‘The White Lotus’ Experience, But Better: How Credit Cards Can Earn You Free Nights

The cast of “The White Lotus” could be headed to Europe for season four, with a high likelihood that the show will be shot at a Four Seasons resort. Fans of the show can book stays at hotel locations from the previous three seasons, and travelers can earn free or discounted stays with travel credit […]

Atmos Rewards Visa Signature Business Card Review 2025: Solid Travel Value for Frequent Flyers

The Alaska Airlines Atmos Rewards Visa® Business card* delivers helpful airline perks like a free checked bag for multiple travelers and the potential for an annual companion fare but falls short of delivering strong earning rates. For companies more focused on saving on airline incidentals, this card fits the bill.

Today’s HELOC & Home Equity Loan Rates: September 8, 2025

Home equity loans and home equity lines of credit (HELOCs) allow homeowners to tap into the value of their homes. A home equity loan is a fixed-rate, lump-sum loan that allows homeowners to borrow up to 85% of their home’s value and pay that amount back in monthly installments. A home equity line of credit […]

CD Rates Today: September 8, 2025 – Rates Move Lower

Key Takeaways Today’s highest CD rate is 4.94% for a jumbo 6-month CD. CD rates from online banks are commonly twice as high as the national average rates. CD ladders let you leverage high rates without locking up all of your money long-term. Today’s best interest rates on CDs (certificates of deposit) are as high […]

Today’s Top Money Market Account Rates For September 8, 2025 – Rates Hit 4.35%

Key Takeaways The highest money market account rate available today is 4.35% Changes from the Fed or your bank can quickly change money market rates Online banks typically offer the most competitive yields on the market Current Money Market Rates As of today, the highest money market rate is 4.35%, compared to a national average […]

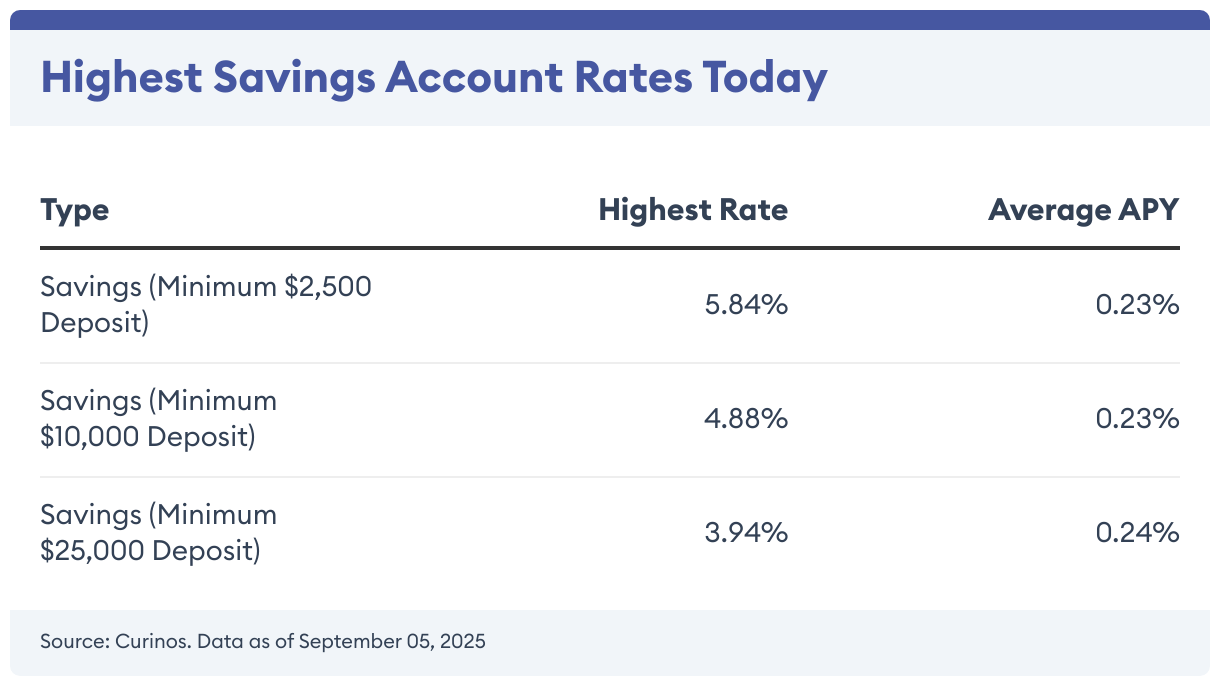

High-Yield Savings Account Rates Today: September 8, 2025 – Rates Are Steady

Key Takeaways Savings account yields are much higher than a few years ago Top rates may fall if the Federal Reserve cuts interest rates Online banks tend to offer the best yields available Rates on savings accounts have held steady versus a week ago. You can now earn as much as 5.84% on your savings. […]

Mortgage Refinance Rates Today: September 8, 2025 – No Movement On Rates

30-year fixed refinance mortgage rates didn’t move at 6.38% today, according to the Mortgage Research Center. The 15-year, fixed-rate refinance mortgage average rate is 5.21%. For 20-year mortgage refinances, the average rate is 6.05%. Related: Compare Current Refinance Rates !function(){“use strict”;window.addEventListener(“message”,(function(a){if(void 0!==a.data[“datawrapper-height”]){var e=document.querySelectorAll(“iframe”);for(var t in a.data[“datawrapper-height”])for(var r,i=0;r=e[i];i++)if(r.contentWindow===a.source){var d=a.data[“datawrapper-height”][t]+”px”;r.style.height=d}}}))}(); 30-Year Refinance Rates Drop 1.98% Currently, the […]

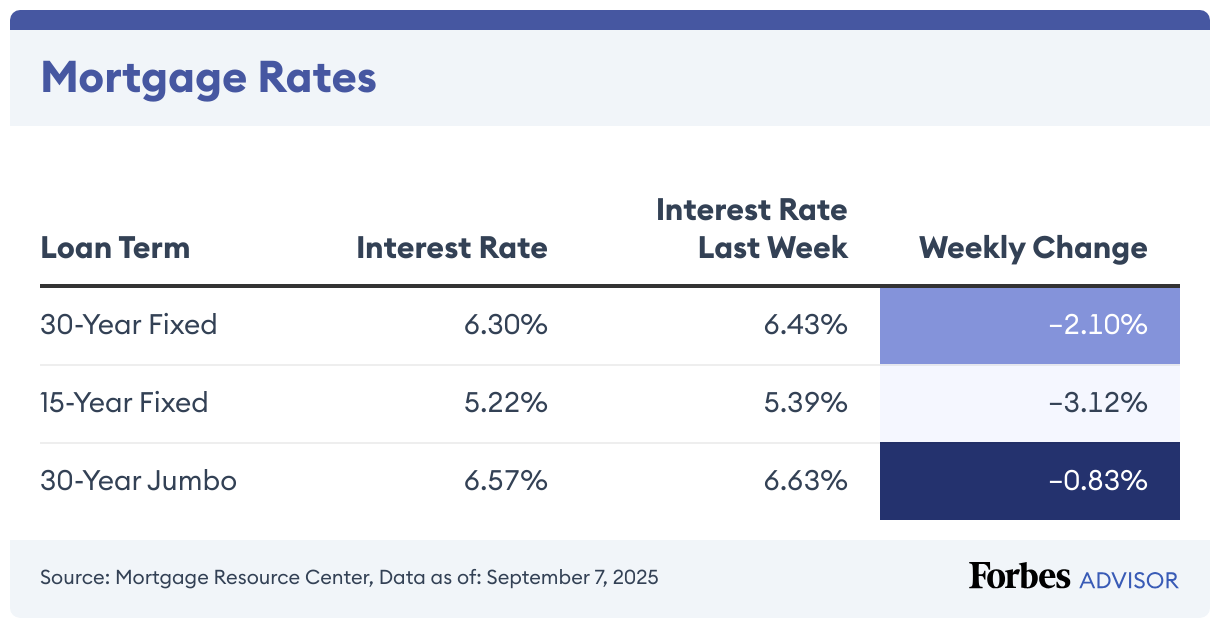

Mortgage Rates Today: September 8, 2025 – Rates Fall

The current mortgage rate on a 30-year fixed mortgage fell by 2.10% in the last week to 6.3%, according to the Mortgage Research Center. Meanwhile, the APR on a 15-year fixed mortgage dropped 0.17 percentage point during the same period to 5.22%. For existing homeowners, compare your current mortgage rates with today’s refinance rates. 30-Year […]

Over 1 Billion People Struggle With Mental Health—Is Your Insurer Here For You?

The World Health Organization’s (WHO) latest data reveals a startling fact: Over one billion people worldwide currently grapple with mental health disorders like anxiety and depression. These conditions rank as the second-largest cause of long-term disability globally. This alarming trend takes a serious toll. Mental health issues affect more than just quality of life—they place […]

Macy’s Stock Is Surging. Here’s How To Ride The Wave Before It’s Too Late

Macy’s stock has been climbing recently, helped by better-than-expected earnings and optimistic forecasts. As shopping habits change, Macy’s has been focusing on its online presence and loyalty programs, which have caught the attention of investors again. Knowing how to execute trades efficiently and cost-effectively matters if you want to get your foot in the investing […]