Current Nebraska Mortgage And Refinance Rates

Understanding current mortgage rates and refinance rates in Nebraska is essential if you’re planning to buy a home or refinance your existing mortgage. These rates directly impact monthly payments and long-term borrowing costs, but they fluctuate based on numerous factors, including market trends, economic conditions and federal policies. We evaluated the current Nebraska mortgage and […]

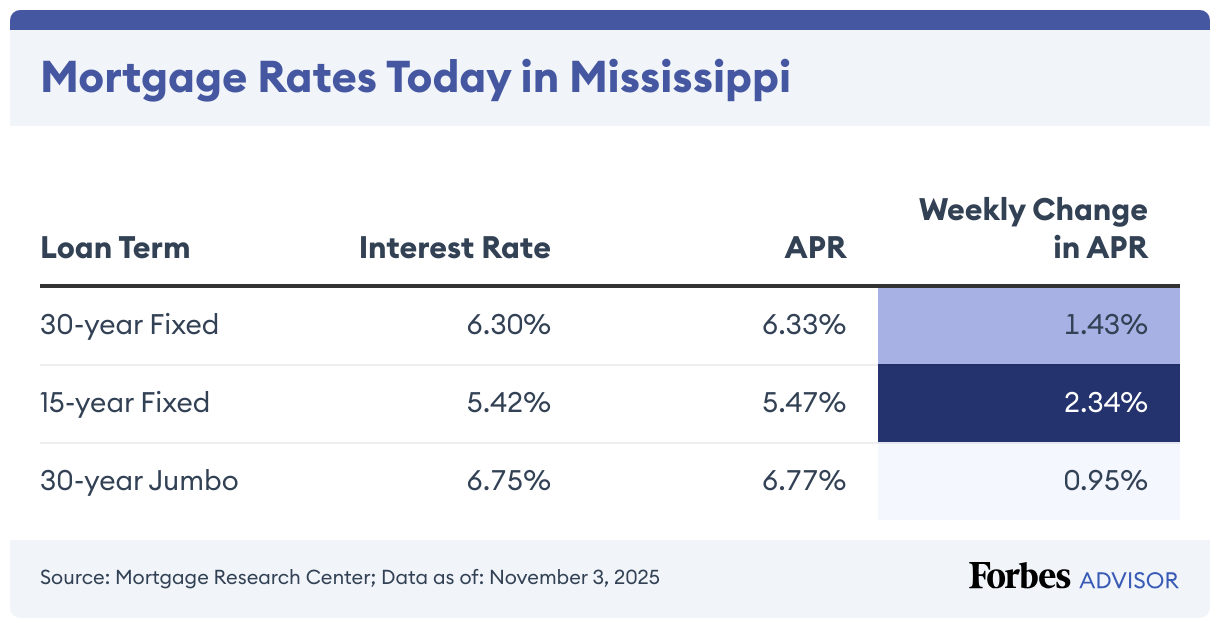

Current Mississippi Mortgage And Refinance Rates

Whether you’re searching for a new home or planning to refinance, understanding mortgage and refinance rates is essential to navigating Mississippi’s housing market. That said, interest rates aren’t set in stone, and they fluctuate based on economic factors, like 10-year Treasury yields, market conditions, inflation and Federal Reserve policy. We summarized the current Mississippi mortgage […]

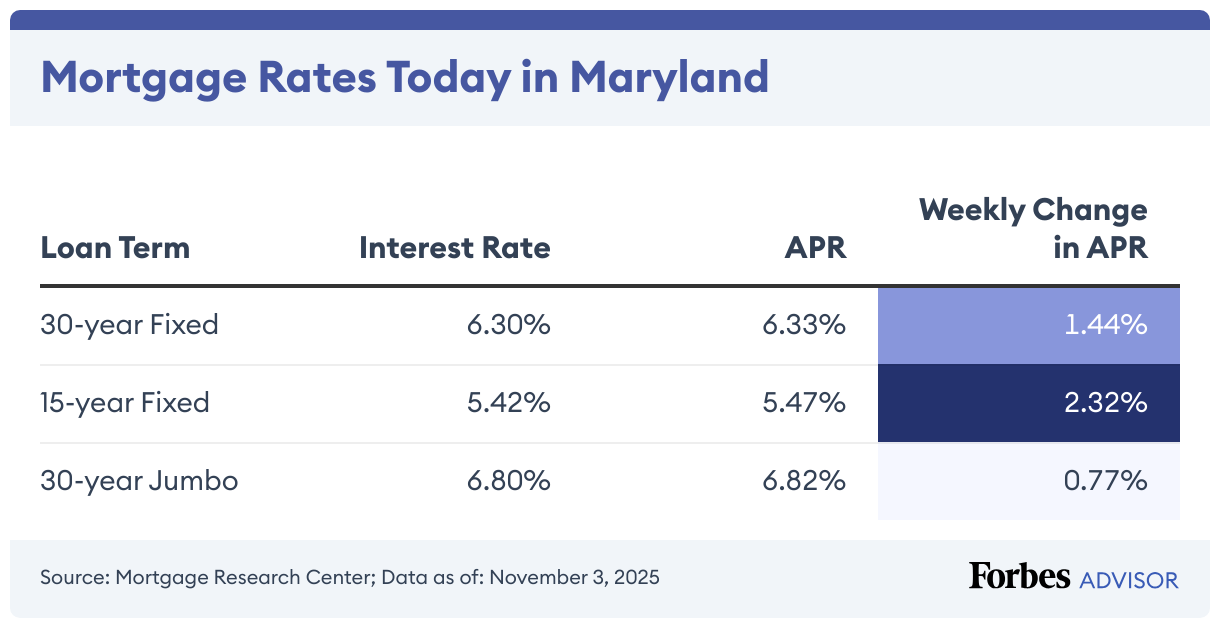

Current Maryland Mortgage And Refinance Rates

Whether you’re searching for a new home or planning to refinance, understanding mortgage and refinance rates is essential to navigating Maryland’s housing market. That said, interest rates aren’t set in stone, and they fluctuate based on economic factors, like 10-year Treasury yields, market conditions, inflation and Federal Reserve policy. We summarized the current Maryland mortgage […]

Current Arkansas Mortgage And Refinance Rates

Understanding current mortgage rates and refinance rates in Arkansas is essential if you’re planning to buy a home or refinance your existing mortgage. These rates directly impact monthly payments and long-term borrowing costs, but they fluctuate based on numerous factors, including market trends, economic conditions and federal policies. We evaluated the current Arkansas mortgage and […]

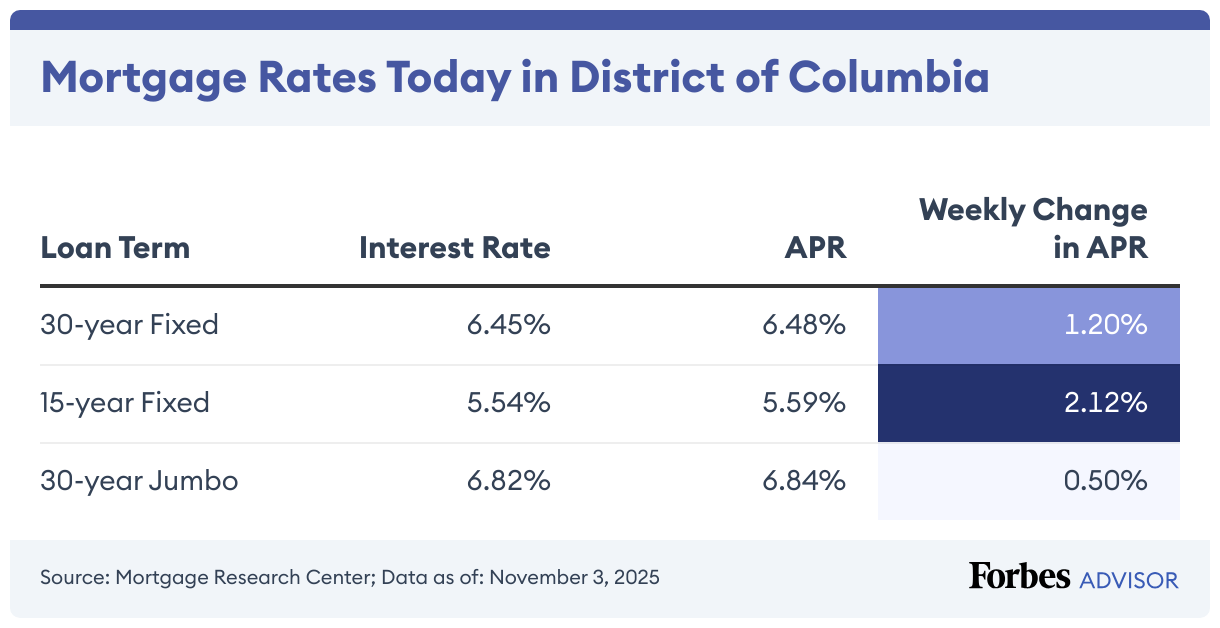

Current District of Columbia Mortgage And Refinance Rates

If you’re getting ready to buy a new home or refinance your mortgage in District of Columbia, understanding current rates is key. That said, these rates aren’t set in stone, and they change based on factors like economic conditions, Federal Reserve policy and inflation. Our team found the current District of Columbia mortgage and refinance […]

Money Market Interest Rates Today: November 4, 2025 – Rates At 4.22%

Key Takeaways The highest money market account rate available today is 4.22% Changes from the Fed or your bank can quickly change money market rates Online banks typically offer the most competitive yields on the market Current Money Market Rates The current average money market rate is 0.5%, while the highest rate is up to […]

Here Are Today’s Mortgage Refinance Rates: November 4, 2025 – Rates Rise

The rate on a 30-year fixed refinance climbed to 6.36% today, according to the Mortgage Research Center. The 15-year, fixed-rate refinance mortgage average rate is 5.4%. For 20-year mortgage refinances, the average rate is 6.06%. Related: Compare Current Refinance Rates !function(){“use strict”;window.addEventListener(“message”,(function(a){if(void 0!==a.data[“datawrapper-height”]){var e=document.querySelectorAll(“iframe”);for(var t in a.data[“datawrapper-height”])for(var r,i=0;r=e[i];i++)if(r.contentWindow===a.source){var d=a.data[“datawrapper-height”][t]+”px”;r.style.height=d}}}))}(); 30-Year Fixed-Rate Mortgage Refinance Rates Climb 0.70% The average rate […]

Latest HELOC & Home Equity Loan Rates: November 4, 2025

Home equity loans and home equity lines of credit (HELOCs) allow homeowners to tap into the value of their homes. A home equity loan is a fixed-rate, lump-sum loan that allows homeowners to borrow up to 85% of their home’s value and pay that amount back in monthly installments. A home equity line of credit […]

6 Best Custodial Accounts

Stash Learn More On Stash’s Website Investment advisory services offered by Stash Investments LLC, an SEC registered investment adviser. Investing involves risk and investments may lose value. Holdings and performance are hypothetical. Offer is subject to T&Cs. Stash Offer Get $25 after investing $5 on Stash* Management Fees $3/mo and $9/mo Minimum Investment No minimum investment […]

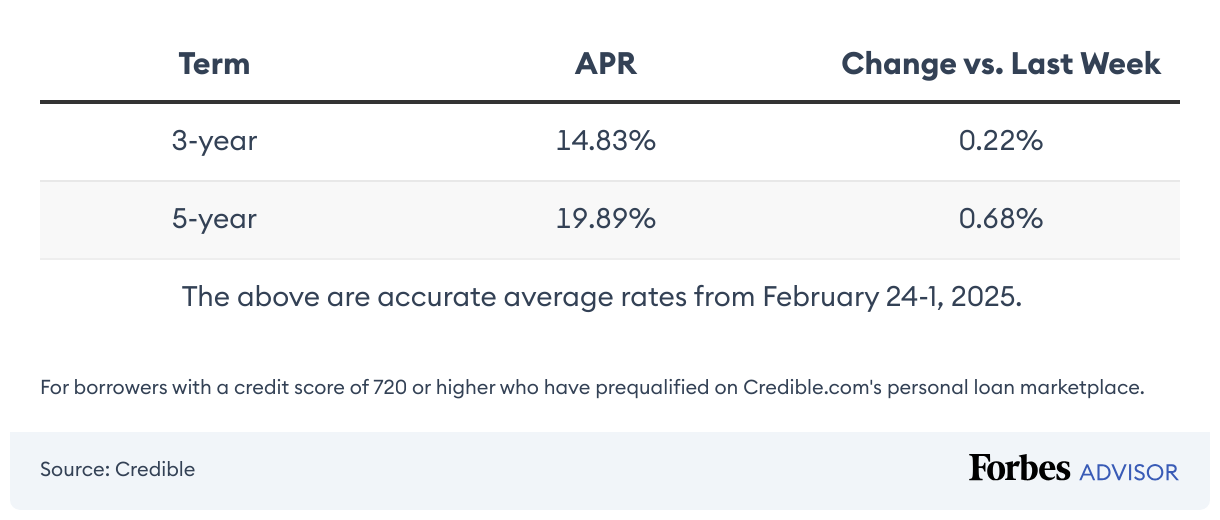

This Week’s Personal Loan Rates: November 3, 2025—Rates Are Falling

Rates on personal loans dropped last week. So long as you’re a qualified borrower, you’ll likely pick up a decent interest rate. For many, this means financing a major purchase or project is within reach. From October 27 to November 1, the average fixed rate on a three-year personal loan was 13.22% for borrowers with […]