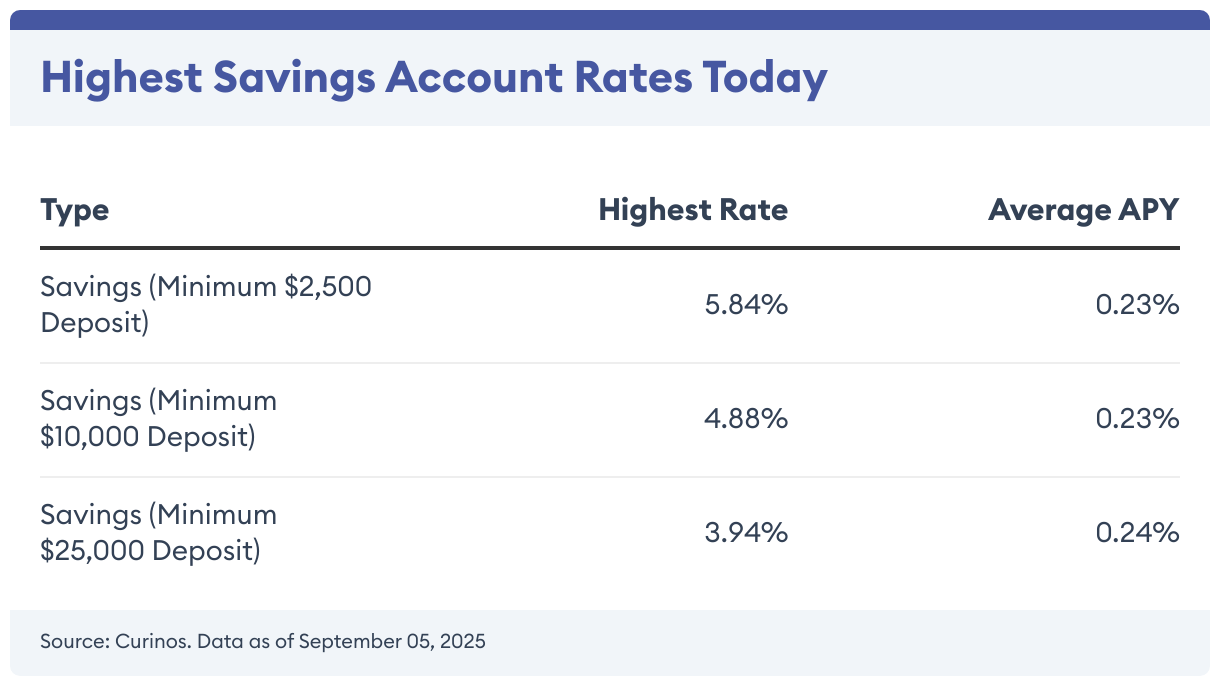

High-Yield Savings Account Rates Today: September 9, 2025 – Rates Are Steady

Key Takeaways Savings account yields are much higher than a few years ago Top rates may fall if the Federal Reserve cuts interest rates Online banks tend to offer the best yields available Rates on savings accounts are about the same from last week. You can now earn up to 5.50% on your savings. Searching […]

Today’s Mortgage Refinance Rates: September 9, 2025 – Rates Fall

The rate on a 30-year fixed refinance decreased to 6.31% today, according to the Mortgage Research Center. For 15-year fixed refinance mortgages, the average rate is 5.16%, and for 20-year mortgages, the average is 5.96%. Related: Compare Current Refinance Rates !function(){“use strict”;window.addEventListener(“message”,(function(a){if(void 0!==a.data[“datawrapper-height”]){var e=document.querySelectorAll(“iframe”);for(var t in a.data[“datawrapper-height”])for(var r,i=0;r=e[i];i++)if(r.contentWindow===a.source){var d=a.data[“datawrapper-height”][t]+”px”;r.style.height=d}}}))}(); 30-Year Fixed-Rate Mortgage Refinance Rates Drop […]

CD Rates Today: September 9, 2025 – Rates Slide

Key Takeaways Today’s highest CD rate is 4.94% for a jumbo 6-month CD. CD rates from online banks are commonly twice as high as the national average rates. CD ladders let you leverage high rates without locking up all of your money long-term. The best interest rates on CDs—certificates of deposit—pay up to 4.94% today, […]

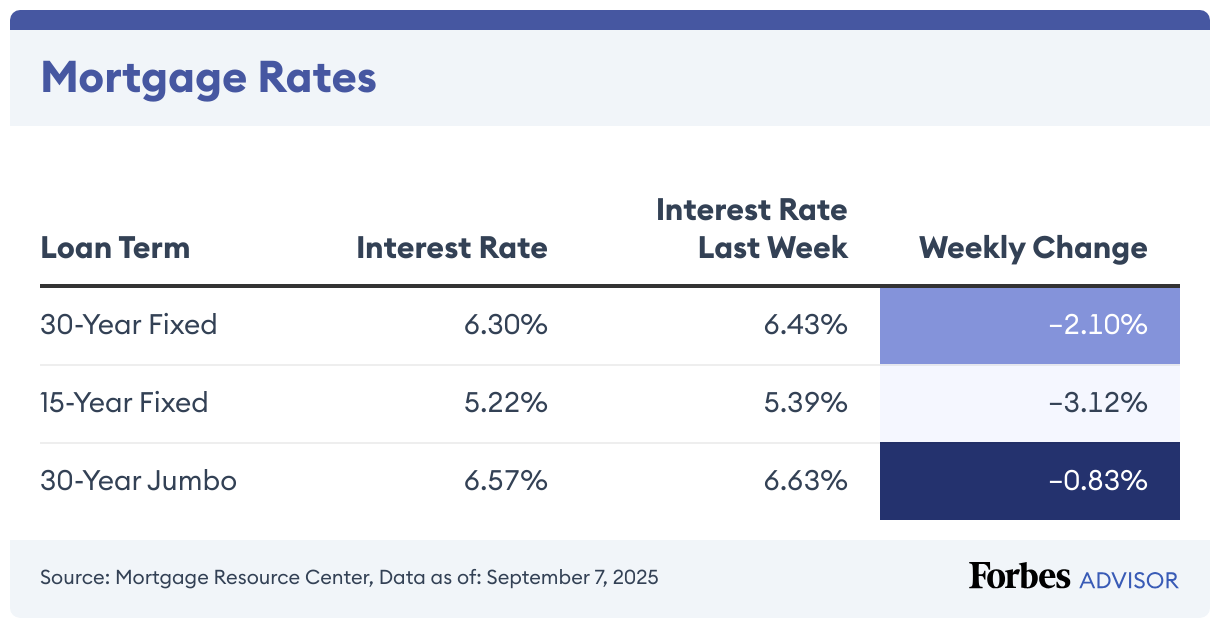

Mortgage Rates Today: September 9, 2025 – Rates Move Lower

Today’s average mortgage rate on a 30-year fixed-rate mortgage is 6.24%, down 3.03% from the previous week, according to the Mortgage Research Center. Borrowers may be able to save on interest costs by going with a 15-year fixed mortgage, which will generally have a lower rate than a 30-year, fixed-rate home loan. The average APR […]

Private Student Loan Rates: September 9, 2025—Loan Rates Fall

Rates on 10-year fixed-rate private student loans moved down last week. If you’re interested in picking up a private student loan, you can still get a relatively low rate. /*! purgecss start ignore */.tns-outer{padding:0!important}.tns-outer [hidden]{display:none!important}.tns-outer [aria-controls],.tns-outer [data-action]{cursor:pointer}.tns-slider{transition:all 0s}.tns-slider>.tns-item{box-sizing:border-box}.tns-horizontal.tns-subpixel{white-space:nowrap}.tns-horizontal.tns-subpixel>.tns-item{display:inline-block;vertical-align:top;white-space:normal}.tns-horizontal.tns-no-subpixel:after{clear:both;content:””;display:table}.tns-horizontal.tns-no-subpixel>.tns-item{float:left}.tns-horizontal.tns-carousel.tns-no-subpixel>.tns-item{margin-right:-100%}.tns-gallery,.tns-no-calc{left:0;position:relative}.tns-gallery{min-height:1px}.tns-gallery>.tns-item{left:-100%;position:absolute;transition:transform 0s,opacity 0s}.tns-gallery>.tns-slide-active{left:auto!important;position:relative}.tns-gallery>.tns-moving{transition:all .25s}.tns-autowidth{display:inline-block}.tns-lazy-img{opacity:.6;transition:opacity .6s}.tns-lazy-img.tns-complete{opacity:1}.tns-ah{transition:height 0s}.tns-ovh{overflow:hidden}.tns-visually-hidden{left:-10000em;position:absolute}.tns-transparent{opacity:0;visibility:hidden}.tns-fadeIn{filter:alpha(opacity=100);opacity:1;z-index:0}.tns-fadeOut,.tns-normal{filter:alpha(opacity=0);opacity:0;z-index:-1}.tns-vpfix{white-space:nowrap}.tns-vpfix>div,.tns-vpfix>li{display:inline-block}.tns-t-subp2{height:10px;margin:0 auto;overflow:hidden;position:relative;width:310px}.tns-t-ct{position:absolute;right:0;width:2333.3333333%;width:2333.33333%;width:2333.3333333333%}.tns-t-ct:after{clear:both;content:””;display:table}.tns-t-ct>div{float:left;height:10px;width:1.4285714%;width:1.42857%;width:1.4285714286%} /*! purgecss end ignore */@media (max-width:1023px){.small-card-rating.rate-fees-present{margin-top:-12px}}@media (max-width:370px){.small-card-rating.rate-fees-present{margin-top:0}}.small-card-rating .card-rating{align-items:center;background:#fff;border:1px solid #eee;border-radius:108px;box-shadow:0 4px […]

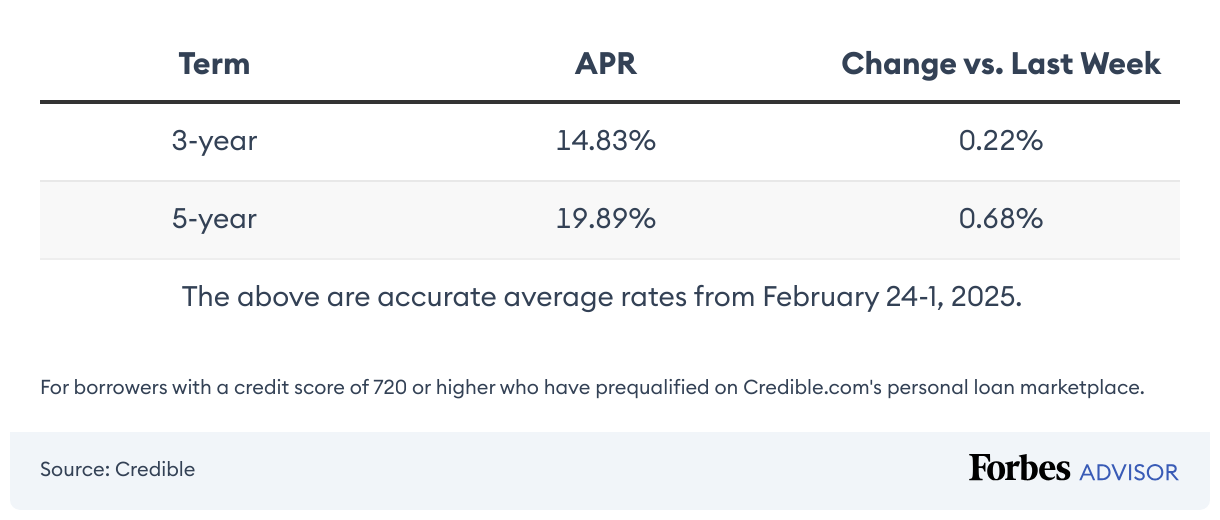

This Week’s Personal Loan Rates: September 9, 2025—Rates Are On The Rise

Rates on personal loans jumped last week. However, it’s still possible for highly qualified borrowers to pick up a reasonable interest rate on a personal loan. If you’re interested in financing a major purchase or project, it’s a good time to shop for a loan. For borrowers with a credit score of at least 720 […]

Airlines Won’t Have To Reimburse You For Flight Disruptions: How To Take The Reins

The Department of Transportation is scrapping a proposal that would have required airlines to compensate travelers for interrupted flights. While the proposal never went into effect, passengers can still protect against delays and cancellations with travel insurance. DOT Says You’re on Your Own The White House rejected a Biden-era proposal that would have required airlines […]

Earn Rewards While Watching Margot Robbie In ‘Wuthering Heights’: Here’s How

Emily Brontë’s tragic love story “Wuthering Heights” is getting the Emerald Fennell treatment, with a star-studded cast led by Margot Robbie and Jacob Elordi. The movie will be released in theatres next year, and fans can earn rewards as they settle in for the “Saltburn” director’s take on the time-old tale. Buzz of the […]

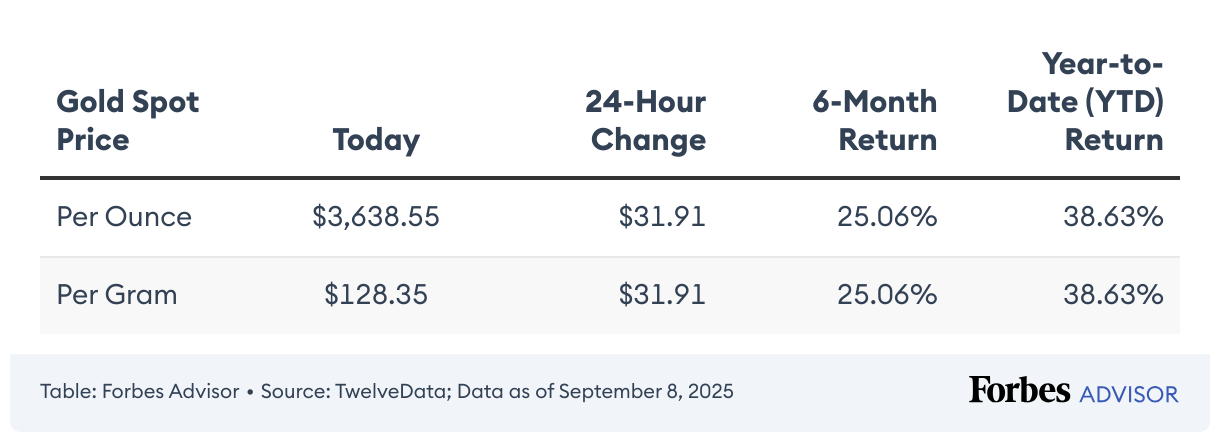

Gold Price Today: September 8, 2025

The price of gold today, as of 2:02 p.m. ET, was $3,638.55 per ounce. That’s up 0.88% in the past 24 hours. The lowest trading price within the last day: $3,588.12 per ounce. The highest gold spot price in the last 24 hours: $3,649.32 per ounce. Compared to last week, the price of gold is […]

Government Payments Will No Longer Be Sent Through Checks: What Chase Customers Need To Know

The federal government will soon stop distributing paper checks for federal payments after the Trump administration announced a move to pivot to a digital-only model. Chase Bank and other financial institution customers can prepare for the change by switching to checking accounts. How To Still Get That Paper President Donald Trump issued an executive order […]