This Week’s Personal Loan Rates: September 23, 2025—Rates Inch Down Again

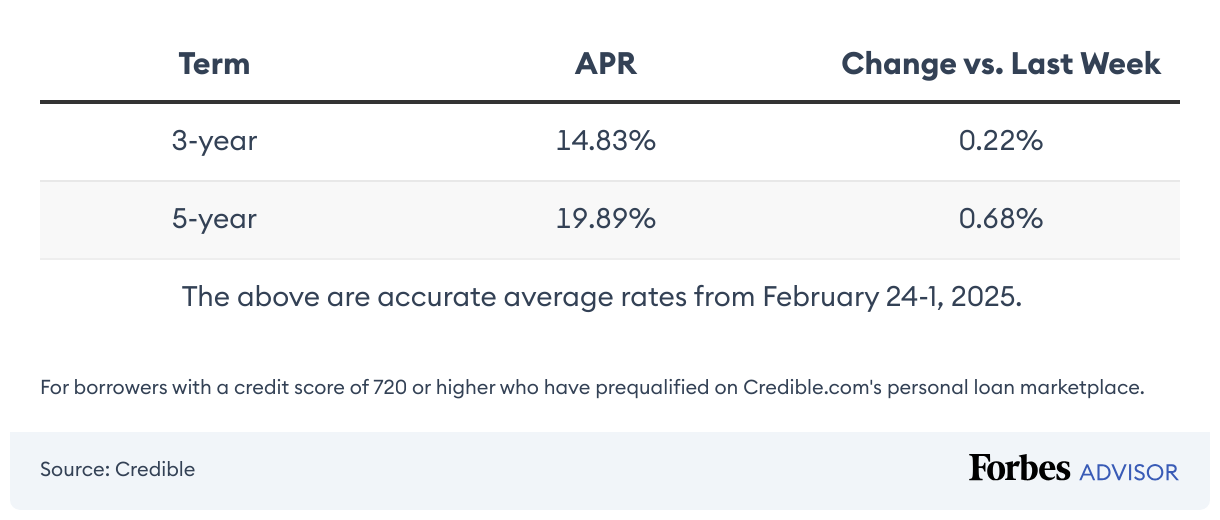

Rates on personal loans dropped last week. This means if you’re in the market for a personal loan, whether to finance a project or major purchase, you can grab a worthwhile interest rate, so long as you’re a qualified borrower. From September 15 to September 20, the average fixed rate on a three-year personal loan […]

Money Market Interest Rates Today: September 23, 2025 – Rates At 4.35%

Key Takeaways The highest money market account rate available today is 4.35% Changes from the Fed or your bank can quickly change money market rates Online banks typically offer the most competitive yields on the market Current Money Market Rates As of today, the highest money market rate is 4.35%, compared to a national average […]

Private Student Loan Rates: September 23, 2025—Loan Rates Edge Up

The average interest rate on 10-year fixed-rate private student loans jumped up last week. For many borrowers, rates continue to be low enough to make private student loans a decent option, especially if you have good credit. /*! purgecss start ignore */.tns-outer{padding:0!important}.tns-outer [hidden]{display:none!important}.tns-outer [aria-controls],.tns-outer [data-action]{cursor:pointer}.tns-slider{transition:all 0s}.tns-slider>.tns-item{box-sizing:border-box}.tns-horizontal.tns-subpixel{white-space:nowrap}.tns-horizontal.tns-subpixel>.tns-item{display:inline-block;vertical-align:top;white-space:normal}.tns-horizontal.tns-no-subpixel:after{clear:both;content:””;display:table}.tns-horizontal.tns-no-subpixel>.tns-item{float:left}.tns-horizontal.tns-carousel.tns-no-subpixel>.tns-item{margin-right:-100%}.tns-gallery,.tns-no-calc{left:0;position:relative}.tns-gallery{min-height:1px}.tns-gallery>.tns-item{left:-100%;position:absolute;transition:transform 0s,opacity 0s}.tns-gallery>.tns-slide-active{left:auto!important;position:relative}.tns-gallery>.tns-moving{transition:all .25s}.tns-autowidth{display:inline-block}.tns-lazy-img{opacity:.6;transition:opacity .6s}.tns-lazy-img.tns-complete{opacity:1}.tns-ah{transition:height 0s}.tns-ovh{overflow:hidden}.tns-visually-hidden{left:-10000em;position:absolute}.tns-transparent{opacity:0;visibility:hidden}.tns-fadeIn{filter:alpha(opacity=100);opacity:1;z-index:0}.tns-fadeOut,.tns-normal{filter:alpha(opacity=0);opacity:0;z-index:-1}.tns-vpfix{white-space:nowrap}.tns-vpfix>div,.tns-vpfix>li{display:inline-block}.tns-t-subp2{height:10px;margin:0 auto;overflow:hidden;position:relative;width:310px}.tns-t-ct{position:absolute;right:0;width:2333.3333333%;width:2333.33333%;width:2333.3333333333%}.tns-t-ct:after{clear:both;content:””;display:table}.tns-t-ct>div{float:left;height:10px;width:1.4285714%;width:1.42857%;width:1.4285714286%} /*! purgecss end […]

Ed Sheeran 2026 Tour: Amex Cardholders Can Unlock Presale Tickets Starting September 23

If you’ve been “Thinking Out Loud” about seeing Ed Sheeran live next year, American Express is giving its card members a head start. Starting Tuesday, September 23, Amex card members can snag presale tickets for select U.S. and Canada shows before the general public. The presale runs through September 25, ending at 11:59 p.m. local […]

What Amex Platinum’s New Wellness Perks From Lululemon, Equinox And Oura Mean For Cardholders

The Platinum Card® from American Express (Terms apply, see rates & fees) has long been associated with airport lounges, premium travel perks and luxury dining. But a new round of benefits suggests the card aims to claim another space: wellness. Amex has added two new perks to the card’s wellness lineup: up to $300 in […]

Your Ticket To Over 1,500 Airport Lounges: What You Need To Know About The Amex Platinum

Many travel cards offer airport lounge access, but The Platinum Card® from American Express (Terms apply, see rates & fees) tops them all. Here’s why frequent travelers should consider picking up the revamped card for the ultimate airport experience. Best in Class While other cards offer travelers entry to Priority Pass lounges, certain lounges remain […]

Chase Aeroplan Card Launches 100,000-Point Bonus Just In Time For Holiday Travel

Chase is kicking off the fall travel season with a significant incentive for travelers. Beginning Thursday, September 18, new applicants for the Aeroplan® Credit Card* can earn an elevated welcome offer of up to 100,000 bonus points after meeting minimum spending requirements. Until now, new cardholders could collect 75,000 points after spending a minimum of […]

Comped Flights To Los Angeles And Polynesia Or Stays In Scandinavia: How To Use The Amex Platinum’s Generous Welcome Offer

The Platinum Card® from American Express (Terms apply, rates & fees) just got a revamp, featuring new statement credits and added value to existing credits, all alongside a higher annual fee. While the fee may be steep, the card’s statement credits do much of the heavy lifting to offset it. And despite the recent changes, […]

Chase Sapphire Reserve Cardholders Can Now Get Up To $750 In Hotel Credits For 2026 Travel

Chase is making it easier for Chase Sapphire Reserve® and Sapphire Reserve for Business℠ cardholders to squeeze more value out of their travel perks. Starting in 2026, the existing $500 credit for bookings at The Edit will become more flexible. Card members will now receive up to $250 back per stay (up to $500 total), […]

Attention Southwest Frequent Flyers: New Elevated Offer Boosts Welcome Bonus

If you’re a frequent flyer on Southwest Airlines but don’t yet carry one of its credit cards, the latest elevated welcome offer on one of its business cards may be the incentive you need. Bigger Welcome Bonus The Southwest® Rapid Rewards® Performance Business Credit Card* gives new cardholders the opportunity to earn 120,000 Rapid Rewards […]