Today’s HELOC & Home Equity Loan Rates: October 7, 2025

Home equity loans and home equity lines of credit (HELOCs) allow homeowners to tap into the value of their homes. A home equity loan is a fixed-rate, lump-sum loan that allows homeowners to borrow up to 85% of their home’s value and pay that amount back in monthly installments. A home equity line of credit […]

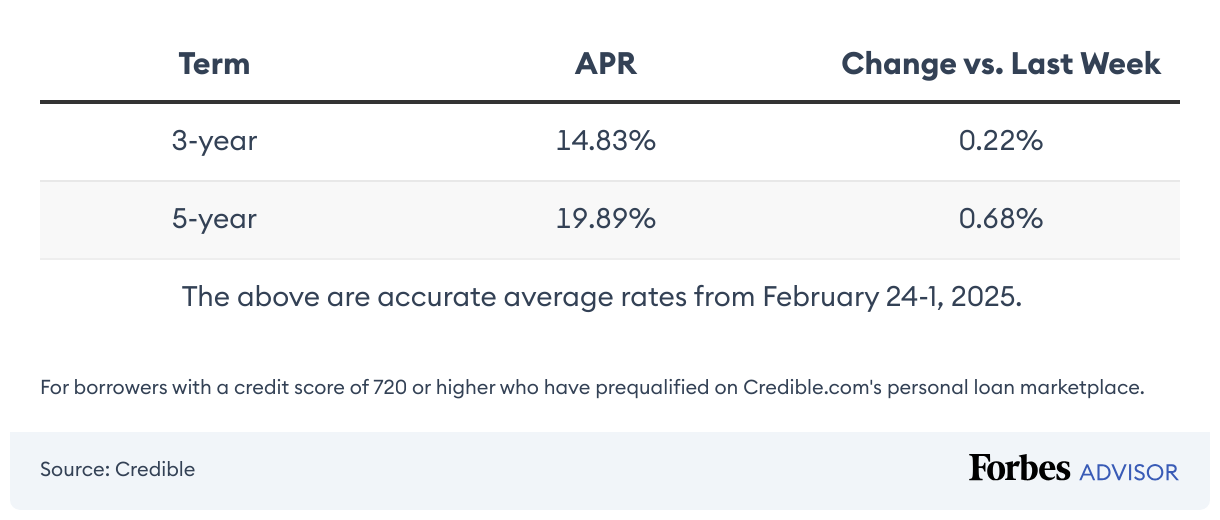

This Week’s Personal Loan Rates: October 7, 2025—Rates Rise Again

Last week, personal loan rates increased. Still, if you’re in the market for a personal loan to finance a project or a large purchase, pay unexpected bills or improve your cash flow, it’s possible to pick up a decent rate. From September 29 to October 4, the average fixed interest rate on a three-year personal […]

CD Rates Today: October 7, 2025 – Rates Fall

Key Takeaways Today’s highest CD rate is 4.94% for a jumbo 6-month CD. CD rates from online banks are commonly twice as high as the national average rates. CD ladders let you leverage high rates without locking up all of your money long-term. The best interest rates on CDs—certificates of deposit—pay up to 4.94% today, […]

New Peloton Lineup: How Chase Sapphire Reserve And Preferred Can Offset Your Buy

Peloton is shifting gears, debuting a souped-up fleet of fitness machines—including its first-ever commercial-grade model—and increasing prices on both equipment and memberships. If you’re eyeing a new bike, treadmill or rowing machine, the timing of these price hikes might sting. But by making your purchase with certain Chase credit cards, you can take advantage of […]

Hilton Honors Aspire Card From American Express Review 2025

If Hilton is your preferred hotel brand, then the Hilton Honors Aspire Card from American Express* should be your jam. Don’t let the $550 annual fee scare you away; the card can provide enough ongoing value through its resort and airline credits. Add into the mix Hilton Honors Diamond elite status, the Annual Free Night […]

Best Investment Credit Cards Of 2025

Cash back, points and miles are great, but they also depreciate over time. Instead, leveraging rewards to build wealth through investing can give purpose to your daily spending. Forbes Advisor compared hundreds of cards to find the best options for credit cards for investing. These cards allow you to turn rewards for everyday purchases into […]

CD Rates Today: October 6, 2025 – Rates Slide

Key Takeaways Today’s highest CD rate is 4.94% for a jumbo 6-month CD. CD rates from online banks are commonly twice as high as the national average rates. CD ladders let you leverage high rates without locking up all of your money long-term. The best interest rates on CDs—certificates of deposit—pay up to 4.94% today, […]

Current Mortgage Refinance Rates: October 6, 2025 – Rates Stay Flat

30-year fixed refinance mortgage rates didn’t move at 6.39% today, according to the Mortgage Research Center. The 15-year, fixed-rate refinance mortgage average rate is 5.32%. For 20-year mortgage refinances, the average rate is 6.03%. Related: Compare Current Refinance Rates !function(){“use strict”;window.addEventListener(“message”,(function(a){if(void 0!==a.data[“datawrapper-height”]){var e=document.querySelectorAll(“iframe”);for(var t in a.data[“datawrapper-height”])for(var r,i=0;r=e[i];i++)if(r.contentWindow===a.source){var d=a.data[“datawrapper-height”][t]+”px”;r.style.height=d}}}))}(); 30-Year Refinance Rates Drop 1.57% The average […]

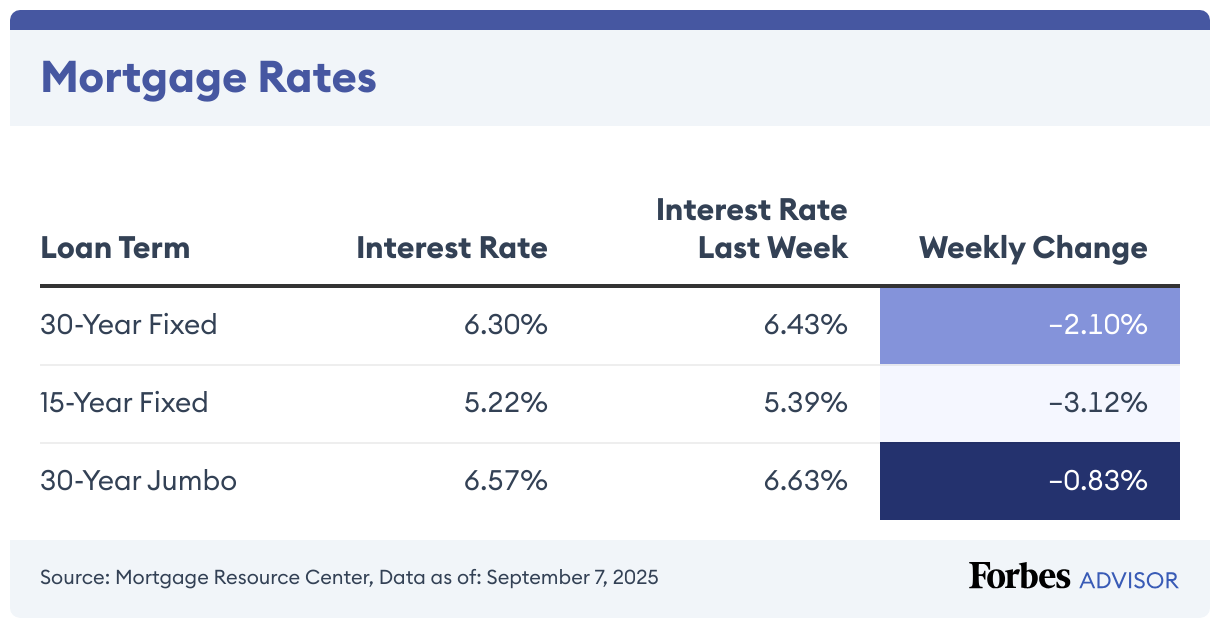

Mortgage Rates Today: October 6, 2025 – Rates Move Lower

Today, the mortgage interest rate on a 30-year fixed mortgage is 6.30%, according to the Mortgage Research Center, while the average rate on a 15-year mortgage is 5.35%. On a 30-year jumbo mortgage, the average rate is 6.64%. 30-Year Mortgage Rates Drop 1.64% Today’s 30-year mortgage—the most popular mortgage product—is 6.3%, down 1.64% from a […]

Today’s HELOC & Home Equity Loan Rates: October 6, 2025

Home equity loans and home equity lines of credit (HELOCs) allow homeowners to tap into the value of their homes. A home equity loan is a fixed-rate, lump-sum loan that allows homeowners to borrow up to 85% of their home’s value and pay that amount back in monthly installments. A home equity line of credit […]