Key Takeaways

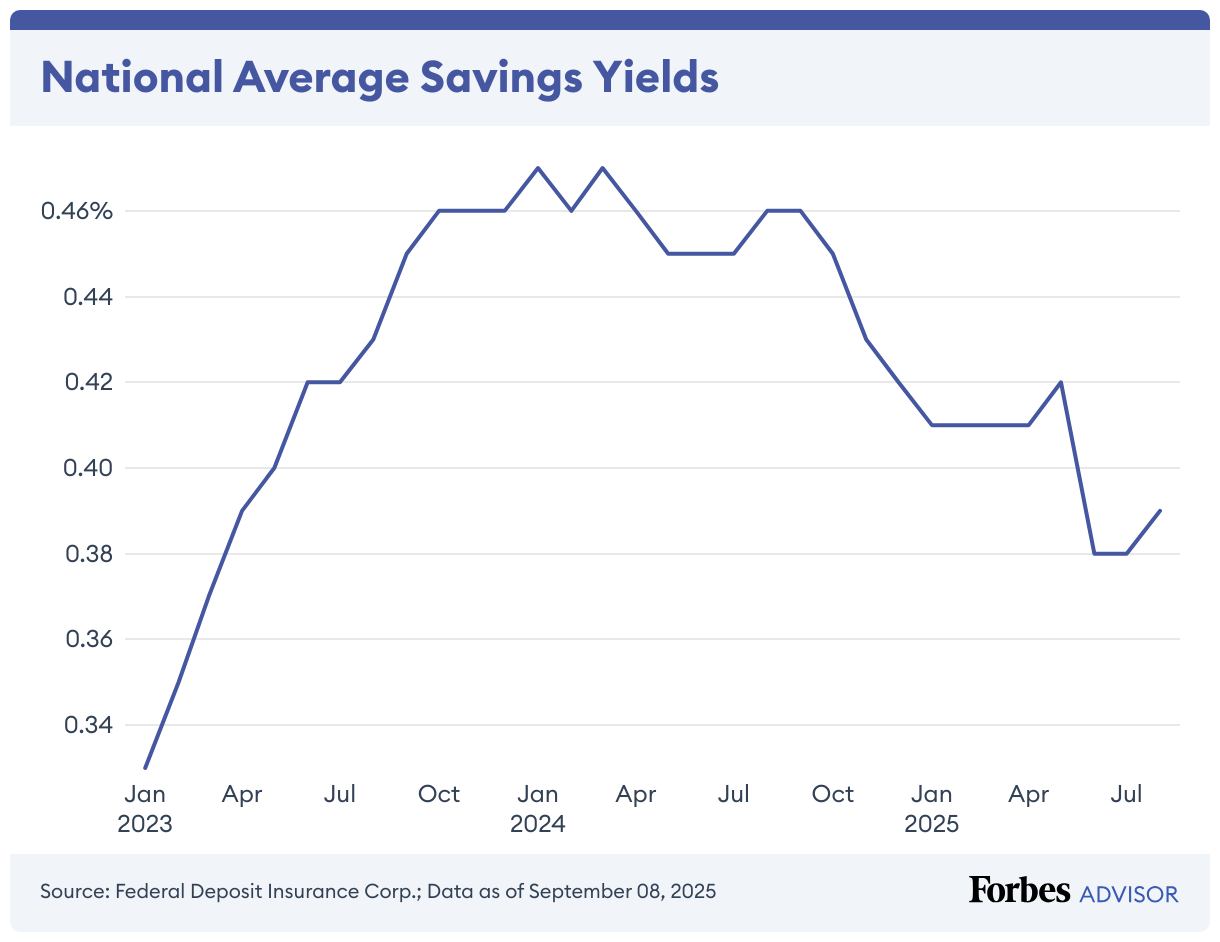

- Savings account yields are much higher than a few years ago

- Top rates may fall if the Federal Reserve cuts interest rates

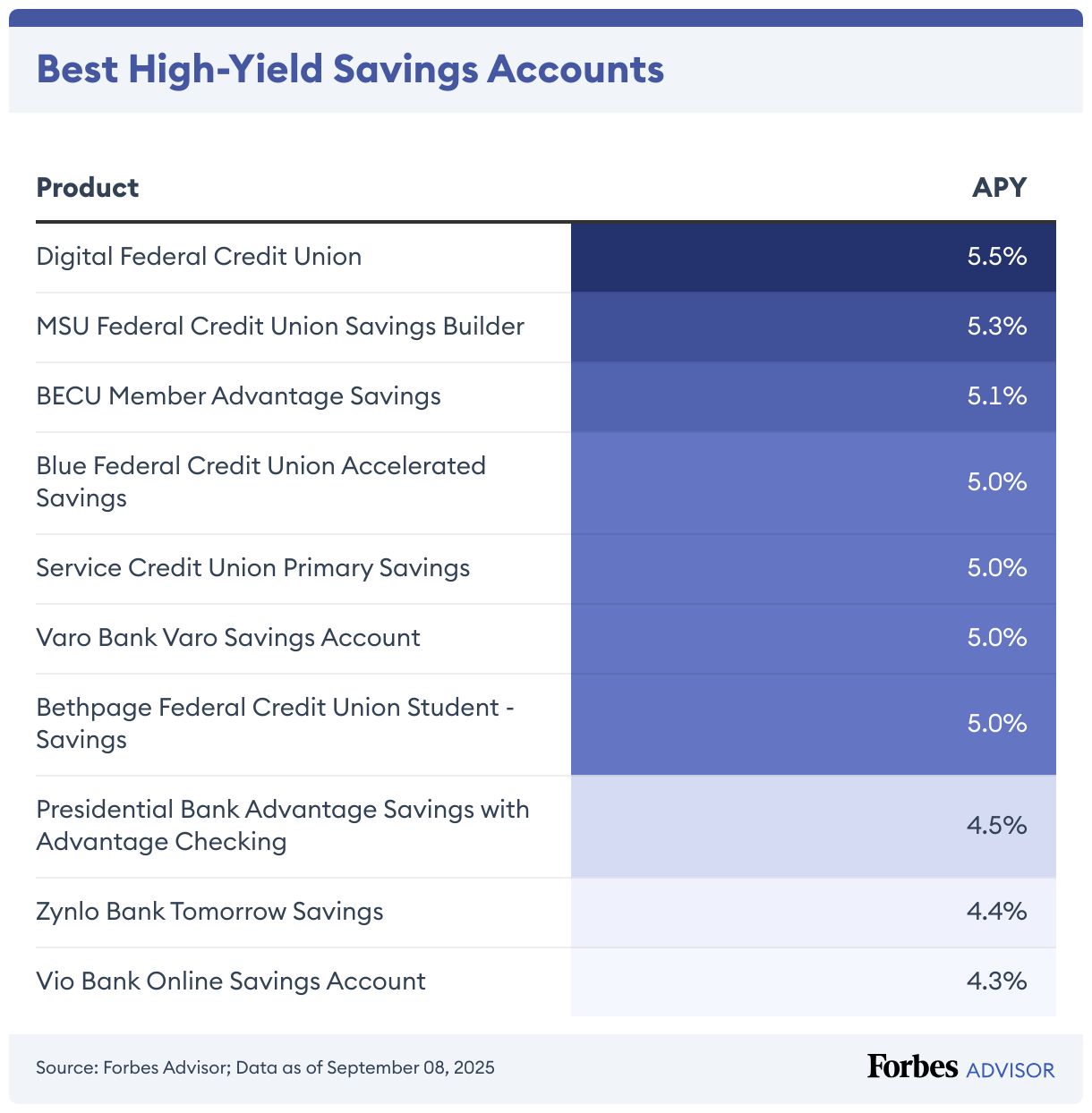

- Online banks tend to offer the best yields available

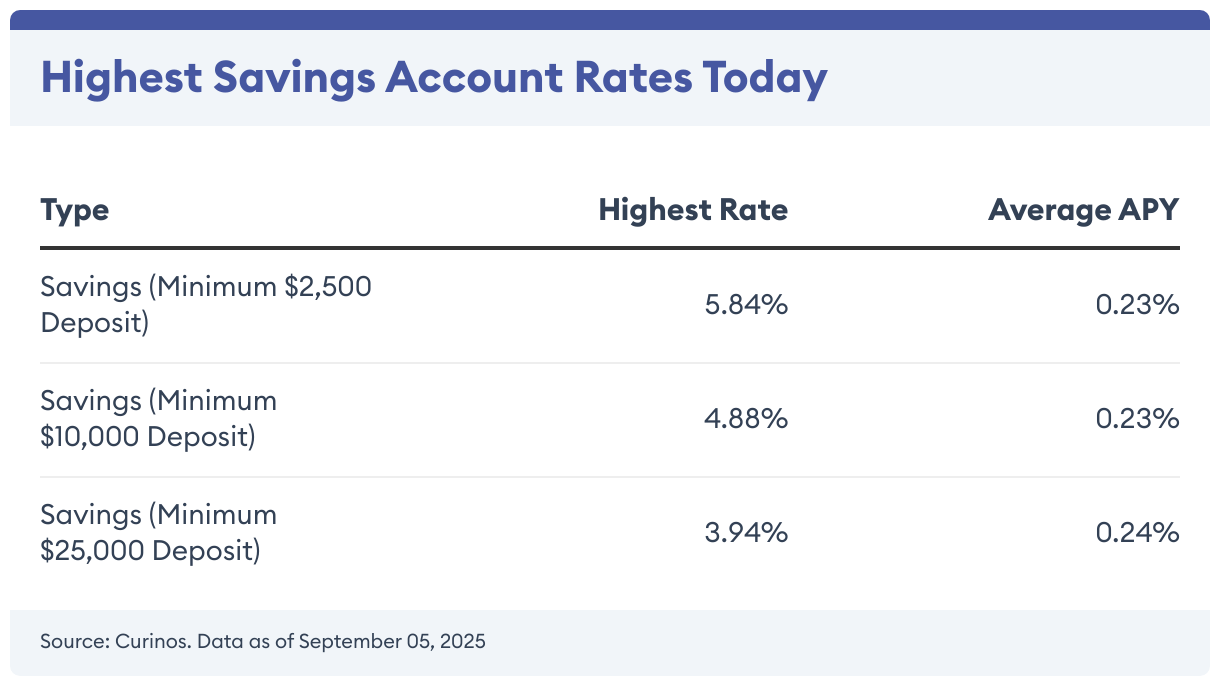

Rates on savings accounts have held steady from a week ago. You can now earn as much as 5.84% on your savings.

In the market for an account where you can save for a rainy day or retirement? Here’s a look at some of the best savings rates you can find today.

Related: Find the Best High-Yield Savings Accounts of 2025

Online and Mobile Banking

n

Dividends build monthly

n

n

Insured by NCUA

“,”annualPercentageYield_boldValue”:”4.05%”,”annualPercentageYield_lightValue”:null,”annualPercentageYield_tooltipText”:”Annual Percentage Yield”,”minimumDepositRequirement_boldValue”:”$75,000.00″,”minimumDepositRequirement_lightValue”:null,”minimumDepositRequirement_tooltipText”:null,”apyEditorialDescription_boldValue”:null,”apyEditorialDescription_lightValue”:null,”apyEditorialDescription_tooltipText”:null,”monthlyMaintenanceFee_boldValue”:”$0.00″,”monthlyMaintenanceFee_shownTooltip”:null,”monthlyMaintenanceFee_tooltipText”:null,”maintenanceFeeEditorial_boldValue”:null,”maintenanceFeeEditorial_isKeyAttr”:null,”bonusAmount_boldValue”:null,”bonusAmount_lightValue”:null,”bonusAmount_tooltipText”:null,”bonusRequirements_boldValue”:null,”bonusRequirements_lightValue”:null,”bonusRequirements_tooltipText”:null,”editorialBonusDescription_boldValue”:null,”products_boldValue”:null,”fees_boldValue”:null,”fees_lightValue”:null,”fees_tooltipText”:null,”terms_boldValue”:”12 months”,”terms_tooltipText”:null,”atmNetwork_boldValue”:null,”minimumAccountBalance_boldValue”:”$75,000.00″,”minimumAccountBalance_lightValue”:null,”minimumAccountBalance_tooltipText”:null,”createdOn”:1761756605367,”createdBy”:”SYSTEM”,”updatedOn”:1766434705054,”updatedBy”:”prod-fmp-pc-tracking-cta-compute-service|63509c38-2848-45c9-b994-28177306c6db”,”earningsCoefficient”:0.0405,”minimumDepositRequirement”:75000,”minTerm”:0,”maxTerm”:12,”depositAmount”:75000},{“mid”:”04f1adb9-fc76-4748-9cba-5f46c03bf02d”,”productId”:”1426617″,”title”:”Capital One 360 Checking®”,”bankInstitution”:”Capital One, N.A.”,”category”:”Checking”,”subCategory”:”Consumer Checking”,”productImage”:”https://www.forbes.com/advisor/wp-content/uploads/2024/08/image-47.png”,”productCtaUrl”:”https://mktp.us/capone_checking_rtsem”,”cnn_productCtaLink”:null,”usat_productCtaLink”:null,”min_term_filter”:null,”max_term_filter”:null,”productCtaLabel”:”Learn More”,”textBelowCta”:”On Capital One’s Website”,”fdic_ncua”:”Member FDIC”,”superlativeFlag”:null,”productRating”:null,”accurateAsOf”:null,”whyWePickedIt”:null,”disclosure”:null,”details”:”

– Open a 360 Checking account on or after August 22, 2024, using promotional code CHECKING250

n

– Set up and receive at least 2 Qualifying Direct Deposits each of $500 or more to your 360 Checking account within 75 days of account opening.

n

– Capital One will deposit the bonus into your account after the first two requirements listed above are completed.

n

– See full offer details and when the bonus will be posted at https://www.capitalone.com/bank/checking250/affiliate.

“,”annualPercentageYield_boldValue”:”0.10%”,”annualPercentageYield_lightValue”:null,”annualPercentageYield_tooltipText”:”Annual Percentage Yield”,”minimumDepositRequirement_boldValue”:”$0.00″,”minimumDepositRequirement_lightValue”:null,”minimumDepositRequirement_tooltipText”:null,”apyEditorialDescription_boldValue”:null,”apyEditorialDescription_lightValue”:null,”apyEditorialDescription_tooltipText”:null,”monthlyMaintenanceFee_boldValue”:”$0.00″,”monthlyMaintenanceFee_shownTooltip”:null,”monthlyMaintenanceFee_tooltipText”:null,”maintenanceFeeEditorial_boldValue”:null,”maintenanceFeeEditorial_isKeyAttr”:null,”bonusAmount_boldValue”:”$250″,”bonusAmount_lightValue”:null,”bonusAmount_tooltipText”:”Earn a $250 bonus with 360 Checking. No fees, no minimums. Terms and eligibility requirements apply*”,”bonusRequirements_boldValue”:null,”bonusRequirements_lightValue”:null,”bonusRequirements_tooltipText”:null,”editorialBonusDescription_boldValue”:”Earn a $250 bonus with 360 Checking. No fees, no minimums. Terms and eligibility requirements apply*”,”products_boldValue”:null,”fees_boldValue”:null,”fees_lightValue”:null,”fees_tooltipText”:null,”terms_boldValue”:null,”terms_tooltipText”:null,”atmNetwork_boldValue”:null,”minimumAccountBalance_boldValue”:”$0.00″,”minimumAccountBalance_lightValue”:null,”minimumAccountBalance_tooltipText”:null,”createdOn”:1732578352421,”createdBy”:”SYSTEM”,”updatedOn”:1766434705054,”updatedBy”:”prod-fmp-pc-tracking-cta-compute-service|63509c38-2848-45c9-b994-28177306c6db”,”earningsCoefficient”:0.001,”minimumDepositRequirement”:0,”minTerm”:0,”maxTerm”:0,”depositAmount”:0},{“mid”:”56e77790-bfa0-458f-8da3-1987d6c80d4d”,”productId”:”1439368″,”title”:”Capital One 360 Performance Savings”,”bankInstitution”:”Capital One, N.A.”,”category”:”Saving”,”subCategory”:”High Yield Saving”,”productImage”:”https://www.forbes.com/advisor/wp-content/uploads/2024/08/image-47.png”,”productCtaUrl”:”https://mktp.us/capitalone_hysa_a2?FRBSADV_adtid=Forbes_TID_value”,”cnn_productCtaLink”:null,”usat_productCtaLink”:null,”min_term_filter”:null,”max_term_filter”:null,”productCtaLabel”:”Learn More”,”textBelowCta”:”On Capital One’s Website”,”fdic_ncua”:”Member FDIC”,”superlativeFlag”:null,”productRating”:null,”accurateAsOf”:null,”whyWePickedIt”:null,”disclosure”:null,”details”:”

n

n

“,”annualPercentageYield_boldValue”:”3.40%”,”annualPercentageYield_lightValue”:null,”annualPercentageYield_tooltipText”:”Annual Percentage Yield, as of 10/01/2025″,”minimumDepositRequirement_boldValue”:”$0.00″,”minimumDepositRequirement_lightValue”:null,”minimumDepositRequirement_tooltipText”:null,”apyEditorialDescription_boldValue”:null,”apyEditorialDescription_lightValue”:null,”apyEditorialDescription_tooltipText”:null,”monthlyMaintenanceFee_boldValue”:”$0.00″,”monthlyMaintenanceFee_shownTooltip”:null,”monthlyMaintenanceFee_tooltipText”:null,”maintenanceFeeEditorial_boldValue”:null,”maintenanceFeeEditorial_isKeyAttr”:null,”bonusAmount_boldValue”:”$0″,”bonusAmount_lightValue”:null,”bonusAmount_tooltipText”:null,”bonusRequirements_boldValue”:null,”bonusRequirements_lightValue”:null,”bonusRequirements_tooltipText”:null,”editorialBonusDescription_boldValue”:null,”products_boldValue”:null,”fees_boldValue”:null,”fees_lightValue”:null,”fees_tooltipText”:null,”terms_boldValue”:null,”terms_tooltipText”:null,”atmNetwork_boldValue”:null,”minimumAccountBalance_boldValue”:”$0.00″,”minimumAccountBalance_lightValue”:null,”minimumAccountBalance_tooltipText”:null,”createdOn”:1733344217976,”createdBy”:”SYSTEM”,”updatedOn”:1766434705054,”updatedBy”:”prod-fmp-pc-tracking-cta-compute-service|63509c38-2848-45c9-b994-28177306c6db”,”earningsCoefficient”:0.034,”minimumDepositRequirement”:0,”minTerm”:0,”maxTerm”:0,”depositAmount”:0},{“mid”:”cacd5bc6-4a19-4451-92fe-28b5c2ddf502″,”productId”:”1829260″,”title”:”Peak Bank High-Yield Savings”,”bankInstitution”:”Peak Bank”,”category”:”Saving”,”subCategory”:”High Yield Saving”,”productImage”:”https://www.forbes.com/advisor/wp-content/uploads/2025/09/Peak_Logo-Idaho-Horizontal-Dark.png”,”productCtaUrl”:”https://api.fintelconnect.com/t/l/68e90ce0e75d78001c3dfbee”,”cnn_productCtaLink”:null,”usat_productCtaLink”:null,”min_term_filter”:null,”max_term_filter”:null,”productCtaLabel”:”Learn More”,”textBelowCta”:”On Peak Bank’s Website”,”fdic_ncua”:”Member FDIC”,”superlativeFlag”:null,”productRating”:null,”accurateAsOf”:null,”whyWePickedIt”:null,”disclosure”:null,”details”:”

4.20% APY on balances of $.01 to $9,999,999.99

n

2.02% APY $10,000,000 and above

n

– No hidden fees

n

– Secure online access

n

– Personalized customer support

n

n

Empowering customers to reach their financial summit.

n

Climb higher with Peak Bank.

“,”annualPercentageYield_boldValue”:”Up to 4.20%”,”annualPercentageYield_lightValue”:null,”annualPercentageYield_tooltipText”:”Annual Percentage Yield”,”minimumDepositRequirement_boldValue”:”$100.00″,”minimumDepositRequirement_lightValue”:null,”minimumDepositRequirement_tooltipText”:null,”apyEditorialDescription_boldValue”:null,”apyEditorialDescription_lightValue”:null,”apyEditorialDescription_tooltipText”:null,”monthlyMaintenanceFee_boldValue”:”$0.00″,”monthlyMaintenanceFee_shownTooltip”:null,”monthlyMaintenanceFee_tooltipText”:null,”maintenanceFeeEditorial_boldValue”:null,”maintenanceFeeEditorial_isKeyAttr”:null,”bonusAmount_boldValue”:null,”bonusAmount_lightValue”:null,”bonusAmount_tooltipText”:null,”bonusRequirements_boldValue”:null,”bonusRequirements_lightValue”:null,”bonusRequirements_tooltipText”:null,”editorialBonusDescription_boldValue”:null,”products_boldValue”:null,”fees_boldValue”:null,”fees_lightValue”:null,”fees_tooltipText”:null,”terms_boldValue”:null,”terms_tooltipText”:null,”atmNetwork_boldValue”:null,”minimumAccountBalance_boldValue”:”$0.01″,”minimumAccountBalance_lightValue”:null,”minimumAccountBalance_tooltipText”:null,”createdOn”:1760105721715,”createdBy”:”SYSTEM”,”updatedOn”:1766434705054,”updatedBy”:”prod-fmp-pc-tracking-cta-compute-service|63509c38-2848-45c9-b994-28177306c6db”,”earningsCoefficient”:0.042,”minimumDepositRequirement”:100,”minTerm”:0,”maxTerm”:0,”depositAmount”:100},{“mid”:”0dc735ae-3ed1-4e54-8bef-603612ea2fd3″,”productId”:”366023″,”title”:”CIT Bank: 11 Month No Penalty CD”,”bankInstitution”:”CIT Bank”,”category”:”CD”,”subCategory”:null,”productImage”:”https://www.forbes.com/advisor/wp-content/uploads/2023/03/cit_bank_logo_member_fdic.png”,”productCtaUrl”:”https://citbank.sjv.io/c/1955282/2720745/30164?sharedid=RT “,”cnn_productCtaLink”:null,”usat_productCtaLink”:null,”min_term_filter”:”0″,”max_term_filter”:”11″,”productCtaLabel”:”Learn More”,”textBelowCta”:”On CIT Bank’s Website”,”fdic_ncua”:”Member FDIC”,”superlativeFlag”:null,”productRating”:null,”accurateAsOf”:”45005″,”whyWePickedIt”:null,”disclosure”:null,”details”:”

No penalty to access funds if needed before maturity. Note no withdrawals are permitted during the first 6 days following the receipt of funds.*

n

Daily compounding interest.

n

No monthly service fees.

n

n

Disclosures

n

APY — Annual Percentage Yield is accurate as of November 20, 2025. $1,000 minimum to open the account.

n

With a No-Penalty CD, you may withdraw the total balance and interest earned, without penalty, beginning 7 days after funds have been received for your CD. No withdrawals are permitted during the first 6 days following the receipt of funds.

n

For complete list of account details and fees, see our Personal Account disclosures.

“,”annualPercentageYield_boldValue”:”3.25%”,”annualPercentageYield_lightValue”:null,”annualPercentageYield_tooltipText”:”Annual Percentage Yield (APY — Annual Percentage Yield is accurate as of November 20, 2025. $1,000 minimum to open the account.)”,”minimumDepositRequirement_boldValue”:”$1,000.00″,”minimumDepositRequirement_lightValue”:null,”minimumDepositRequirement_tooltipText”:null,”apyEditorialDescription_boldValue”:null,”apyEditorialDescription_lightValue”:null,”apyEditorialDescription_tooltipText”:null,”monthlyMaintenanceFee_boldValue”:”$0.00″,”monthlyMaintenanceFee_shownTooltip”:null,”monthlyMaintenanceFee_tooltipText”:null,”maintenanceFeeEditorial_boldValue”:null,”maintenanceFeeEditorial_isKeyAttr”:null,”bonusAmount_boldValue”:null,”bonusAmount_lightValue”:null,”bonusAmount_tooltipText”:null,”bonusRequirements_boldValue”:null,”bonusRequirements_lightValue”:null,”bonusRequirements_tooltipText”:null,”editorialBonusDescription_boldValue”:null,”products_boldValue”:null,”fees_boldValue”:null,”fees_lightValue”:null,”fees_tooltipText”:null,”terms_boldValue”:”11 months”,”terms_tooltipText”:null,”atmNetwork_boldValue”:null,”minimumAccountBalance_boldValue”:”$1,000″,”minimumAccountBalance_lightValue”:null,”minimumAccountBalance_tooltipText”:null,”createdOn”:1711039049397,”createdBy”:”SYSTEM”,”updatedOn”:1766434705054,”updatedBy”:”prod-fmp-pc-tracking-cta-compute-service|63509c38-2848-45c9-b994-28177306c6db”,”earningsCoefficient”:0.02979167,”minimumDepositRequirement”:1000,”minTerm”:0,”maxTerm”:11,”depositAmount”:1000},{“mid”:”bdf48fa9-0f66-42dd-bab0-18b723f2c92b”,”productId”:”365922″,”title”:”Bluevine Business Checking”,”bankInstitution”:”Bluevine”,”category”:”Checking”,”subCategory”:”Business Checking”,”productImage”:”https://www.forbes.com/advisor/wp-content/uploads/2022/03/Bluevine-Logo_Bluevine-Blue.png”,”productCtaUrl”:”https://www.bluevine.com/partner/forbesadvisor3002-checking?utm_source=forbesadvisorwidget-0291301&utm_medium=partner_referral&utm_campaign=site”,”cnn_productCtaLink”:null,”usat_productCtaLink”:null,”min_term_filter”:null,”max_term_filter”:null,”productCtaLabel”:”Learn More”,”textBelowCta”:”On BlueVine’s Website”,”fdic_ncua”:”Member FDIC”,”superlativeFlag”:null,”productRating”:null,”accurateAsOf”:null,”whyWePickedIt”:null,”disclosure”:null,”details”:”

Open an account with no monthly or overdraft fees, no minimum balance, and unlimited transactions

n

Earn 1.30% APY on balances up to $250,000 if you meet a monthly activity goal — you must spend $500 per month with your Bluevine Business Debit Mastercard or receive $2,500 per month in customer payments into your Bluevine Business Checking account via ACH, wire transfer, mobile check deposit or directly from your merchant payment processing provider.

n

FDIC-insured up to $3 million per depositor through Coastal Community Bank, Member FDIC, and other program banks.

“,”annualPercentageYield_boldValue”:”up to 3.00%”,”annualPercentageYield_lightValue”:null,”annualPercentageYield_tooltipText”:”Annual Percentage Yield”,”minimumDepositRequirement_boldValue”:”$0.00″,”minimumDepositRequirement_lightValue”:null,”minimumDepositRequirement_tooltipText”:null,”apyEditorialDescription_boldValue”:null,”apyEditorialDescription_lightValue”:null,”apyEditorialDescription_tooltipText”:null,”monthlyMaintenanceFee_boldValue”:”$0.00″,”monthlyMaintenanceFee_shownTooltip”:null,”monthlyMaintenanceFee_tooltipText”:null,”maintenanceFeeEditorial_boldValue”:null,”maintenanceFeeEditorial_isKeyAttr”:null,”bonusAmount_boldValue”:”$500″,”bonusAmount_lightValue”:null,”bonusAmount_tooltipText”:”Earn a $500 bonus after opening a new Bluevine Business Checking account between now and March 31, 2026, using referral code FORBES500 and meeting eligibility requirements. Terms apply.”,”bonusRequirements_boldValue”:null,”bonusRequirements_lightValue”:null,”bonusRequirements_tooltipText”:null,”editorialBonusDescription_boldValue”:”Earn a $500 bonus after opening a new Bluevine Business Checking account between now and March 31, 2026, using referral code FORBES500 and meeting eligibility requirements. Terms apply.”,”products_boldValue”:null,”fees_boldValue”:null,”fees_lightValue”:null,”fees_tooltipText”:null,”terms_boldValue”:null,”terms_tooltipText”:null,”atmNetwork_boldValue”:null,”minimumAccountBalance_boldValue”:”$0″,”minimumAccountBalance_lightValue”:null,”minimumAccountBalance_tooltipText”:null,”createdOn”:1711039048362,”createdBy”:”SYSTEM”,”updatedOn”:1766434705054,”updatedBy”:”prod-fmp-pc-tracking-cta-compute-service|63509c38-2848-45c9-b994-28177306c6db”,”earningsCoefficient”:0.03,”minimumDepositRequirement”:0,”minTerm”:0,”maxTerm”:0,”depositAmount”:0},{“mid”:”0bb488c2-1622-45a1-bde8-7ca984796094″,”productId”:”1072763″,”title”:”Bask Bank Certificates of Deposit (CD) – 12 mos”,”bankInstitution”:”Bask Bank”,”category”:”CD”,”subCategory”:null,”productImage”:”https://www.forbes.com/advisor/wp-content/uploads/2024/04/2.0_Bask_logo_rgb.png”,”productCtaUrl”:”https://click.linksynergy.com/fs-bin/click?id=4e4NFxuugkU&offerid=1597082.42&type=3&subid=0″,”cnn_productCtaLink”:null,”usat_productCtaLink”:null,”min_term_filter”:”0″,”max_term_filter”:”12″,”productCtaLabel”:”Learn More”,”textBelowCta”:”On Bask Bank’s Website”,”fdic_ncua”:”Member FDIC”,”superlativeFlag”:null,”productRating”:null,”accurateAsOf”:null,”whyWePickedIt”:null,”disclosure”:null,”details”:”

-New CD account must be funded with a single, lump-sum deposit of at least $1,000 within the first 10 business days after account opening. If your CD is not funded with at least $1,000 within 10 business days, your account will be closed automatically. Once you make your initial deposit, you will not be able to make any additional deposits until the renewal grace period at the completion of the CD term.

“,”annualPercentageYield_boldValue”:”4.40%”,”annualPercentageYield_lightValue”:null,”annualPercentageYield_tooltipText”:”Annual Percentage Yield (APY) is fixed and assumes reinvestment of principal and interest until maturity; penalty may be incurred if funds are withdrawn prior to maturity.”,”minimumDepositRequirement_boldValue”:”$1,000.00″,”minimumDepositRequirement_lightValue”:null,”minimumDepositRequirement_tooltipText”:null,”apyEditorialDescription_boldValue”:null,”apyEditorialDescription_lightValue”:null,”apyEditorialDescription_tooltipText”:null,”monthlyMaintenanceFee_boldValue”:”$0.00″,”monthlyMaintenanceFee_shownTooltip”:null,”monthlyMaintenanceFee_tooltipText”:null,”maintenanceFeeEditorial_boldValue”:null,”maintenanceFeeEditorial_isKeyAttr”:null,”bonusAmount_boldValue”:null,”bonusAmount_lightValue”:null,”bonusAmount_tooltipText”:null,”bonusRequirements_boldValue”:null,”bonusRequirements_lightValue”:null,”bonusRequirements_tooltipText”:null,”editorialBonusDescription_boldValue”:null,”products_boldValue”:null,”fees_boldValue”:null,”fees_lightValue”:null,”fees_tooltipText”:null,”terms_boldValue”:”12 months”,”terms_tooltipText”:null,”atmNetwork_boldValue”:null,”minimumAccountBalance_boldValue”:”$1,000.00″,”minimumAccountBalance_lightValue”:null,”minimumAccountBalance_tooltipText”:null,”createdOn”:1719259250674,”createdBy”:”SYSTEM”,”updatedOn”:1766434705054,”updatedBy”:”prod-fmp-pc-tracking-cta-compute-service|63509c38-2848-45c9-b994-28177306c6db”,”earningsCoefficient”:0.044,”minimumDepositRequirement”:1000,”minTerm”:0,”maxTerm”:12,”depositAmount”:1000},{“mid”:”04b2a26d-a75f-4dfd-bc6c-b6cec394a4e8″,”productId”:”1043457″,”title”:”Synchrony Bank High Yield Savings Account”,”bankInstitution”:”Synchrony Bank”,”category”:”Saving”,”subCategory”:”High Yield Saving”,”productImage”:”https://www.forbes.com/advisor/wp-content/uploads/2024/04/47380_4-2.jpg”,”productCtaUrl”:”https://click.linksynergy.com/fs-bin/click?id=4e4NFxuugkU&offerid=1755703.2079&type=3&subid=0″,”cnn_productCtaLink”:null,”usat_productCtaLink”:null,”min_term_filter”:null,”max_term_filter”:null,”productCtaLabel”:”Learn More”,”textBelowCta”:”On Synchrony Bank’s Website”,”fdic_ncua”:”Member FDIC”,”superlativeFlag”:null,”productRating”:null,”accurateAsOf”:null,”whyWePickedIt”:null,”disclosure”:null,”details”:”

– Save with Synchrony Bank. Open a High Yield savings account without a minimum deposit. Member FDIC. Learn more about banking online with Synchrony Bank today.

n

– Savings products with competitive rates, no required minimum balances, and no monthly fees.

n

– Save easy with Synchrony Bank. Our app makes it a snap to bank anywhere; manage accounts from your smartphone or tablet.

“,”annualPercentageYield_boldValue”:”3.65%”,”annualPercentageYield_lightValue”:null,”annualPercentageYield_tooltipText”:”Annual Percentage Yield (APY) is subject to change at any time without notice. Offer applies to personal accounts only. Fees may reduce earnings. For High Yield Savings accounts, the rate may change after the account is opened. Visit synchrony.com/banking for current rates, terms and account requirements. Member FDIC.”,”minimumDepositRequirement_boldValue”:”$0.00″,”minimumDepositRequirement_lightValue”:null,”minimumDepositRequirement_tooltipText”:null,”apyEditorialDescription_boldValue”:null,”apyEditorialDescription_lightValue”:null,”apyEditorialDescription_tooltipText”:null,”monthlyMaintenanceFee_boldValue”:”$0.00″,”monthlyMaintenanceFee_shownTooltip”:null,”monthlyMaintenanceFee_tooltipText”:null,”maintenanceFeeEditorial_boldValue”:null,”maintenanceFeeEditorial_isKeyAttr”:null,”bonusAmount_boldValue”:null,”bonusAmount_lightValue”:null,”bonusAmount_tooltipText”:null,”bonusRequirements_boldValue”:null,”bonusRequirements_lightValue”:null,”bonusRequirements_tooltipText”:null,”editorialBonusDescription_boldValue”:null,”products_boldValue”:null,”fees_boldValue”:null,”fees_lightValue”:null,”fees_tooltipText”:null,”terms_boldValue”:null,”terms_tooltipText”:null,”atmNetwork_boldValue”:null,”minimumAccountBalance_boldValue”:”$0″,”minimumAccountBalance_lightValue”:null,”minimumAccountBalance_tooltipText”:null,”createdOn”:1719334023668,”createdBy”:”SYSTEM”,”updatedOn”:1766434705054,”updatedBy”:”prod-fmp-pc-tracking-cta-compute-service|63509c38-2848-45c9-b994-28177306c6db”,”earningsCoefficient”:0.0365,”minimumDepositRequirement”:0,”minTerm”:0,”maxTerm”:0,”depositAmount”:0},{“mid”:”e0346f37-182d-4bbc-9a1b-c9746fc671e6″,”productId”:”1879096″,”title”:”Sallie Mae High-Yield Savings Account”,”bankInstitution”:”Sallie Mae”,”category”:”Saving”,”subCategory”:”High Yield Saving”,”productImage”:”https://www.forbes.com/advisor/wp-content/uploads/2024/01/SallieMae_logo_rasp.png”,”productCtaUrl”:”https://www.salliemae.com/banking/high-yield-savings-account/?dtd_cell=RDMKS1DCZPMAPCFRRTBOTHRN030001″,”cnn_productCtaLink”:null,”usat_productCtaLink”:null,”min_term_filter”:null,”max_term_filter”:null,”productCtaLabel”:”Learn More”,”textBelowCta”:”On Sallie Mae’s Website”,”fdic_ncua”:”Member FDIC”,”superlativeFlag”:null,”productRating”:null,”accurateAsOf”:null,”whyWePickedIt”:null,”disclosure”:null,”details”:”

– No minimum deposit required

n

– No monthly maintenance fees

n

– Free transfers

n

– FDIC-insured

n

– Easy online account management

“,”annualPercentageYield_boldValue”:”3.90%”,”annualPercentageYield_lightValue”:null,”annualPercentageYield_tooltipText”:”Advertised Annual Percentage Yield (APY) for the Sallie Mae High-Yield Savings Account Account is variable and may change after account opening, applies to personal accounts only, and is accurate as of 11/10/2025. Fees could reduce earnings. Please refer to the Account Terms and Conditions Agreement: https://www.salliemae.com/banking/terms/rd/ for details.”,”minimumDepositRequirement_boldValue”:”$0.00″,”minimumDepositRequirement_lightValue”:null,”minimumDepositRequirement_tooltipText”:null,”apyEditorialDescription_boldValue”:null,”apyEditorialDescription_lightValue”:null,”apyEditorialDescription_tooltipText”:null,”monthlyMaintenanceFee_boldValue”:”$0.00″,”monthlyMaintenanceFee_shownTooltip”:null,”monthlyMaintenanceFee_tooltipText”:null,”maintenanceFeeEditorial_boldValue”:null,”maintenanceFeeEditorial_isKeyAttr”:null,”bonusAmount_boldValue”:null,”bonusAmount_lightValue”:null,”bonusAmount_tooltipText”:null,”bonusRequirements_boldValue”:null,”bonusRequirements_lightValue”:null,”bonusRequirements_tooltipText”:null,”editorialBonusDescription_boldValue”:null,”products_boldValue”:null,”fees_boldValue”:null,”fees_lightValue”:null,”fees_tooltipText”:null,”terms_boldValue”:null,”terms_tooltipText”:null,”atmNetwork_boldValue”:null,”minimumAccountBalance_boldValue”:”$0.00″,”minimumAccountBalance_lightValue”:null,”minimumAccountBalance_tooltipText”:null,”createdOn”:1762456224205,”createdBy”:”SYSTEM”,”updatedOn”:1766434705054,”updatedBy”:”prod-fmp-pc-tracking-cta-compute-service|63509c38-2848-45c9-b994-28177306c6db”,”earningsCoefficient”:0.039,”minimumDepositRequirement”:0,”minTerm”:0,”maxTerm”:0,”depositAmount”:0},{“mid”:”9a4c8884-55da-49f5-87a3-a7d8f6ceacfa”,”productId”:”562827″,”title”:”Quontic Bank Certificate of Deposit”,”bankInstitution”:”Quontic Bank”,”category”:”CD”,”subCategory”:null,”productImage”:”https://www.forbes.com/advisor/wp-content/uploads/2021/12/Quontic-Bank.png”,”productCtaUrl”:”https://click.linksynergy.com/fs-bin/click?id=4e4NFxuugkU&offerid=1328517.48&type=3&subid=0″,”cnn_productCtaLink”:null,”usat_productCtaLink”:null,”min_term_filter”:”0″,”max_term_filter”:”12″,”productCtaLabel”:”Learn More”,”textBelowCta”:”On Quontic Bank’s Website”,”fdic_ncua”:”Member FDIC”,”superlativeFlag”:null,”productRating”:null,”accurateAsOf”:null,”whyWePickedIt”:null,”disclosure”:null,”details”:”Quontic offers competitive certificates of deposit (CDs) across five terms, from six to sixty months. Opening a Quontic Bank Certificate of Deposit requires a minimum deposit of $500.”,”annualPercentageYield_boldValue”:”3.00%”,”annualPercentageYield_lightValue”:null,”annualPercentageYield_tooltipText”:”Annual Percentage Yield”,”minimumDepositRequirement_boldValue”:”$500.00″,”minimumDepositRequirement_lightValue”:null,”minimumDepositRequirement_tooltipText”:null,”apyEditorialDescription_boldValue”:null,”apyEditorialDescription_lightValue”:null,”apyEditorialDescription_tooltipText”:null,”monthlyMaintenanceFee_boldValue”:”$0.00″,”monthlyMaintenanceFee_shownTooltip”:null,”monthlyMaintenanceFee_tooltipText”:null,”maintenanceFeeEditorial_boldValue”:null,”maintenanceFeeEditorial_isKeyAttr”:null,”bonusAmount_boldValue”:null,”bonusAmount_lightValue”:null,”bonusAmount_tooltipText”:null,”bonusRequirements_boldValue”:null,”bonusRequirements_lightValue”:null,”bonusRequirements_tooltipText”:null,”editorialBonusDescription_boldValue”:null,”products_boldValue”:null,”fees_boldValue”:null,”fees_lightValue”:null,”fees_tooltipText”:null,”terms_boldValue”:”12 months”,”terms_tooltipText”:null,”atmNetwork_boldValue”:null,”minimumAccountBalance_boldValue”:null,”minimumAccountBalance_lightValue”:null,”minimumAccountBalance_tooltipText”:null,”createdOn”:1711039050750,”createdBy”:”SYSTEM”,”updatedOn”:1766434705054,”updatedBy”:”prod-fmp-pc-tracking-cta-compute-service|63509c38-2848-45c9-b994-28177306c6db”,”earningsCoefficient”:0.03,”minimumDepositRequirement”:500,”minTerm”:0,”maxTerm”:12,”depositAmount”:500},{“mid”:”c019dc90-2094-4f45-ae18-aa8e38409e1a”,”productId”:”1678858″,”title”:”Believe Savings – High-Yield Savings”,”bankInstitution”:”Believe Savings, a division of Regent Bank”,”category”:”Saving”,”subCategory”:”High Yield Saving”,”productImage”:”https://www.forbes.com/advisor/wp-content/uploads/2025/05/Screenshot-2025-05-09-at-2.22.14%E2%80%AFPM.png”,”productCtaUrl”:”https://api.fintelconnect.com/t/l/68238a25adeacf001bbf5dc4 “,”cnn_productCtaLink”:null,”usat_productCtaLink”:null,”min_term_filter”:null,”max_term_filter”:null,”productCtaLabel”:”Learn More”,”textBelowCta”:”On Believe Saving’s Website”,”fdic_ncua”:”Member FDIC”,”superlativeFlag”:null,”productRating”:null,”accurateAsOf”:null,”whyWePickedIt”:null,”disclosure”:null,”details”:”

– 3.55% APY¹ on all balances of $0.01 or more

n

– No monthly fees or minimum balance to earn interest

n

– 0.10% charitable donation made by the bank (not deducted from customer returns)

n

– Fast & easy sign-up — under 5 minutes

n

– Fully digital onboarding & secure account access

n

– Customers can select or change their nonprofit beneficiary at any time

n

n

Disclosures:

n

¹APY (Annual Percentage Yield) is accurate as of 12/15/25. Minimum balance required to open an account is $100. Must maintain $0.01 to earn interest. Rates may change at any time without notice. Fees may reduce earnings.

“,”annualPercentageYield_boldValue”:”3.55%”,”annualPercentageYield_lightValue”:null,”annualPercentageYield_tooltipText”:”APY (Annual Percentage Yield) is accurate as of 12/15/25. Minimum balance required to open an account is $100. Must maintain $0.01 to earn interest. Rates may change at any time without notice. Fees may reduce earnings. “,”minimumDepositRequirement_boldValue”:”$100.00″,”minimumDepositRequirement_lightValue”:null,”minimumDepositRequirement_tooltipText”:null,”apyEditorialDescription_boldValue”:null,”apyEditorialDescription_lightValue”:null,”apyEditorialDescription_tooltipText”:null,”monthlyMaintenanceFee_boldValue”:”$0.00″,”monthlyMaintenanceFee_shownTooltip”:null,”monthlyMaintenanceFee_tooltipText”:null,”maintenanceFeeEditorial_boldValue”:null,”maintenanceFeeEditorial_isKeyAttr”:null,”bonusAmount_boldValue”:null,”bonusAmount_lightValue”:null,”bonusAmount_tooltipText”:null,”bonusRequirements_boldValue”:null,”bonusRequirements_lightValue”:null,”bonusRequirements_tooltipText”:null,”editorialBonusDescription_boldValue”:null,”products_boldValue”:null,”fees_boldValue”:null,”fees_lightValue”:null,”fees_tooltipText”:null,”terms_boldValue”:null,”terms_tooltipText”:null,”atmNetwork_boldValue”:null,”minimumAccountBalance_boldValue”:”$0.01″,”minimumAccountBalance_lightValue”:null,”minimumAccountBalance_tooltipText”:null,”createdOn”:1747159652267,”createdBy”:”SYSTEM”,”updatedOn”:1766434705054,”updatedBy”:”prod-fmp-pc-tracking-cta-compute-service|63509c38-2848-45c9-b994-28177306c6db”,”earningsCoefficient”:0.0355,”minimumDepositRequirement”:100,”minTerm”:0,”maxTerm”:0,”depositAmount”:100},{“mid”:”4d6e18b7-6de6-4396-9bc7-30c27997d188″,”productId”:”1615566″,”title”:”U.S. Bank 6-month CD Special”,”bankInstitution”:”U.S. Bank”,”category”:”CD”,”subCategory”:null,”productImage”:”https://www.forbes.com/advisor/wp-content/uploads/2023/12/US_Bank_logo_red_blue_RGB_8.31-1.jpg”,”productCtaUrl”:”https://cdspecial.pxf.io/c/1955282/3721739/32545?sharedid=RT”,”cnn_productCtaLink”:null,”usat_productCtaLink”:null,”min_term_filter”:”0″,”max_term_filter”:”6″,”productCtaLabel”:”Learn More”,”textBelowCta”:”On U.S. Bank’s Website”,”fdic_ncua”:”Member FDIC”,”superlativeFlag”:null,”productRating”:null,”accurateAsOf”:null,”whyWePickedIt”:null,”disclosure”:null,”details”:”

Grow your money with a Certificate of Deposit account at U.S. Bank. Now, get a higher rate of return by locking in an exclusive rate on balances up to $250,000:

n

– 3.67% Annual Percentage Yield (APY) for 6 months

n

Rates vary by term and location. Member FDIC.

“,”annualPercentageYield_boldValue”:”3.67%”,”annualPercentageYield_lightValue”:null,”annualPercentageYield_tooltipText”:”Annual Percentage Yield. See website for details.”,”minimumDepositRequirement_boldValue”:”$1,000.00″,”minimumDepositRequirement_lightValue”:null,”minimumDepositRequirement_tooltipText”:null,”apyEditorialDescription_boldValue”:null,”apyEditorialDescription_lightValue”:null,”apyEditorialDescription_tooltipText”:null,”monthlyMaintenanceFee_boldValue”:”$0.00″,”monthlyMaintenanceFee_shownTooltip”:null,”monthlyMaintenanceFee_tooltipText”:null,”maintenanceFeeEditorial_boldValue”:null,”maintenanceFeeEditorial_isKeyAttr”:null,”bonusAmount_boldValue”:null,”bonusAmount_lightValue”:null,”bonusAmount_tooltipText”:null,”bonusRequirements_boldValue”:null,”bonusRequirements_lightValue”:null,”bonusRequirements_tooltipText”:null,”editorialBonusDescription_boldValue”:null,”products_boldValue”:null,”fees_boldValue”:null,”fees_lightValue”:null,”fees_tooltipText”:null,”terms_boldValue”:”6 months”,”terms_tooltipText”:null,”atmNetwork_boldValue”:null,”minimumAccountBalance_boldValue”:”$1,000.00″,”minimumAccountBalance_lightValue”:null,”minimumAccountBalance_tooltipText”:null,”createdOn”:1742827653019,”createdBy”:”SYSTEM”,”updatedOn”:1766434705054,”updatedBy”:”prod-fmp-pc-tracking-cta-compute-service|63509c38-2848-45c9-b994-28177306c6db”,”earningsCoefficient”:0.01835,”minimumDepositRequirement”:1000,”minTerm”:0,”maxTerm”:6,”depositAmount”:1000},{“mid”:”7a432c92-a351-4a32-9b88-25788df4f17a”,”productId”:”404112″,”title”:”Live Oak Personal Savings”,”bankInstitution”:”Live Oak Bank”,”category”:”Saving”,”subCategory”:”High Yield Saving”,”productImage”:”https://www.forbes.com/advisor/wp-content/uploads/2022/11/23-LOB-Forbes-RateTable_Personal-e1682697963280-300×151.png”,”productCtaUrl”:”https://api.fintelconnect.com/t/l/65fb32cd5d99a2001ba9b870″,”cnn_productCtaLink”:null,”usat_productCtaLink”:null,”min_term_filter”:null,”max_term_filter”:null,”productCtaLabel”:”Learn More”,”textBelowCta”:”On Live Oak Bank’s Website”,”fdic_ncua”:”Member FDIC”,”superlativeFlag”:null,”productRating”:null,”accurateAsOf”:”45008″,”whyWePickedIt”:null,”disclosure”:null,”details”:”

The Live Oak Personal Savings account has no monthly maintenance fees.

n

It also has no minimum deposit requirement to open an account.

n

You can open an account in minutes online and access your account online or through the bank’s mobile app.

“,”annualPercentageYield_boldValue”:”3.90%”,”annualPercentageYield_lightValue”:null,”annualPercentageYield_tooltipText”:”Annual Percentage Yield”,”minimumDepositRequirement_boldValue”:”$0.00″,”minimumDepositRequirement_lightValue”:null,”minimumDepositRequirement_tooltipText”:null,”apyEditorialDescription_boldValue”:null,”apyEditorialDescription_lightValue”:null,”apyEditorialDescription_tooltipText”:null,”monthlyMaintenanceFee_boldValue”:”$0.00″,”monthlyMaintenanceFee_shownTooltip”:null,”monthlyMaintenanceFee_tooltipText”:null,”maintenanceFeeEditorial_boldValue”:null,”maintenanceFeeEditorial_isKeyAttr”:null,”bonusAmount_boldValue”:null,”bonusAmount_lightValue”:null,”bonusAmount_tooltipText”:null,”bonusRequirements_boldValue”:null,”bonusRequirements_lightValue”:null,”bonusRequirements_tooltipText”:null,”editorialBonusDescription_boldValue”:null,”products_boldValue”:null,”fees_boldValue”:null,”fees_lightValue”:null,”fees_tooltipText”:null,”terms_boldValue”:null,”terms_tooltipText”:null,”atmNetwork_boldValue”:null,”minimumAccountBalance_boldValue”:”$0.01″,”minimumAccountBalance_lightValue”:null,”minimumAccountBalance_tooltipText”:null,”createdOn”:1711039050309,”createdBy”:”SYSTEM”,”updatedOn”:1766434705054,”updatedBy”:”prod-fmp-pc-tracking-cta-compute-service|63509c38-2848-45c9-b994-28177306c6db”,”earningsCoefficient”:0.039,”minimumDepositRequirement”:0,”minTerm”:0,”maxTerm”:0,”depositAmount”:0},{“mid”:”fda4d9b5-c8ff-475c-9e2e-f7e3976f5cb5″,”productId”:”1230117″,”title”:”Live Oak – 1 Year CD”,”bankInstitution”:”Live Oak Bank”,”category”:”CD”,”subCategory”:null,”productImage”:”https://www.forbes.com/advisor/wp-content/uploads/2024/07/live-oak-bank-vector-logo-2022.png”,”productCtaUrl”:”https://api.fintelconnect.com/t/l/65fb3a0eb0d17e001cd11013″,”cnn_productCtaLink”:null,”usat_productCtaLink”:null,”min_term_filter”:”0″,”max_term_filter”:”12″,”productCtaLabel”:”Learn More”,”textBelowCta”:”On Live Oak Bank’s Website”,”fdic_ncua”:”Member FDIC”,”superlativeFlag”:null,”productRating”:null,”accurateAsOf”:null,”whyWePickedIt”:null,”disclosure”:null,”details”:”

A CD is a great savings tool for your long-term financial goals. When interest rates fluctuate, you can be confident that you have a guaranteed rate of return on the money you’ve placed in your Live Oak CD account.

n

– 4.00% APY (accurate as of 10/22/25)

n

– $2,500 minimum to open

n

– Monthly interest disbursement fee: $0

n

– Interest can be automatically disbursed monthly

n

– FDIC insured up to $250,000 per depositor for each account ownership category

n

– No online banking or monthly maintenance fees

n

– Available to people nationwide

n

– Manage renewal preferences online

“,”annualPercentageYield_boldValue”:”4.00%”,”annualPercentageYield_lightValue”:null,”annualPercentageYield_tooltipText”:”Annual Percentage Yield”,”minimumDepositRequirement_boldValue”:”$2,500.00″,”minimumDepositRequirement_lightValue”:null,”minimumDepositRequirement_tooltipText”:null,”apyEditorialDescription_boldValue”:null,”apyEditorialDescription_lightValue”:null,”apyEditorialDescription_tooltipText”:null,”monthlyMaintenanceFee_boldValue”:”$0.00″,”monthlyMaintenanceFee_shownTooltip”:null,”monthlyMaintenanceFee_tooltipText”:null,”maintenanceFeeEditorial_boldValue”:null,”maintenanceFeeEditorial_isKeyAttr”:null,”bonusAmount_boldValue”:null,”bonusAmount_lightValue”:null,”bonusAmount_tooltipText”:null,”bonusRequirements_boldValue”:null,”bonusRequirements_lightValue”:null,”bonusRequirements_tooltipText”:null,”editorialBonusDescription_boldValue”:null,”products_boldValue”:null,”fees_boldValue”:null,”fees_lightValue”:null,”fees_tooltipText”:null,”terms_boldValue”:”12 months”,”terms_tooltipText”:null,”atmNetwork_boldValue”:null,”minimumAccountBalance_boldValue”:”$0.01″,”minimumAccountBalance_lightValue”:null,”minimumAccountBalance_tooltipText”:null,”createdOn”:1724251759909,”createdBy”:”SYSTEM”,”updatedOn”:1766434705054,”updatedBy”:”prod-fmp-pc-tracking-cta-compute-service|63509c38-2848-45c9-b994-28177306c6db”,”earningsCoefficient”:0.04,”minimumDepositRequirement”:2500,”minTerm”:0,”maxTerm”:12,”depositAmount”:2500},{“mid”:”cad63a45-ef4e-413f-854a-0710934b24c5″,”productId”:”365966″,”title”:”Axos Bank Basic Business Checking”,”bankInstitution”:”Axos Bank”,”category”:”Checking”,”subCategory”:”Business Checking”,”productImage”:”https://www.forbes.com/advisor/wp-content/uploads/2020/07/1200px-Axos_Bank_Logo.svg_-e1593593029821.png”,”productCtaUrl”:”https://www.dpbolvw.net/click-100640841-15921476″,”cnn_productCtaLink”:null,”usat_productCtaLink”:null,”min_term_filter”:null,”max_term_filter”:null,”productCtaLabel”:”Learn More”,”textBelowCta”:”On Axos Bank’s Website”,”fdic_ncua”:”Member FDIC”,”superlativeFlag”:null,”productRating”:null,”accurateAsOf”:null,”whyWePickedIt”:null,”disclosure”:null,”details”:”

No monthly maintenance fees

n

Unlimited transactions

n

Unlimited domestic ATM fee reimbursements

n

Free domestic incoming wires

“,”annualPercentageYield_boldValue”:”N/A”,”annualPercentageYield_lightValue”:null,”annualPercentageYield_tooltipText”:null,”minimumDepositRequirement_boldValue”:”$0.00″,”minimumDepositRequirement_lightValue”:null,”minimumDepositRequirement_tooltipText”:null,”apyEditorialDescription_boldValue”:null,”apyEditorialDescription_lightValue”:null,”apyEditorialDescription_tooltipText”:null,”monthlyMaintenanceFee_boldValue”:”$0.00″,”monthlyMaintenanceFee_shownTooltip”:null,”monthlyMaintenanceFee_tooltipText”:null,”maintenanceFeeEditorial_boldValue”:null,”maintenanceFeeEditorial_isKeyAttr”:null,”bonusAmount_boldValue”:”$200″,”bonusAmount_lightValue”:null,”bonusAmount_tooltipText”:null,”bonusRequirements_boldValue”:null,”bonusRequirements_lightValue”:null,”bonusRequirements_tooltipText”:null,”editorialBonusDescription_boldValue”:”Open a Basic Business Checking account using promo code START200 by June 30, 2026 and maintain and minimum average daily balance of $3,000. Terms apply.”,”products_boldValue”:null,”fees_boldValue”:null,”fees_lightValue”:null,”fees_tooltipText”:null,”terms_boldValue”:null,”terms_tooltipText”:null,”atmNetwork_boldValue”:null,”minimumAccountBalance_boldValue”:”$0″,”minimumAccountBalance_lightValue”:null,”minimumAccountBalance_tooltipText”:null,”createdOn”:1711039048057,”createdBy”:”SYSTEM”,”updatedOn”:1766434705054,”updatedBy”:”prod-fmp-pc-tracking-cta-compute-service|63509c38-2848-45c9-b994-28177306c6db”,”minimumDepositRequirement”:0,”minTerm”:0,”maxTerm”:0,”depositAmount”:0},{“mid”:”c22f1f62-4cc4-4123-82f8-5e07cd58572b”,”productId”:”635951″,”title”:”Found Business Checking”,”bankInstitution”:”Piermont Bank”,”category”:”Checking”,”subCategory”:”Business Checking”,”productImage”:”https://www.forbes.com/advisor/wp-content/uploads/2023/06/Found_logo_black.png”,”productCtaUrl”:”https://found.sjv.io/c/1955282/2128548/16824?sharedid=rate-table”,”cnn_productCtaLink”:null,”usat_productCtaLink”:null,”min_term_filter”:null,”max_term_filter”:null,”productCtaLabel”:”Learn More”,”textBelowCta”:”On Found’s Website”,”fdic_ncua”:null,”superlativeFlag”:null,”productRating”:null,”accurateAsOf”:null,”whyWePickedIt”:null,”disclosure”:null,”details”:”

*1.5% Annual Percentage Yield (APY) up to $20,000 when users subscribe to Found Plus. Compounds monthly based on the Monthly Average Balance of up to $20,000.

n

Found is a financial technology company, not a bank. Business banking services are provided by Lead Bank, Member FDIC. The funds in your account are FDIC-insured up to $250,000 per depositor for each account ownership category. FDIC insurance only covers the failure of an FDIC-insured depository institution. The Found Mastercard Business debit card is issued by Lead Bank pursuant to a license from Mastercard Inc. and may be used everywhere Mastercard debit cards are accepted.

n

n

Found’s core features are free. Found also offers two optional paid products, Found Plus for $19.99 / month or $149.99 / year or Found Pro for $80 / month or $720 / year.

n

Optional subscriptions to Found Plus for $19.99 / month or $149.99 / year or Found Pro for $80 / month or $720 / year. There are no monthly account maintenance fees, but other fees such as transactional fees for wires, instant transfers, and ATM apply. Read Found Fee Schedule.

“,”annualPercentageYield_boldValue”:”1.50%*”,”annualPercentageYield_lightValue”:null,”annualPercentageYield_tooltipText”:”Annual Percentage Yield”,”minimumDepositRequirement_boldValue”:”$0.00″,”minimumDepositRequirement_lightValue”:null,”minimumDepositRequirement_tooltipText”:null,”apyEditorialDescription_boldValue”:null,”apyEditorialDescription_lightValue”:null,”apyEditorialDescription_tooltipText”:null,”monthlyMaintenanceFee_boldValue”:”$0.00″,”monthlyMaintenanceFee_shownTooltip”:null,”monthlyMaintenanceFee_tooltipText”:”$0 for free version; $19.99 for FoundPlus”,”maintenanceFeeEditorial_boldValue”:null,”maintenanceFeeEditorial_isKeyAttr”:null,”bonusAmount_boldValue”:null,”bonusAmount_lightValue”:null,”bonusAmount_tooltipText”:null,”bonusRequirements_boldValue”:null,”bonusRequirements_lightValue”:null,”bonusRequirements_tooltipText”:null,”editorialBonusDescription_boldValue”:null,”products_boldValue”:null,”fees_boldValue”:null,”fees_lightValue”:null,”fees_tooltipText”:null,”terms_boldValue”:null,”terms_tooltipText”:null,”atmNetwork_boldValue”:null,”minimumAccountBalance_boldValue”:”$0″,”minimumAccountBalance_lightValue”:null,”minimumAccountBalance_tooltipText”:null,”createdOn”:1711039050116,”createdBy”:”SYSTEM”,”updatedOn”:1766434705054,”updatedBy”:”prod-fmp-pc-tracking-cta-compute-service|63509c38-2848-45c9-b994-28177306c6db”,”earningsCoefficient”:0.015,”minimumDepositRequirement”:0,”minTerm”:0,”maxTerm”:0,”depositAmount”:0},{“mid”:”f47c6cdd-a76d-4738-ab70-ccc6a495be79″,”productId”:”1230123″,”title”:”Mercury Business Banking*”,”bankInstitution”:”Choice Financial Group, Evolve Bank & Trust and Column, N.A.”,”category”:”Checking”,”subCategory”:”Business Checking”,”productImage”:”https://www.forbes.com/advisor/wp-content/uploads/2024/07/mercury-logo-horizontal-7-1.png”,”productCtaUrl”:”https://referral.mercury.com/c/1955282/1990416/19270″,”cnn_productCtaLink”:null,”usat_productCtaLink”:null,”min_term_filter”:null,”max_term_filter”:null,”productCtaLabel”:”Learn More”,”textBelowCta”:”On Mercury’s Website”,”fdic_ncua”:null,”superlativeFlag”:null,”productRating”:null,”accurateAsOf”:null,”whyWePickedIt”:null,”disclosure”:null,”details”:”

– No monthly or overdraft fees, or minimum balances.

n

– Checking and savings accounts with up to $5M in FDIC insurance through our partner banks and sweep networks.

n

– Free domestic and international wires (USD)

n

– Make scheduled & recurring payments via ACH, wire, or check

n

– Access credit sooner with the IO Mastercard thanks to startup-friendly terms, and earn unlimited 1.5% cashback¹

n

– Virtual and physical debit cards

n

– Earn yield on idle cash right alongside your operating accounts via Mercury Treasury (With $350K minimum balance)²

n

n

Disclosuresn

*Mercury is a fintech company, not an FDIC-insured bank. Banking services provided through Choice Financial Group and Column N.A., Members FDIC. The IO Card is issued by Patriot Bank, Member FDIC, pursuant to a license from Mastercard®.

n

¹The IO Card is issued by Patriot Bank, Member FDIC, pursuant to a license from Mastercard®. To receive cash back, your Mercury accounts must be open and in good standing, meaning they cannot be suspended, restricted, past due, or otherwise in default.

n

²Mercury Treasury is offered by Mercury Advisory, LLC, an SEC-registered investment adviser. This communication does not constitute an offer to sell or the solicitation of any offer to purchase any security. Funds in Mercury Treasury are subject to investment risks, including possible loss of the principal invested, and past performance is not indicative of future results. Please see full disclosures at mercury.com/treasury. Mercury Advisory is a wholly-owned subsidiary of Mercury Technologies.

Mercury Treasury is not insured by the FDIC. Funds in Mercury Treasury are not deposits or other obligations of Choice Financial Group or Column N.A., and are not guaranteed by Choice Financial Group or Column N.A.

“,”annualPercentageYield_boldValue”:”N/A”,”annualPercentageYield_lightValue”:null,”annualPercentageYield_tooltipText”:”Annual Percentage Yield”,”minimumDepositRequirement_boldValue”:”$0.00″,”minimumDepositRequirement_lightValue”:null,”minimumDepositRequirement_tooltipText”:null,”apyEditorialDescription_boldValue”:null,”apyEditorialDescription_lightValue”:null,”apyEditorialDescription_tooltipText”:null,”monthlyMaintenanceFee_boldValue”:”$0.00″,”monthlyMaintenanceFee_shownTooltip”:null,”monthlyMaintenanceFee_tooltipText”:null,”maintenanceFeeEditorial_boldValue”:null,”maintenanceFeeEditorial_isKeyAttr”:null,”bonusAmount_boldValue”:null,”bonusAmount_lightValue”:null,”bonusAmount_tooltipText”:null,”bonusRequirements_boldValue”:null,”bonusRequirements_lightValue”:null,”bonusRequirements_tooltipText”:null,”editorialBonusDescription_boldValue”:null,”products_boldValue”:null,”fees_boldValue”:null,”fees_lightValue”:null,”fees_tooltipText”:null,”terms_boldValue”:null,”terms_tooltipText”:null,”atmNetwork_boldValue”:null,”minimumAccountBalance_boldValue”:”$0.00″,”minimumAccountBalance_lightValue”:null,”minimumAccountBalance_tooltipText”:null,”createdOn”:1725901406239,”createdBy”:”SYSTEM”,”updatedOn”:1766434705054,”updatedBy”:”prod-fmp-pc-tracking-cta-compute-service|63509c38-2848-45c9-b994-28177306c6db”,”minimumDepositRequirement”:0,”minTerm”:0,”maxTerm”:0,”depositAmount”:0},{“mid”:”547b58bd-b7db-4619-a3ca-9f175a00671e”,”productId”:”1131893″,”title”:”U.S. Bank Smartly® Checking”,”bankInstitution”:”U.S. Bank”,”category”:”Checking”,”subCategory”:”Consumer Checking”,”productImage”:”https://www.forbes.com/advisor/wp-content/uploads/2023/12/US_Bank_logo_red_blue_RGB_8.31-1.jpg”,”productCtaUrl”:”https://usbankconsumer.sjv.io/c/1955282/3407464/31404″,”cnn_productCtaLink”:null,”usat_productCtaLink”:null,”min_term_filter”:null,”max_term_filter”:null,”productCtaLabel”:”Learn More”,”textBelowCta”:”On U.S. Bank’s Website”,”fdic_ncua”:”Member FDIC”,”superlativeFlag”:null,”productRating”:null,”accurateAsOf”:null,”whyWePickedIt”:null,”disclosure”:null,”details”:”

Get started on your path to better banking with U.S. Bank Smartly® Checking, an account made for more.

n

n

• Be rewarded as your relationship grows with automatic access to U.S. Bank Smart Rewards® with benefits like fee waivers, loan discounts, and more with qualifying activities

n

• Start off on the right foot with no monthly maintenance fee for the first two statement periods, then multiple ways to waive after that

n

• Pair with U.S. Bank Smartly® Savings to unlock higher rates on your savings

n

• Get helpful insights, track spending, and manage bills & subscriptions with the U.S. Bank Mobile App

n

n

U.S. Bank Smartly® Checking may not be available if you live outside of the U.S. Bank footprint. Member FDIC.

“,”annualPercentageYield_boldValue”:”up to .005%”,”annualPercentageYield_lightValue”:null,”annualPercentageYield_tooltipText”:”Annual Percentage Yield. See website for details.”,”minimumDepositRequirement_boldValue”:”$25.00″,”minimumDepositRequirement_lightValue”:null,”minimumDepositRequirement_tooltipText”:null,”apyEditorialDescription_boldValue”:null,”apyEditorialDescription_lightValue”:null,”apyEditorialDescription_tooltipText”:null,”monthlyMaintenanceFee_boldValue”:”$12 or $0″,”monthlyMaintenanceFee_shownTooltip”:null,”monthlyMaintenanceFee_tooltipText”:”The $12 monthly maintenance fee waived by (must meet at least one of the following criteria): -Combined monthly direct deposit $1,500+ -Average account balance of $1,500+ -Owner of an eligible Small Business Checking account -Is part of one of the following customer groups: Youth, Young Adult, Senior, Military, and more -Customer is in Smart Rewards® Gold Tier or Above -Owner of a U.S. Bank Smartly™ Visa Signature® Card”,”maintenanceFeeEditorial_boldValue”:null,”maintenanceFeeEditorial_isKeyAttr”:null,”bonusAmount_boldValue”:”Up to $450*”,”bonusAmount_lightValue”:null,”bonusAmount_tooltipText”:null,”bonusRequirements_boldValue”:null,”bonusRequirements_lightValue”:null,”bonusRequirements_tooltipText”:null,”editorialBonusDescription_boldValue”:”*•Earn up to $450 when you open a new U.S. Bank Smartly® Checking account and complete qualifying activities. Subject to certain terms and limitations. Offer valid through January 28, 2026. Member FDIC.n•Offer may not be available if you are an existing U.S. Bank customer or live outside of the U.S. Bank footprint.”,”products_boldValue”:null,”fees_boldValue”:null,”fees_lightValue”:null,”fees_tooltipText”:null,”terms_boldValue”:null,”terms_tooltipText”:null,”atmNetwork_boldValue”:null,”minimumAccountBalance_boldValue”:”$25.00″,”minimumAccountBalance_lightValue”:null,”minimumAccountBalance_tooltipText”:null,”createdOn”:1719334024844,”createdBy”:”SYSTEM”,”updatedOn”:1766434705054,”updatedBy”:”prod-fmp-pc-tracking-cta-compute-service|63509c38-2848-45c9-b994-28177306c6db”,”earningsCoefficient”:0.00005,”minimumDepositRequirement”:25,”minTerm”:0,”maxTerm”:0,”depositAmount”:25},{“mid”:”03b0b5c3-d3cf-46a7-9e06-88bceb341cac”,”productId”:”1198793″,”title”:”Synchrony Bank 9-Month CD”,”bankInstitution”:”Synchrony Bank”,”category”:”CD”,”subCategory”:null,”productImage”:”https://www.forbes.com/advisor/wp-content/uploads/2024/04/47380_4-2.jpg”,”productCtaUrl”:”https://click.linksynergy.com/fs-bin/click?id=4e4NFxuugkU&offerid=1765983.2151&type=3&subid=0″,”cnn_productCtaLink”:null,”usat_productCtaLink”:null,”min_term_filter”:”0″,”max_term_filter”:”9″,”productCtaLabel”:”Learn More”,”textBelowCta”:”On Synchrony Bank’s Website”,”fdic_ncua”:”Member FDIC”,”superlativeFlag”:null,”productRating”:null,”accurateAsOf”:null,”whyWePickedIt”:null,”disclosure”:null,”details”:”

– Open a CD Account with Great Rates and No Minimum Deposit.

n

– No minimum balance.

n

– No monthly fees.

“,”annualPercentageYield_boldValue”:”4.10%”,”annualPercentageYield_lightValue”:null,”annualPercentageYield_tooltipText”:”Annual Percentage Yield (APY) is subject to change at any time without notice. Offer applies to personal non-IRA accounts only. Fees may reduce earnings. For CD accounts, a penalty may be imposed for early withdrawals. After maturity, if your CD rolls over, you will earn the offered rate of interest in effect at that time. Visit synchrony.com/banking for current rates, terms and account requirements. Member FDIC.”,”minimumDepositRequirement_boldValue”:”$0.00″,”minimumDepositRequirement_lightValue”:null,”minimumDepositRequirement_tooltipText”:null,”apyEditorialDescription_boldValue”:null,”apyEditorialDescription_lightValue”:null,”apyEditorialDescription_tooltipText”:null,”monthlyMaintenanceFee_boldValue”:”$0.00″,”monthlyMaintenanceFee_shownTooltip”:null,”monthlyMaintenanceFee_tooltipText”:null,”maintenanceFeeEditorial_boldValue”:null,”maintenanceFeeEditorial_isKeyAttr”:null,”bonusAmount_boldValue”:null,”bonusAmount_lightValue”:null,”bonusAmount_tooltipText”:null,”bonusRequirements_boldValue”:null,”bonusRequirements_lightValue”:null,”bonusRequirements_tooltipText”:null,”editorialBonusDescription_boldValue”:null,”products_boldValue”:null,”fees_boldValue”:null,”fees_lightValue”:null,”fees_tooltipText”:null,”terms_boldValue”:”9 months”,”terms_tooltipText”:null,”atmNetwork_boldValue”:null,”minimumAccountBalance_boldValue”:”$0.00″,”minimumAccountBalance_lightValue”:null,”minimumAccountBalance_tooltipText”:null,”createdOn”:1719334023977,”createdBy”:”SYSTEM”,”updatedOn”:1766434705054,”updatedBy”:”prod-fmp-pc-tracking-cta-compute-service|63509c38-2848-45c9-b994-28177306c6db”,”earningsCoefficient”:0.03075,”minimumDepositRequirement”:0,”minTerm”:0,”maxTerm”:9,”depositAmount”:0},{“mid”:”7c719650-52e8-44c4-a9fc-8cea96876445″,”productId”:”358828″,”title”:”Axos Bank”,”bankInstitution”:”Axos Bank”,”category”:”Online”,”subCategory”:null,”productImage”:”https://www.forbes.com/advisor/wp-content/uploads/2020/07/1200px-Axos_Bank_Logo.svg_-e1593593029821.png”,”productCtaUrl”:”https://www.anrdoezrs.net/click-100640841-16992142″,”cnn_productCtaLink”:null,”usat_productCtaLink”:null,”min_term_filter”:null,”max_term_filter”:null,”productCtaLabel”:”Learn More”,”textBelowCta”:”On Axos Bank’s Website”,”fdic_ncua”:”Member FDIC”,”superlativeFlag”:null,”productRating”:null,”accurateAsOf”:null,”whyWePickedIt”:null,”disclosure”:null,”details”:”

Axos Bank offers a range of competitive banking products for individuals and businesses alike. Its digital-first approach makes it a great choice for those who prefer to manage their finances online. With fee fees, industry-leading interest rates and an expansive ATM network, Axos Bank is a great choice if you’re looking for a trusted online bank with modern features.

“,”annualPercentageYield_boldValue”:null,”annualPercentageYield_lightValue”:null,”annualPercentageYield_tooltipText”:null,”minimumDepositRequirement_boldValue”:null,”minimumDepositRequirement_lightValue”:null,”minimumDepositRequirement_tooltipText”:null,”apyEditorialDescription_boldValue”:null,”apyEditorialDescription_lightValue”:null,”apyEditorialDescription_tooltipText”:null,”monthlyMaintenanceFee_boldValue”:null,”monthlyMaintenanceFee_shownTooltip”:null,”monthlyMaintenanceFee_tooltipText”:null,”maintenanceFeeEditorial_boldValue”:null,”maintenanceFeeEditorial_isKeyAttr”:null,”bonusAmount_boldValue”:null,”bonusAmount_lightValue”:null,”bonusAmount_tooltipText”:null,”bonusRequirements_boldValue”:null,”bonusRequirements_lightValue”:null,”bonusRequirements_tooltipText”:null,”editorialBonusDescription_boldValue”:null,”products_boldValue”:”Checking, savings, money market account, CDs”,”fees_boldValue”:”Excess withdrawal and outgoing wire transfer fees”,”fees_lightValue”:null,”fees_tooltipText”:null,”terms_boldValue”:null,”terms_tooltipText”:null,”atmNetwork_boldValue”:”91,000+ ATMs nationwide”,”minimumAccountBalance_boldValue”:null,”minimumAccountBalance_lightValue”:null,”minimumAccountBalance_tooltipText”:null,”createdOn”:1711039047959,”createdBy”:”SYSTEM”,”updatedOn”:1766434705054,”updatedBy”:”prod-fmp-pc-tracking-cta-compute-service|63509c38-2848-45c9-b994-28177306c6db”,”minTerm”:0,”maxTerm”:0},{“mid”:”4c02838a-7e03-4c00-b5e4-ff4bf6ae2510″,”productId”:”1072768″,”title”:”Bask Bank Interest Savings Account”,”bankInstitution”:”Bask Bank”,”category”:”Saving”,”subCategory”:”High Yield Saving”,”productImage”:”https://www.forbes.com/advisor/wp-content/uploads/2024/04/2.0_Bask_logo_rgb.png”,”productCtaUrl”:”https://click.linksynergy.com/fs-bin/click?id=4e4NFxuugkU&offerid=1569648.43&type=3&subid=0″,”cnn_productCtaLink”:null,”usat_productCtaLink”:null,”min_term_filter”:null,”max_term_filter”:null,”productCtaLabel”:”Learn More”,”textBelowCta”:”On Bask Bank’s Website”,”fdic_ncua”:”Member FDIC”,”superlativeFlag”:null,”productRating”:null,”accurateAsOf”:null,”whyWePickedIt”:null,”disclosure”:null,”details”:”Annual Percentage Yield (APY) is variable and subject to change at any time. No minimum balance required and no monthly account fees. Must fund within 15 business days of account opening to avoid account closure.”,”annualPercentageYield_boldValue”:”3.75%”,”annualPercentageYield_lightValue”:null,”annualPercentageYield_tooltipText”:”Annual Percentage Yield”,”minimumDepositRequirement_boldValue”:”$0.00″,”minimumDepositRequirement_lightValue”:null,”minimumDepositRequirement_tooltipText”:null,”apyEditorialDescription_boldValue”:null,”apyEditorialDescription_lightValue”:null,”apyEditorialDescription_tooltipText”:null,”monthlyMaintenanceFee_boldValue”:”$0.00″,”monthlyMaintenanceFee_shownTooltip”:null,”monthlyMaintenanceFee_tooltipText”:null,”maintenanceFeeEditorial_boldValue”:null,”maintenanceFeeEditorial_isKeyAttr”:null,”bonusAmount_boldValue”:null,”bonusAmount_lightValue”:null,”bonusAmount_tooltipText”:null,”bonusRequirements_boldValue”:null,”bonusRequirements_lightValue”:null,”bonusRequirements_tooltipText”:null,”editorialBonusDescription_boldValue”:null,”products_boldValue”:null,”fees_boldValue”:null,”fees_lightValue”:null,”fees_tooltipText”:null,”terms_boldValue”:null,”terms_tooltipText”:null,”atmNetwork_boldValue”:null,”minimumAccountBalance_boldValue”:”$0.00″,”minimumAccountBalance_lightValue”:null,”minimumAccountBalance_tooltipText”:null,”createdOn”:1719252673062,”createdBy”:”SYSTEM”,”updatedOn”:1766434705054,”updatedBy”:”prod-fmp-pc-tracking-cta-compute-service|63509c38-2848-45c9-b994-28177306c6db”,”earningsCoefficient”:0.0375,”minimumDepositRequirement”:0,”minTerm”:0,”maxTerm”:0,”depositAmount”:0},{“mid”:”f761e45e-b6d4-4558-9cb5-85e2501e99f4″,”productId”:”360723″,”title”:”Quontic Bank High Interest Checking”,”bankInstitution”:”Quontic Bank”,”category”:”Checking”,”subCategory”:”Consumer Checking”,”productImage”:”https://www.forbes.com/advisor/wp-content/uploads/2021/12/Quontic-Bank.png”,”productCtaUrl”:”https://click.linksynergy.com/fs-bin/click?id=4e4NFxuugkU&offerid=1328517.3&type=3&subid=0″,”cnn_productCtaLink”:null,”usat_productCtaLink”:null,”min_term_filter”:null,”max_term_filter”:null,”productCtaLabel”:”Learn More”,”textBelowCta”:”On Quontic Bank’s Website”,”fdic_ncua”:”Member FDIC”,”superlativeFlag”:null,”productRating”:null,”accurateAsOf”:null,”whyWePickedIt”:null,”disclosure”:null,”details”:”Earn 1.10% APY on all balance tiers if you make at least 10 qualifying debit card point of sale transactions of $10 or more per statement cycle. $100 minimum opening deposit.”,”annualPercentageYield_boldValue”:”1.10%”,”annualPercentageYield_lightValue”:null,”annualPercentageYield_tooltipText”:”Annual Percentage Yield”,”minimumDepositRequirement_boldValue”:”$100.00″,”minimumDepositRequirement_lightValue”:null,”minimumDepositRequirement_tooltipText”:null,”apyEditorialDescription_boldValue”:null,”apyEditorialDescription_lightValue”:null,”apyEditorialDescription_tooltipText”:null,”monthlyMaintenanceFee_boldValue”:”$0.00″,”monthlyMaintenanceFee_shownTooltip”:null,”monthlyMaintenanceFee_tooltipText”:null,”maintenanceFeeEditorial_boldValue”:null,”maintenanceFeeEditorial_isKeyAttr”:null,”bonusAmount_boldValue”:null,”bonusAmount_lightValue”:null,”bonusAmount_tooltipText”:null,”bonusRequirements_boldValue”:null,”bonusRequirements_lightValue”:null,”bonusRequirements_tooltipText”:null,”editorialBonusDescription_boldValue”:null,”products_boldValue”:null,”fees_boldValue”:null,”fees_lightValue”:null,”fees_tooltipText”:null,”terms_boldValue”:null,”terms_tooltipText”:null,”atmNetwork_boldValue”:null,”minimumAccountBalance_boldValue”:”$0.00″,”minimumAccountBalance_lightValue”:null,”minimumAccountBalance_tooltipText”:null,”createdOn”:1711039050848,”createdBy”:”SYSTEM”,”updatedOn”:1766434705054,”updatedBy”:”prod-fmp-pc-tracking-cta-compute-service|63509c38-2848-45c9-b994-28177306c6db”,”earningsCoefficient”:0.011,”minimumDepositRequirement”:100,”minTerm”:0,”maxTerm”:0,”depositAmount”:100},{“mid”:”ca581560-630b-496a-b729-aadf16a873fd”,”productId”:”1267323″,”title”:”Capital One 360 Checking®”,”bankInstitution”:”Capital One, N.A.”,”category”:”Checking”,”subCategory”:”Consumer Checking”,”productImage”:”https://www.forbes.com/advisor/wp-content/uploads/2024/08/image-47.png”,”productCtaUrl”:”https://mktp.us/capone_checking_rtseo”,”cnn_productCtaLink”:null,”usat_productCtaLink”:null,”min_term_filter”:null,”max_term_filter”:null,”productCtaLabel”:”Learn More”,”textBelowCta”:”On Capital One’s Website”,”fdic_ncua”:”Member FDIC”,”superlativeFlag”:null,”productRating”:null,”accurateAsOf”:null,”whyWePickedIt”:null,”disclosure”:null,”details”:”

– Open a 360 Checking account on or after August 22, 2024, using promotional code CHECKING250

n

– Set up and receive at least 2 Qualifying Direct Deposits each of $500 or more to your 360 Checking account within 75 days of account opening.

n

– Capital One will deposit the bonus into your account after the first two requirements listed above are completed.

n

– See full offer details and when the bonus will be posted at https://www.capitalone.com/bank/checking250/affiliate.

“,”annualPercentageYield_boldValue”:”0.10%”,”annualPercentageYield_lightValue”:null,”annualPercentageYield_tooltipText”:”Annual Percentage Yield”,”minimumDepositRequirement_boldValue”:”$0.00″,”minimumDepositRequirement_lightValue”:null,”minimumDepositRequirement_tooltipText”:null,”apyEditorialDescription_boldValue”:null,”apyEditorialDescription_lightValue”:null,”apyEditorialDescription_tooltipText”:null,”monthlyMaintenanceFee_boldValue”:”$0.00″,”monthlyMaintenanceFee_shownTooltip”:null,”monthlyMaintenanceFee_tooltipText”:null,”maintenanceFeeEditorial_boldValue”:null,”maintenanceFeeEditorial_isKeyAttr”:null,”bonusAmount_boldValue”:”$250″,”bonusAmount_lightValue”:null,”bonusAmount_tooltipText”:”Earn a $250 bonus with 360 Checking. No fees, no minimums. Terms and eligibility requirements apply*”,”bonusRequirements_boldValue”:null,”bonusRequirements_lightValue”:null,”bonusRequirements_tooltipText”:null,”editorialBonusDescription_boldValue”:”Earn a $250 bonus with 360 Checking. No fees, no minimums. Terms and eligibility requirements apply*”,”products_boldValue”:null,”fees_boldValue”:null,”fees_lightValue”:null,”fees_tooltipText”:null,”terms_boldValue”:null,”terms_tooltipText”:null,”atmNetwork_boldValue”:null,”minimumAccountBalance_boldValue”:”$0.00″,”minimumAccountBalance_lightValue”:null,”minimumAccountBalance_tooltipText”:null,”createdOn”:1729717915635,”createdBy”:”SYSTEM”,”updatedOn”:1766434705054,”updatedBy”:”prod-fmp-pc-tracking-cta-compute-service|63509c38-2848-45c9-b994-28177306c6db”,”earningsCoefficient”:0.001,”minimumDepositRequirement”:0,”minTerm”:0,”maxTerm”:0,”depositAmount”:0},{“mid”:”dea7a555-d78f-47a2-bf36-697d5d0155cd”,”productId”:”358794″,”title”:”Quontic Bank”,”bankInstitution”:”Quontic Bank”,”category”:”Online”,”subCategory”:null,”productImage”:”https://www.forbes.com/advisor/wp-content/uploads/2021/12/Quontic-Bank.png”,”productCtaUrl”:”https://click.linksynergy.com/fs-bin/click?id=4e4NFxuugkU&offerid=1120358.17&type=3&subid=0″,”cnn_productCtaLink”:null,”usat_productCtaLink”:null,”min_term_filter”:null,”max_term_filter”:null,”productCtaLabel”:”Learn More”,”textBelowCta”:”On Quontic Bank’s Website”,”fdic_ncua”:”Member FDIC”,”superlativeFlag”:null,”productRating”:null,”accurateAsOf”:null,”whyWePickedIt”:null,”disclosure”:null,”details”:”Quontic Bank offers one savings account, two checking accounts, a money market account and five CDs with terms ranging from six months to five years.”,”annualPercentageYield_boldValue”:null,”annualPercentageYield_lightValue”:null,”annualPercentageYield_tooltipText”:null,”minimumDepositRequirement_boldValue”:null,”minimumDepositRequirement_lightValue”:null,”minimumDepositRequirement_tooltipText”:null,”apyEditorialDescription_boldValue”:null,”apyEditorialDescription_lightValue”:null,”apyEditorialDescription_tooltipText”:null,”monthlyMaintenanceFee_boldValue”:null,”monthlyMaintenanceFee_shownTooltip”:null,”monthlyMaintenanceFee_tooltipText”:null,”maintenanceFeeEditorial_boldValue”:null,”maintenanceFeeEditorial_isKeyAttr”:null,”bonusAmount_boldValue”:null,”bonusAmount_lightValue”:null,”bonusAmount_tooltipText”:null,”bonusRequirements_boldValue”:null,”bonusRequirements_lightValue”:null,”bonusRequirements_tooltipText”:null,”editorialBonusDescription_boldValue”:null,”products_boldValue”:”Checking, savings, money market, certificates of deposit”,”fees_boldValue”:”Outgoing wire transfer and dormant account fees”,”fees_lightValue”:null,”fees_tooltipText”:null,”terms_boldValue”:null,”terms_tooltipText”:null,”atmNetwork_boldValue”:”90,000+ ATMs nationwide”,”minimumAccountBalance_boldValue”:null,”minimumAccountBalance_lightValue”:null,”minimumAccountBalance_tooltipText”:null,”createdOn”:1711039050613,”createdBy”:”SYSTEM”,”updatedOn”:1766434705054,”updatedBy”:”prod-fmp-pc-tracking-cta-compute-service|63509c38-2848-45c9-b994-28177306c6db”,”minTerm”:0,”maxTerm”:0},{“mid”:”3df6ade9-fda5-4d01-aca2-9a5e2d95258a”,”productId”:”1401683″,”title”:”BMO Smart Advantage Checking account”,”bankInstitution”:”BMO Bank N.A.”,”category”:”Checking”,”subCategory”:”Consumer Checking”,”productImage”:”https://www.forbes.com/advisor/wp-content/uploads/2024/11/bmo-blue-on-transparent-en-4.png”,”productCtaUrl”:”https://www.dpbolvw.net/click-100640841-17146675″,”cnn_productCtaLink”:null,”usat_productCtaLink”:null,”min_term_filter”:null,”max_term_filter”:null,”productCtaLabel”:”Learn More”,”textBelowCta”:”On BMO’s Website”,”fdic_ncua”:”Member FDIC”,”superlativeFlag”:null,”productRating”:null,”accurateAsOf”:null,”whyWePickedIt”:null,”disclosure”:null,”details”:”

– No monthly maintenance fee

n

– Access to over 40,000 fee-free ATMs across the U.S.

n

– Personalized support through online chat, phone and in branch

“,”annualPercentageYield_boldValue”:”N/A”,”annualPercentageYield_lightValue”:null,”annualPercentageYield_tooltipText”:null,”minimumDepositRequirement_boldValue”:”$25.00″,”minimumDepositRequirement_lightValue”:null,”minimumDepositRequirement_tooltipText”:null,”apyEditorialDescription_boldValue”:null,”apyEditorialDescription_lightValue”:null,”apyEditorialDescription_tooltipText”:null,”monthlyMaintenanceFee_boldValue”:”$0.00″,”monthlyMaintenanceFee_shownTooltip”:null,”monthlyMaintenanceFee_tooltipText”:null,”maintenanceFeeEditorial_boldValue”:null,”maintenanceFeeEditorial_isKeyAttr”:null,”bonusAmount_boldValue”:”$400*”,”bonusAmount_lightValue”:null,”bonusAmount_tooltipText”:null,”bonusRequirements_boldValue”:null,”bonusRequirements_lightValue”:null,”bonusRequirements_tooltipText”:null,”editorialBonusDescription_boldValue”:”Earn a $400 Cash Bonus* when you have $4,000 in direct deposits within 90 days of opening between 9/9/25 – 1/28/26 *Conditions apply. Accounts are subject to approval and provided in the U.S. by BMO Bank N.A. Member FDIC”,”products_boldValue”:null,”fees_boldValue”:null,”fees_lightValue”:null,”fees_tooltipText”:null,”terms_boldValue”:null,”terms_tooltipText”:null,”atmNetwork_boldValue”:null,”minimumAccountBalance_boldValue”:”$0″,”minimumAccountBalance_lightValue”:null,”minimumAccountBalance_tooltipText”:null,”createdOn”:1742500698639,”createdBy”:”SYSTEM”,”updatedOn”:1766434705054,”updatedBy”:”prod-fmp-pc-tracking-cta-compute-service|63509c38-2848-45c9-b994-28177306c6db”,”minimumDepositRequirement”:25,”minTerm”:0,”maxTerm”:0,”depositAmount”:25},{“mid”:”80980733-9540-42b8-b360-2cb9a16db23e”,”productId”:”562816″,”title”:”Quontic Bank High Yield Savings”,”bankInstitution”:”Quontic Bank”,”category”:”Saving”,”subCategory”:”High Yield Saving”,”productImage”:”https://www.forbes.com/advisor/wp-content/uploads/2021/12/Quontic-Bank.png”,”productCtaUrl”:”https://click.linksynergy.com/fs-bin/click?id=4e4NFxuugkU&offerid=1328517.46&type=3&subid=0″,”cnn_productCtaLink”:null,”usat_productCtaLink”:null,”min_term_filter”:null,”max_term_filter”:null,”productCtaLabel”:”Learn More”,”textBelowCta”:”On Quontic Bank’s Website”,”fdic_ncua”:”Member FDIC”,”superlativeFlag”:null,”productRating”:null,”accurateAsOf”:null,”whyWePickedIt”:null,”disclosure”:null,”details”:”Interest is compounded daily and credited monthly. There is a $10 excess transaction fee for certain transactions over six from the account per account statement cycle.”,”annualPercentageYield_boldValue”:”3.85%”,”annualPercentageYield_lightValue”:null,”annualPercentageYield_tooltipText”:”Annual Percentage Yield”,”minimumDepositRequirement_boldValue”:”$100.00″,”minimumDepositRequirement_lightValue”:null,”minimumDepositRequirement_tooltipText”:null,”apyEditorialDescription_boldValue”:null,”apyEditorialDescription_lightValue”:null,”apyEditorialDescription_tooltipText”:null,”monthlyMaintenanceFee_boldValue”:”$0.00″,”monthlyMaintenanceFee_shownTooltip”:null,”monthlyMaintenanceFee_tooltipText”:null,”maintenanceFeeEditorial_boldValue”:null,”maintenanceFeeEditorial_isKeyAttr”:null,”bonusAmount_boldValue”:null,”bonusAmount_lightValue”:null,”bonusAmount_tooltipText”:null,”bonusRequirements_boldValue”:null,”bonusRequirements_lightValue”:null,”bonusRequirements_tooltipText”:null,”editorialBonusDescription_boldValue”:null,”products_boldValue”:”Savings”,”fees_boldValue”:”No monthly, overdraft, or ATM”,”fees_lightValue”:null,”fees_tooltipText”:null,”terms_boldValue”:null,”terms_tooltipText”:null,”atmNetwork_boldValue”:”90,000+ ATMs nationwide”,”minimumAccountBalance_boldValue”:”$0.00″,”minimumAccountBalance_lightValue”:null,”minimumAccountBalance_tooltipText”:null,”createdOn”:1711039050927,”createdBy”:”SYSTEM”,”updatedOn”:1766434705054,”updatedBy”:”prod-fmp-pc-tracking-cta-compute-service|63509c38-2848-45c9-b994-28177306c6db”,”earningsCoefficient”:0.0385,”minimumDepositRequirement”:100,”minTerm”:0,”maxTerm”:0,”depositAmount”:100},{“mid”:”9b418370-745b-4364-9909-353507e6f3f6″,”productId”:”1738961″,”title”:”Cash App Savings”,”bankInstitution”:”Wells Fargo Bank, N.A., Member FDIC”,”category”:”Saving”,”subCategory”:”High Yield Saving”,”productImage”:”https://www.forbes.com/advisor/wp-content/uploads/2025/07/vectorseek.com-Cashapp-Logo-Vector-1.png”,”productCtaUrl”:”https://click.linksynergy.com/fs-bin/click?id=4e4NFxuugkU&offerid=1875879.21&type=3&subid=0″,”cnn_productCtaLink”:null,”usat_productCtaLink”:null,”min_term_filter”:null,”max_term_filter”:null,”productCtaLabel”:”Learn More”,”textBelowCta”:”On Cash App’s Website”,”fdic_ncua”:”Member FDIC”,”superlativeFlag”:null,”productRating”:null,”accurateAsOf”:null,”whyWePickedIt”:null,”disclosure”:null,”details”:”

-Unlock Cash App’s highest savings interest offer of up to 3.25%.*

n

-Automated savings tools to foster financial success and track goals.

n

-No monthly fees or minimum balance.

n

-24/7 fraud monitoring and prevention.

n

n

Disclosures

n

Cash App is a financial services platform, not a bank. Banking services provided by Cash App’s bank partner(s). Savings provided by Cash App, a Block, Inc. brand.

n

Prepaid debit Cards issued by Sutton Bank, Member FDIC. See Terms and Conditions.

n

Your balance is eligible for FDIC pass-through insurance through our Program Banks Wells Fargo Bank, N.A. and/or Sutton Bank, Members FDIC for up to $250,000 per customer when aggregated with all other deposits held in the same legal capacity at each Program Bank above, if certain conditions are met. Cash App is a financial services platform, and not an FDIC-insured bank. Prepaid debit cards issued by Sutton Bank, Member FDIC. See terms and conditions.

n

n

Customers can qualify for Cash App Green by spending $500 in Qualifying Purchases using your Cash App Card or Cash App Pay per month, or by depositing $300 of Qualifying Deposits per month. Eligibility restrictions apply to some benefits. See Terms and Conditions for more information.

n

To earn the highest interest rate on your Cash App savings balance, you need to (a) have a Cash App Card, or sponsor one or more sponsored accounts, and qualify for Cash App Green or (b) have a sponsored account with sponsor approval. Customers can qualify for Cash App Green by spending $500 in Qualifying Purchases using your Cash App Card or Cash App Pay per month, or by depositing $300 in Qualifying Deposits per month. See terms and conditions for more information on how to qualify.

n

If you are signed up to earn interest, Cash App will pass through a portion of the interest paid on your savings balance held in an account for the benefit of Cash App customers at Wells Fargo Bank, N.A., Member FDIC. Exceptions may apply. Savings yield rate is subject to change.

“,”annualPercentageYield_boldValue”:”Up to 3.25%”,”annualPercentageYield_lightValue”:null,”annualPercentageYield_tooltipText”:”Annual Percentage Yield, $300 monthly deposit requirement for the 3.25% APY.”,”minimumDepositRequirement_boldValue”:”$0.00″,”minimumDepositRequirement_lightValue”:null,”minimumDepositRequirement_tooltipText”:null,”apyEditorialDescription_boldValue”:null,”apyEditorialDescription_lightValue”:null,”apyEditorialDescription_tooltipText”:null,”monthlyMaintenanceFee_boldValue”:”$0.00″,”monthlyMaintenanceFee_shownTooltip”:null,”monthlyMaintenanceFee_tooltipText”:null,”maintenanceFeeEditorial_boldValue”:null,”maintenanceFeeEditorial_isKeyAttr”:null,”bonusAmount_boldValue”:null,”bonusAmount_lightValue”:null,”bonusAmount_tooltipText”:null,”bonusRequirements_boldValue”:null,”bonusRequirements_lightValue”:null,”bonusRequirements_tooltipText”:null,”editorialBonusDescription_boldValue”:null,”products_boldValue”:null,”fees_boldValue”:null,”fees_lightValue”:null,”fees_tooltipText”:null,”terms_boldValue”:null,”terms_tooltipText”:null,”atmNetwork_boldValue”:null,”minimumAccountBalance_boldValue”:”$0.00″,”minimumAccountBalance_lightValue”:null,”minimumAccountBalance_tooltipText”:”$300 monthly deposit required for the 3.25% APY”,”createdOn”:1756928459653,”createdBy”:”SYSTEM”,”updatedOn”:1766434705054,”updatedBy”:”prod-fmp-pc-tracking-cta-compute-service|63509c38-2848-45c9-b994-28177306c6db”,”earningsCoefficient”:0.0325,”minimumDepositRequirement”:0,”minTerm”:0,”maxTerm”:0,”depositAmount”:0},{“mid”:”c28b694e-b40c-487d-a1ec-5da94c44b026″,”productId”:”1832294″,”title”:”U.S. Bank Platinum Business Checking Account”,”bankInstitution”:”U.S. Bank”,”category”:”Checking”,”subCategory”:”Business Checking”,”productImage”:”https://www.forbes.com/advisor/wp-content/uploads/2023/12/US_Bank_logo_red_blue_RGB_8.31-1.jpg”,”productCtaUrl”:”https://businesschecking.sjv.io/c/1955282/2229720/26389?sharedid=800″,”cnn_productCtaLink”:null,”usat_productCtaLink”:null,”min_term_filter”:null,”max_term_filter”:null,”productCtaLabel”:”Learn More”,”textBelowCta”:”On U.S. Bank’s Website”,”fdic_ncua”:”Member FDIC”,”superlativeFlag”:null,”productRating”:null,”accurateAsOf”:null,”whyWePickedIt”:null,”disclosure”:null,”details”:”

Promo code Q4AFL25 MUST be used when opening a Platinum Business Checking account. Limit of one bonus per business. A $100 minimum deposit is required to open one of the referenced accounts.

n

– Earn your $1,200 Business Checking bonus by opening a new U.S. Bank Platinum Business Checking account between 10/01/2025 and 1/14/2026. You must make deposit(s) of at least $25,000 in new money within 30 days of account opening and thereafter maintain a daily balance of at least $25,000 until the 60th day after account opening. You must also complete 5 qualifying transactions within 60 days of account opening.

n

n

**Monthly Maintenance Fee Waiver Options: Gold Business Checking: U.S. Bank Payment Solutions Merchant Banking OR $10,000 average collected balance OR $20,000 combined average collected business deposit balances OR $50,000 combined average collected business deposits and outstanding credit balances. Platinum Business Checking: $25,000 average collected balance OR $75,000 combined average collected business deposits and outstanding business credit balances.

“,”annualPercentageYield_boldValue”:”N/A”,”annualPercentageYield_lightValue”:null,”annualPercentageYield_tooltipText”:null,”minimumDepositRequirement_boldValue”:”$100.00″,”minimumDepositRequirement_lightValue”:null,”minimumDepositRequirement_tooltipText”:null,”apyEditorialDescription_boldValue”:null,”apyEditorialDescription_lightValue”:null,”apyEditorialDescription_tooltipText”:null,”monthlyMaintenanceFee_boldValue”:”$30, or $0**”,”monthlyMaintenanceFee_shownTooltip”:null,”monthlyMaintenanceFee_tooltipText”:”**Monthly Maintenance Fee Waiver Options: Gold Business Checking: U.S. Bank Payment Solutions Merchant Banking OR $10,000 average collected balance OR $20,000 combined average collected business deposit balances OR $50,000 combined average collected business deposits and outstanding credit balances. Platinum Business Checking: $25,000 average collected balance OR $75,000 combined average collected business deposits and outstanding business credit balances.”,”maintenanceFeeEditorial_boldValue”:null,”maintenanceFeeEditorial_isKeyAttr”:null,”bonusAmount_boldValue”:”$1,200*”,”bonusAmount_lightValue”:null,”bonusAmount_tooltipText”:null,”bonusRequirements_boldValue”:null,”bonusRequirements_lightValue”:null,”bonusRequirements_tooltipText”:null,”editorialBonusDescription_boldValue”:”*Earn a $400 bonus when you open a U.S. Bank Business Essentials Account or $1,200 when you open a Platinum Business Checking Account online with promo code Q4AFL25 and complete qualifying activities, subject to certain terms and limitations. Offer valid through January 14, 2026. Member FDIC. “,”products_boldValue”:null,”fees_boldValue”:null,”fees_lightValue”:null,”fees_tooltipText”:null,”terms_boldValue”:null,”terms_tooltipText”:null,”atmNetwork_boldValue”:null,”minimumAccountBalance_boldValue”:”$0.00″,”minimumAccountBalance_lightValue”:null,”minimumAccountBalance_tooltipText”:null,”createdOn”:1759339373528,”createdBy”:”SYSTEM”,”updatedOn”:1766434705054,”updatedBy”:”prod-fmp-pc-tracking-cta-compute-service|63509c38-2848-45c9-b994-28177306c6db”,”minimumDepositRequirement”:100,”minTerm”:0,”maxTerm”:0,”depositAmount”:100},{“mid”:”129428cb-7f5d-41f8-8b17-3ae6c06ff189″,”productId”:”1681918″,”title”:”SoFi Checking and Savings”,”bankInstitution”:”SoFi”,”category”:”Saving”,”subCategory”:”High Yield Saving”,”productImage”:”https://www.forbes.com/advisor/wp-content/uploads/2025/04/SoFi_logo.svg.png”,”productCtaUrl”:”https://refer.sofi.com/c/1955282/2248979/11190?adcampaigngroup=bank&adnetwork=BD”,”cnn_productCtaLink”:null,”usat_productCtaLink”:null,”min_term_filter”:null,”max_term_filter”:null,”productCtaLabel”:”Learn More”,”textBelowCta”:”On SoFi’s Website”,”fdic_ncua”:”Member FDIC”,”superlativeFlag”:null,”productRating”:null,”accurateAsOf”:null,”whyWePickedIt”:null,”disclosure”:null,”details”:”

– No account fees**

n

– No minimum deposit requirement

n

n

Disclosures:

n

Annual percentage yield (APY) is variable and subject to change at any time. Rates are current as of 12/23/25. There is no minimum balance requirement. Fees may reduce earnings. Additional rates and information can be found at https://www.sofi.com/legal/banking-rate-sheet

n

n

**SoFi does not charge any account, service or maintenance fees for SoFi Checking and Savings. We do charge a transaction fee to process each outgoing wire transfer. SoFi does not charge a fee for incoming wire transfers, however the sending bank may charge a fee. Our fee policy is subject to change at any time. See the SoFi Bank Fee Sheet for details at sofi.com/legal/banking-fees/.

n

n