 – 30-Year Rate Hits One-Month Low

Thirty-year mortgage rates fell to a one-month low today. The current average mortgage rate on a 30-year fixed mortgage is 6.19%, compared to 6.25% a week earlier, according to the Mortgage Research Center. For borrowers who want a shorter mortgage, the average rate on a 15-year fixed mortgage is 5.35%, down 0.60% from the previous week. Homeowners who want […]

Today’s HELOC & Home Equity Loan Rates: December 23, 2025

Home equity loans and home equity lines of credit (HELOCs) allow homeowners to tap into the value of their homes. A home equity loan is a fixed-rate, lump-sum loan that allows homeowners to borrow up to 85% of their home’s value and pay that amount back in monthly installments. A home equity line of credit is a variable-rate second mortgage that […]

CD Rates Today: December 23, 2025 – Rates As High As 4.94%

Key Takeaways Today’s highest CD rate is 4.94% for a jumbo 6-month CD. CD rates from online banks are commonly twice as high as the national average rates. CD ladders let you leverage high rates without locking up all of your money long-term. A CD is a specific type of savings account (known as a time deposit […]

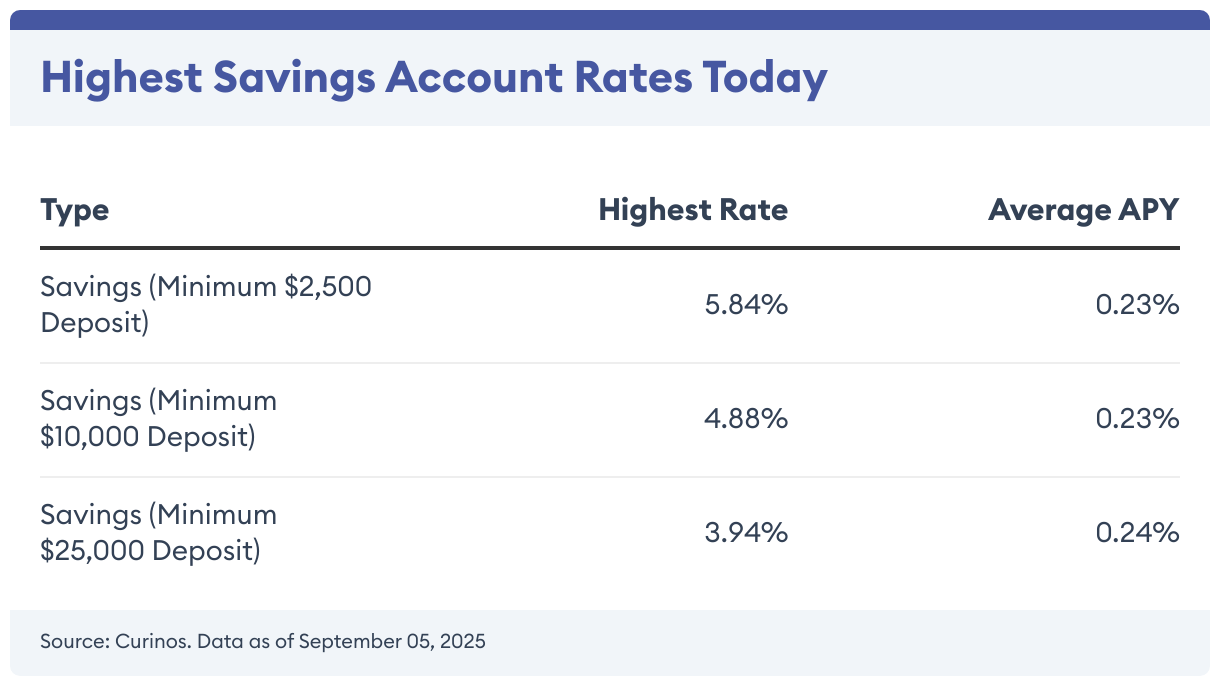

High-Yield Savings Account Rates Today: December 23, 2025 – Rates Are Steady

Key Takeaways Savings account yields are much higher than a few years ago Top rates may fall if the Federal Reserve cuts interest rates Online banks tend to offer the best yields available Rates on savings accounts have held steady from a week ago. You can now earn as much as 5.84% on your savings. In the market for […]

Current Mortgage Refinance Rates: December 23, 2025 – Rates Hold Steady

30-year fixed refinance mortgage rates stayed flat at 6.26% today, according to the Mortgage Research Center. Rates averaged 5.33% for a 15-year financed mortgage and 6% for a 20-year financed mortgage. Related: Compare Current Refinance Rates !function(){“use strict”;window.addEventListener(“message”,(function(a){if(void 0!==a.data[“datawrapper-height”]){var e=document.querySelectorAll(“iframe”);for(var t in a.data[“datawrapper-height”])for(var r,i=0;r=e[i];i++)if(r.contentWindow===a.source){var d=a.data[“datawrapper-height”][t]+”px”;r.style.height=d}}}))}(); 30-Year Fixed-Rate Mortgage Refinance Rates Drop 0.81% Currently, the average rate for a 30-year, fixed-rate mortgage refinance […]

Money Market Interest Rates Today: December 23, 2025 – Rates At 4.22%

Key Takeaways The highest money market account rate available today is 4.22% Changes from the Fed or your bank can quickly change money market rates Online banks typically offer the most competitive yields on the market Current Money Market Rates As of today, the highest money market rate is 4.22%, compared to a national average […]

10 Best Travel Insurance Companies For 2026

.hero-banner-v2-wrap{background:linear-gradient(180deg,var(–color-white-solid,#fff) 0,var(–color-grey-96,#f5f5f7) 100%);font-family:Work Sans,”sans-serif”;margin-bottom:20px;padding:24px 16px}@media screen and (min-width:1024px){.hero-banner-v2-wrap{margin-bottom:40px}}.hero-banner-v2-wrap .disclosure-wrap{display:flex;flex-direction:column;margin:0 auto 16px}@media screen and (min-width:768px){.hero-banner-v2-wrap .disclosure-wrap{margin:0 auto 24px}}@media screen and (min-width:1220px){.hero-banner-v2-wrap .disclosure-wrap{align-items:flex-start;flex-direction:row;justify-content:space-between;order:1}}.hero-banner-v2-wrap .disclosure-wrap .top-disclosure-text{color:#7f8b9a;font-size:12px;font-weight:400;line-height:18px;order:2}@media screen and (min-width:768px){.hero-banner-v2-wrap .disclosure-wrap .top-disclosure-text{font-size:12px;line-height:24px}}@media screen and (min-width:1220px){.hero-banner-v2-wrap .disclosure-wrap .top-disclosure-text{order:1}}.hero-banner-v2-wrap .disclosure-wrap .top-disclosure-text a{color:inherit;cursor:pointer;font-weight:600;text-decoration:underline}@media screen and (min-width:768px){.hero-banner-v2-wrap .disclosure-wrap .top-disclosure-text a{font-weight:700}}.hero-banner-v2-wrap .disclosure-wrap .advertiser-disclosure-wrap{cursor:pointer;margin-bottom:8px;min-width:160px;order:1}@media screen and (min-width:768px){.hero-banner-v2-wrap .disclosure-wrap .advertiser-disclosure-wrap{margin-bottom:0;text-align:end}}.hero-banner-v2-wrap .disclosure-wrap .advertiser-disclosure-item{color:#7f8b9a;display:inline;font-size:12px;font-weight:600;line-height:16px}.hero-banner-v2-wrap .disclosure-wrap .advertiser-disclosure-item:hover{text-decoration:underline}.hero-banner-v2-wrap .breadcrumbs-wrap{color:#383c43;font-family:Graphik,”sans-serif”;font-size:12px;font-weight:400;line-height:16px;margin-bottom:16px;text-transform:uppercase}.hero-banner-v2-wrap .title-wrap{color:#1e2125;font-family:SchnyderS,”sans-serif”;font-size:32px;font-weight:700;line-height:40px;margin-bottom:12px}@media […]

Mortgage Rates Today: December 22, 2025 – Rates Fall For 3rd Straight Day

The current average mortgage rate on a 30-year fixed mortgage is 6.20% with an APR of 6.22%, according to the Mortgage Research Center. The 15-year fixed mortgage has an average rate of 5.32% with an APR of 5.37%. On a 30-year jumbo mortgage, the average rate is 6.36% with an APR of 6.38%. 30-Year Mortgage Rates Drop 1.43% Borrowers will pay less in interest this week as the […]

CD Rates Today: December 22, 2025 – Take Home Up To 4.94%

Key Takeaways Today’s highest CD rate is 4.94% for a jumbo 6-month CD. CD rates from online banks are commonly twice as high as the national average rates. CD ladders let you leverage high rates without locking up all of your money long-term. A CD is a specific type of savings account (known as a time deposit […]