Latest HELOC & Home Equity Loan Rates: October 13, 2025

Home equity loans and home equity lines of credit (HELOCs) allow homeowners to tap into the value of their homes. A home equity loan is a fixed-rate, lump-sum loan that allows homeowners to borrow up to 85% of their home’s value and pay that amount back in monthly installments. A home equity line of credit […]

Small Business Owners Can Earn $750 With U.S. Bank’s Triple Cash Rewards Card—No Annual Fee Required

Small-business owners shopping for a cash-back card now have a bigger incentive to consider the U.S. Bank Triple Cash Rewards Visa® Business Card. Its limited-time welcome bonus allows new cardholders to earn $750 in cash back after spending $6,000 on the Account Owner’s card in the first 180 days of opening an account. Details of the […]

How Discover, Wells Fargo And Citi Cards Can Help You Tackle Credit Card Debt This Year

Recent data from Experian shows how credit card debt varies across generations. Generation-Z carries an average balance of $3,493; Millennials hold $6,961 and Generation-X carries the most at $9,600. Average balances then dip to $6,795 for Baby Boomers and $3,445 for the Silent Generation. The data reveals that credit card balances have risen faster for […]

Disney Tickets Just Got Pricier—Chase And Wells Fargo Cards To Offset Rising Park Costs

Disney is once again raising the price of magic. Effective October 8, 2025, ticket prices at U.S. theme parks will increase. Starting with the 2026 holiday season, ticket prices will reach new heights during peak periods like Thanksgiving week and New Year’s Eve. At Walt Disney World, the top tier for a one-day one-park ticket […]

Best Credit Cards Without A Social Security Number Requirement Of 2025

If you don’t have a Social Security number, you still have options for opening a U.S. credit card Forbes Advisor has evaluated and chosen the top card options available from issuers that don’t require a Social Security number to apply. Be aware that in all cases, an alternative ID will be requested in the application […]

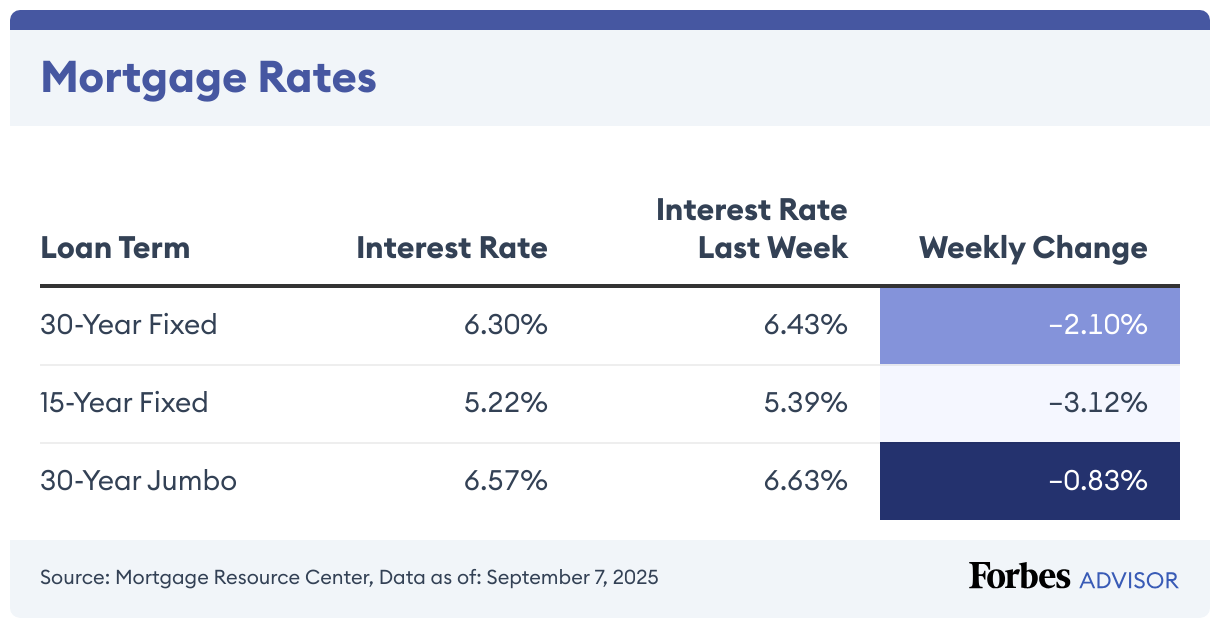

Mortgage Rates Today: October 7, 2025 – Rates Hold Firm

The current mortgage rate on a 30-year fixed mortgage fell by 1.07% in the last week to 6.35%, according to the Mortgage Research Center. Meanwhile, the APR on a 15-year fixed mortgage dropped 0.08 percentage point during the same period to 5.4%. For existing homeowners, compare your current mortgage rates with today’s refinance rates. 30-Year […]

Mortgage Refinance Rates Today: October 7, 2025 – Rates Climb

The rate on a 30-year fixed refinance climbed to 6.43% today, according to the Mortgage Research Center. For 15-year fixed refinance mortgages, the average rate is 5.38%, and for 20-year mortgages, the average is 6.06%. Related: Compare Current Refinance Rates !function(){“use strict”;window.addEventListener(“message”,(function(a){if(void 0!==a.data[“datawrapper-height”]){var e=document.querySelectorAll(“iframe”);for(var t in a.data[“datawrapper-height”])for(var r,i=0;r=e[i];i++)if(r.contentWindow===a.source){var d=a.data[“datawrapper-height”][t]+”px”;r.style.height=d}}}))}(); 30-Year Fixed-Rate Mortgage Refinance Rates Drop […]

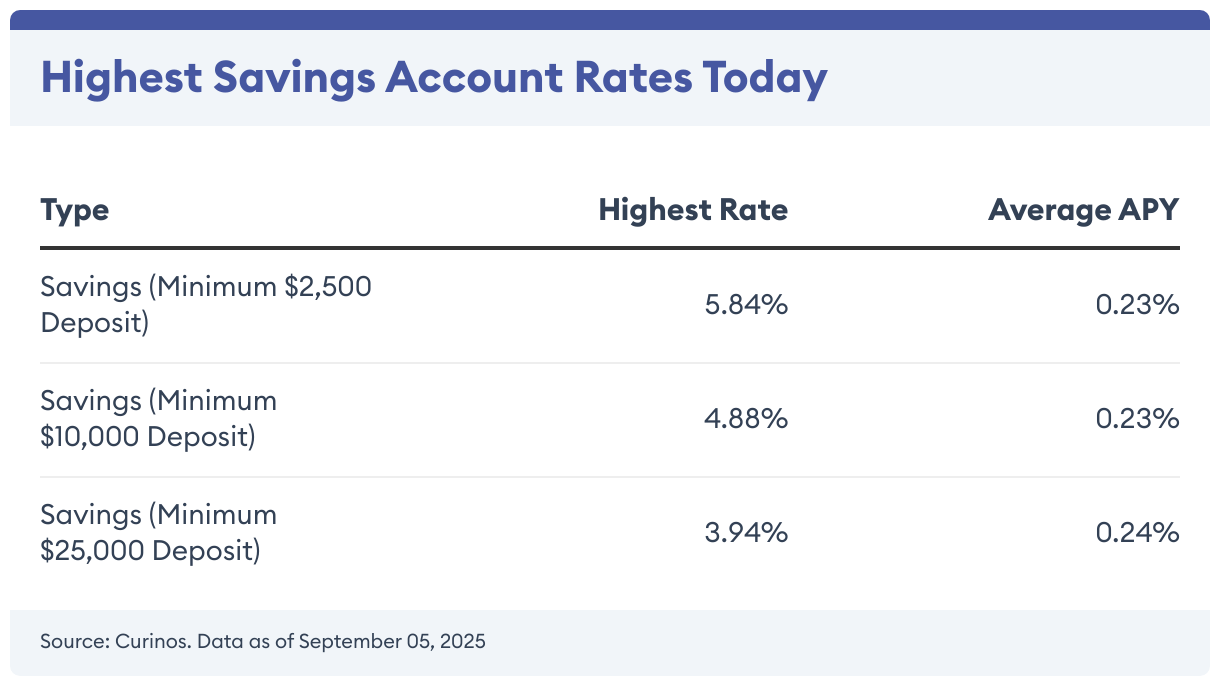

High-Yield Savings Account Rates Today: October 7, 2025 – Rates Are Steady

Key Takeaways Savings account yields are much higher than a few years ago Top rates may fall if the Federal Reserve cuts interest rates Online banks tend to offer the best yields available Rates on savings accounts have held steady since a week ago. You can now earn up to 5.50% on your savings. In […]

Private Student Loan Rates: October 7, 2025—Loan Rates Edge Up

Last week, the average interest rate on 10-year fixed-rate private student loans rose. /*! purgecss start ignore */.tns-outer{padding:0!important}.tns-outer [hidden]{display:none!important}.tns-outer [aria-controls],.tns-outer [data-action]{cursor:pointer}.tns-slider{transition:all 0s}.tns-slider>.tns-item{box-sizing:border-box}.tns-horizontal.tns-subpixel{white-space:nowrap}.tns-horizontal.tns-subpixel>.tns-item{display:inline-block;vertical-align:top;white-space:normal}.tns-horizontal.tns-no-subpixel:after{clear:both;content:””;display:table}.tns-horizontal.tns-no-subpixel>.tns-item{float:left}.tns-horizontal.tns-carousel.tns-no-subpixel>.tns-item{margin-right:-100%}.tns-gallery,.tns-no-calc{left:0;position:relative}.tns-gallery{min-height:1px}.tns-gallery>.tns-item{left:-100%;position:absolute;transition:transform 0s,opacity 0s}.tns-gallery>.tns-slide-active{left:auto!important;position:relative}.tns-gallery>.tns-moving{transition:all .25s}.tns-autowidth{display:inline-block}.tns-lazy-img{opacity:.6;transition:opacity .6s}.tns-lazy-img.tns-complete{opacity:1}.tns-ah{transition:height 0s}.tns-ovh{overflow:hidden}.tns-visually-hidden{left:-10000em;position:absolute}.tns-transparent{opacity:0;visibility:hidden}.tns-fadeIn{filter:alpha(opacity=100);opacity:1;z-index:0}.tns-fadeOut,.tns-normal{filter:alpha(opacity=0);opacity:0;z-index:-1}.tns-vpfix{white-space:nowrap}.tns-vpfix>div,.tns-vpfix>li{display:inline-block}.tns-t-subp2{height:10px;margin:0 auto;overflow:hidden;position:relative;width:310px}.tns-t-ct{position:absolute;right:0;width:2333.3333333%;width:2333.33333%;width:2333.3333333333%}.tns-t-ct:after{clear:both;content:””;display:table}.tns-t-ct>div{float:left;height:10px;width:1.4285714%;width:1.42857%;width:1.4285714286%} /*! purgecss end ignore */@media (max-width:1023px){.small-card-rating.rate-fees-present{margin-top:-12px}}@media (max-width:370px){.small-card-rating.rate-fees-present{margin-top:0}}.small-card-rating .card-rating{align-items:center;background:#fff;border:1px solid #eee;border-radius:108px;box-shadow:0 4px 2px hsla(45,7%,44%,.04);display:flex;margin-top:15px;max-width:150px;padding:8px 13px;position:relative;z-index:9}.small-card-rating .card-rating.has-tooltip{cursor:pointer}@media (max-width:1023px){.small-card-rating .card-rating{margin-top:0}}.small-card-rating .card-rating .rating-value{color:#333;font-family:EuclidCircularB,sans-serif;font-size:24px;font-weight:600;letter-spacing:-.752688px;line-height:31px}.small-card-rating .card-rating .cc-rating-wrapper{background:url(“data:image/svg+xml;base64,PHN2ZyB3aWR0aD0iMTciIGhlaWdodD0iMTMiIHZpZXdCb3g9IjAgMCAxMyAxMyIgZmlsbD0ibm9uZSIgeG1sbnM9Imh0dHA6Ly93d3cudzMub3JnLzIwMDAvc3ZnIj48ZyBjbGlwLXBhdGg9InVybCgjYSkiPjxwYXRoIGQ9Im02LjM1NCAxLjUzIDEuNTUgMy4xNDEgMy40NjguNTA3LTIuNTA5IDIuNDQ0LjU5MiAzLjQ1Mi0zLjEtMS42My0zLjEwMiAxLjYzLjU5Mi0zLjQ1Mi0yLjUwOS0yLjQ0NCAzLjQ2OC0uNTA3IDEuNTUtMy4xNFoiIHN0cm9rZT0iI0RCREJEQiIgc3Ryb2tlLXdpZHRoPSIuNzUzIiBzdHJva2UtbGluZWNhcD0icm91bmQiIHN0cm9rZS1saW5lam9pbj0icm91bmQiLz48L2c+PGRlZnM+PGNsaXBQYXRoIGlkPSJhIj48cGF0aCBmaWxsPSIjZmZmIiB0cmFuc2Zvcm09InRyYW5zbGF0ZSguMzMzIC41MjYpIiBkPSJNMCAwaDEyLjA0M3YxMi4wNDNIMHoiLz48L2NsaXBQYXRoPjwvZGVmcz48L3N2Zz4=”) repeat-x 0 0;margin-bottom:5px;width:85px}.small-card-rating .card-rating .cc-rating{background:url(“data:image/svg+xml;base64,PHN2ZyB3aWR0aD0iMTciIGhlaWdodD0iMTMiIHZpZXdCb3g9IjAgMCAxMyAxMyIgZmlsbD0ibm9uZSIgeG1sbnM9Imh0dHA6Ly93d3cudzMub3JnLzIwMDAvc3ZnIj48ZyBjbGlwLXBhdGg9InVybCgjYSkiPjxwYXRoIGQ9Im02LjMxMSAxLjUzIDEuNTUgMy4xNDEgMy40NjguNTA3TDguODIgNy42MjJsLjU5MiAzLjQ1Mi0zLjEtMS42My0zLjEwMiAxLjYzLjU5Mi0zLjQ1Mi0yLjUwOS0yLjQ0NCAzLjQ2OC0uNTA3IDEuNTUtMy4xNFoiIGZpbGw9IiNGN0M3NDgiIHN0cm9rZT0iI0Y3Qzk0QSIgc3Ryb2tlLXdpZHRoPSIxLjAyNiIgc3Ryb2tlLWxpbmVjYXA9InJvdW5kIiBzdHJva2UtbGluZWpvaW49InJvdW5kIi8+PC9nPjxkZWZzPjxjbGlwUGF0aCBpZD0iYSI+PHBhdGggZmlsbD0iI2ZmZiIgdHJhbnNmb3JtPSJ0cmFuc2xhdGUoLjI5IC41MjYpIiBkPSJNMCAwaDEyLjA0M3YxMi4wNDNIMHoiLz48L2NsaXBQYXRoPjwvZGVmcz48L3N2Zz4=”);display:block;height:13px;max-width:100%;position:relative;width:0;z-index:2}.small-card-rating .card-rating […]

Today’s Top Money Market Account Rates For October 7, 2025 – Rates Hit 5%

Key Takeaways The highest money market account rate available today is 5.00% Changes from the Fed or your bank can quickly change money market rates Online banks typically offer the most competitive yields on the market Current Money Market Rates As of today, the highest money market rate is 5%, compared to a national average […]