Prime Lending Rates Dip: If You Have Excellent Credit, Now May Be The Best Time To Get A Loan

While boring, there’s a bountiful list of reasons to be the responsible friend in the group and nurture your credit score. Among them: Prime credit score borrowers can continue to get ahead as banks cut prime interest rates on Thursday, opening up more financial options. It’s Like a Reward National banks JP Morgan Chase, Wells […]

With Falling Interest Rates, Now May Be The Time To Tackle That Home Improvement Project

Home renovation costs can be high but well worth the investment. New interest rate cuts mean that homeowners can tap their home equity to tackle an improvement project like gutting their bathroom or sprucing up a guest bedroom. The Federal Reserve lowered its target interest rate by a quarter point Wednesday, which means that banks […]

Prime Credit Score Borrowers: Here’s Why Now Is The Best Time To Get A Business Loan

Advantageous interest rates can only benefit you, as they help keep your credit score high and make loan payments more manageable. Borrowers with great credit will reap these benefits as banks cut prime interest rates, making it the perfect time to invest in a business, if you feel so inclined. Prime Time Following the September […]

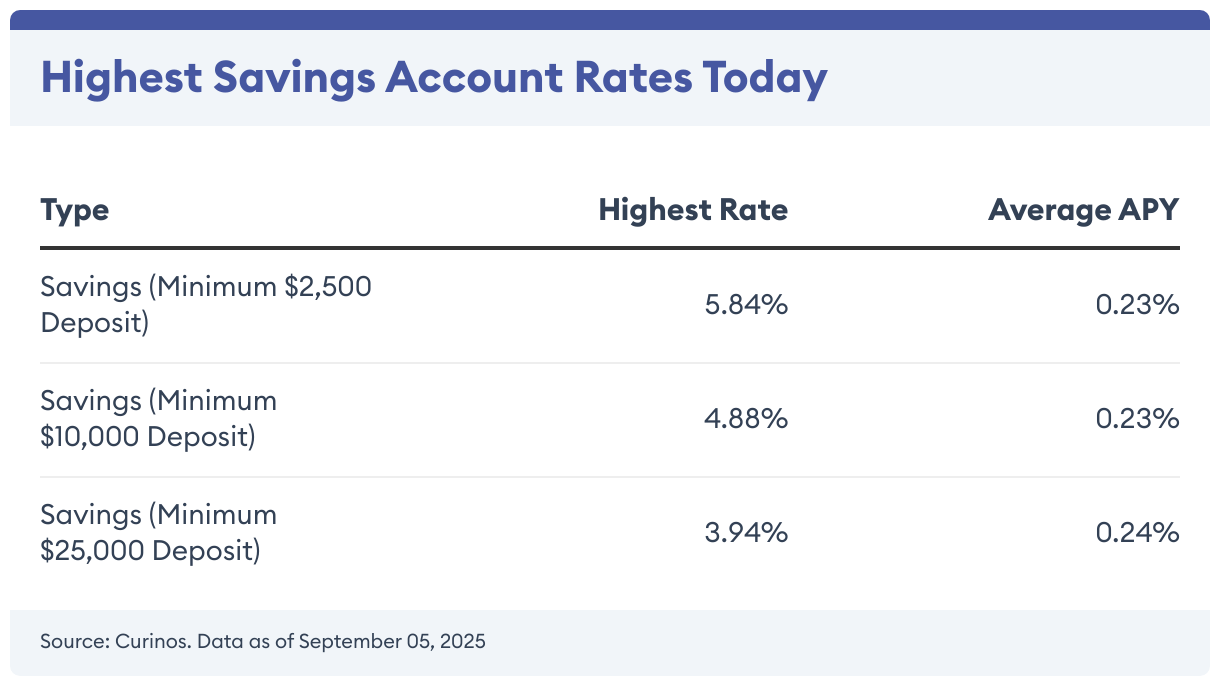

High-Yield Savings Account Rates Today: September 22, 2025 – Rates Are Steady

Key Takeaways Savings account yields are much higher than a few years ago Top rates may fall if the Federal Reserve cuts interest rates Online banks tend to offer the best yields available Rates on savings accounts are relatively unchanged since last week. You can now earn as much as 5.50% on your savings. In […]

CD Rates Today: September 22, 2025 – Take Home Up To 4.94%

Key Takeaways Today’s highest CD rate is 4.94% for a jumbo 6-month CD. CD rates from online banks are commonly twice as high as the national average rates. CD ladders let you leverage high rates without locking up all of your money long-term. The best interest rates on CDs—certificates of deposit—pay up to 4.94% today, […]

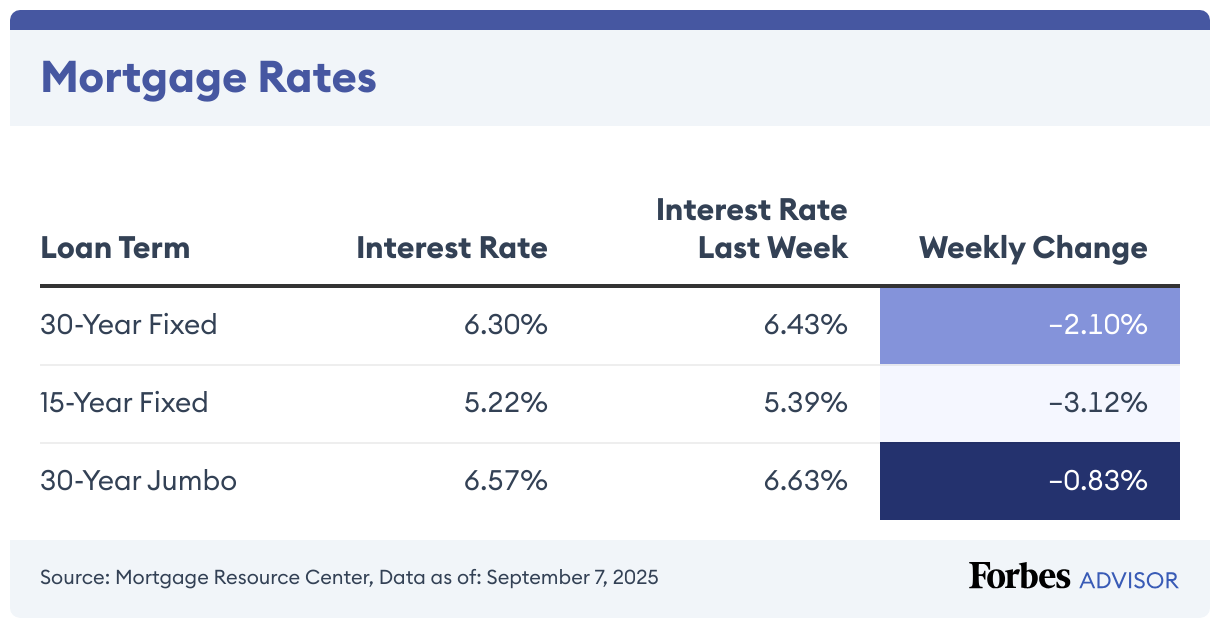

Mortgage Rates Today: September 22, 2025 – 30-Year Rates Steady, 15-Year Rates Up

The current mortgage rate on a 30-year fixed mortgage rose by 1.12% in the last week to 6.32%, according to the Mortgage Research Center. Meanwhile, the APR on a 15-year fixed mortgage climbed 0.12 percentage point during the same period to 5.36%. For existing homeowners, compare your current mortgage rates with today’s refinance rates. 30-Year […]

Mortgage Refinance Rates Today: September 22, 2025 – No Movement On Rates

30-year fixed refinance mortgage rates stayed flat at 6.4% today, according to the Mortgage Research Center. The 15-year, fixed-rate refinance mortgage average rate is 5.35%. For 20-year mortgage refinances, the average rate is 6.02%. Related: Compare Current Refinance Rates !function(){“use strict”;window.addEventListener(“message”,(function(a){if(void 0!==a.data[“datawrapper-height”]){var e=document.querySelectorAll(“iframe”);for(var t in a.data[“datawrapper-height”])for(var r,i=0;r=e[i];i++)if(r.contentWindow===a.source){var d=a.data[“datawrapper-height”][t]+”px”;r.style.height=d}}}))}(); 30-Year Refinance Rates Climb 0.87% The average […]

Money Market Interest Rates Today: September 22, 2025 – Earn Up To 4.35%

Key Takeaways The highest money market account rate available today is 4.35% Changes from the Fed or your bank can quickly change money market rates Online banks typically offer the most competitive yields on the market Current Money Market Rates The current average money market rate is 0.52%, while the highest rate is up to […]

Today’s HELOC & Home Equity Loan Rates: September 22, 2025

Home equity loans and home equity lines of credit (HELOCs) allow homeowners to tap into the value of their homes. A home equity loan is a fixed-rate, lump-sum loan that allows homeowners to borrow up to 85% of their home’s value and pay that amount back in monthly installments. A home equity line of credit […]

Best Credit Cards For Travel Of 2025

The right travel card can turn everyday spending into free flights, hotel stays and unforgettable experiences. But with a sea of options, many with high annual fees, how do you know which ones are truly worth it? To find the best credit cards for travel, we began with a pool of over 400 credit cards […]