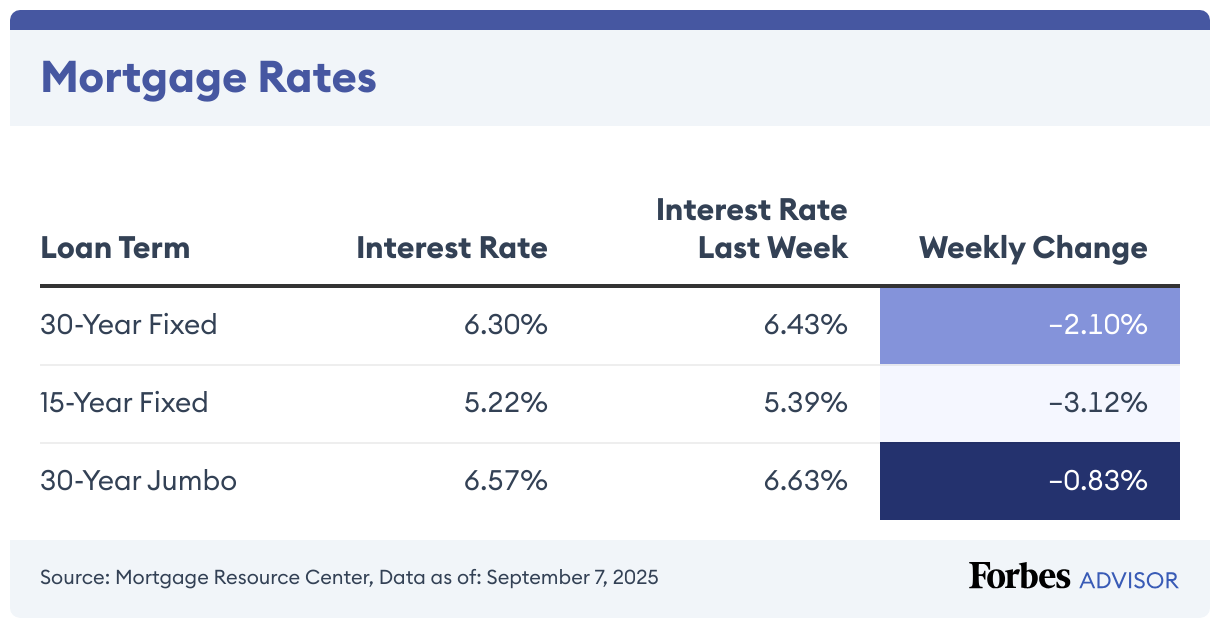

Today, the mortgage interest rate on a 30-year fixed mortgage is 6.27%, according to the Mortgage Research Center, while the average rate on a 15-year mortgage is 5.33%. On a 30-year jumbo mortgage, the average rate is 6.62%.

30-Year Mortgage Rates Drop 1.14%

Today’s average rate on a 30-year, fixed-rate mortgage is 6.27%, which is 1.14% lower than last week.

The interest plus lender fees, called the annual percentage rate (APR), on a 30-year fixed mortgage is 6.29%. The APR was 6.37% last week.

To get an idea about how much you might pay in interest, consider that the current 30-year, fixed-rate mortgage of 6.27% on a $100,000 loan will cost $617 per month in principal and interest (taxes and fees not included), the Forbes Advisor mortgage calculator shows. The total amount you’ll pay in interest during the loan’s lifespan is $122,689.

15-Year Mortgage Rates Drop 1.24%

Today’s 15-year mortgage (fixed-rate) is 5.33%, down 1.24% from the previous week. The same time last week, the 15-year, fixed-rate mortgage was at 5.4%.

The APR on a 15-year fixed is 5.38%. It was 5.44% a week earlier.

A 15-year, fixed-rate mortgage with today’s interest rate of 5.33% will cost $808 per month in principal and interest on a $100,000 mortgage (not including taxes and insurance). In this scenario, borrowers would pay approximately $45,903 in total interest.

Jumbo Mortgage Rates Drop 0.66%

The current average interest rate on a 30-year fixed-rate jumbo mortgage (a mortgage above 2025’s conforming loan limit of $806,500 in most areas) is 6.62%. Last week, the average rate was 6.67%.

If you lock in the latest rate on a 30-year, fixed-rate jumbo mortgage, you will pay $640 per month in principal and interest per $100,000 borrowed, which amounts to $130,893 in total interest over the life of the loan.

Overview of 2025 Mortgage Rate Trends to Date

After reaching highs in 2024, the average 30-year fixed mortgage rate has remained in the mid-to-high 6% range since late January 2025. The 15-year fixed mortgage rate has hovered between the low-6% and mid-to-high-5% range.

While interest rates have fallen since mid-January 2025, experts expect them to remain relatively steady for the remainder of the year. If the Federal Reserve continues to cut the federal funds rate, it’s possible that mortgage rates will decrease in 2026.

!function(){“use strict”;window.addEventListener(“message”,function(a){if(void 0!==a.data[“datawrapper-height”]){var e=document.querySelectorAll(“iframe”);for(var t in a.data[“datawrapper-height”])for(var r,i=0;r=e[i];i++)if(r.contentWindow===a.source){var d=a.data[“datawrapper-height”][t]+”px”;r.style.height=d}}})}();

When Will Mortgage Rates Go Down?

Mortgage rates are influenced by various economic factors, making it difficult to predict when they will drop.

Mortgage rates follow U.S. Treasury bond yields. When bond yields decrease, mortgage rates generally follow suit.

The Federal Reserve’s decisions and global events also play a key role in shaping mortgage rates. If inflation rises or the economy slows, the Fed may lower its federal funds rate. For example, during the Covid-19 pandemic, the Fed reduced rates, which drove interest rates to record lows.

A significant drop in mortgage rates seems unlikely in the near future. However, they may decline if inflation eases or the economy weakens.

How Much House Can I Afford?

Everyone’s budget and financial goals vary. How much house you can afford comes down to a number of factors, including what you earn and what you owe. You’ll also want to consider how much you want to save for retirement, school and other expenses down the road.

Here are a few basic factors that go into what you can afford:

- Income

- Debt

- Debt-to-income ratio (DTI)

- Down payment

- Credit score

Find the Best Mortgage Lenders of 2025

How Are Mortgage Rates Determined?

Multiple factors affect the interest rate for a mortgage, including the economy’s overall health, benchmark interest rates and borrower-specific factors.

The Federal Reserve’s rate decisions and inflation can influence rates to move higher or lower. Although the Fed raising rates doesn’t directly cause mortgage rates to rise, an increase to its benchmark interest rate makes it more expensive for banks to lend money to consumers. Conversely, rates tend to decrease during periods of rate cuts and cooling inflation.

Home buyers can make several moves to improve their finances and qualify for competitive rates. One is having a good or excellent credit score, which ranges from 670 to 850. Another is maintaining a debt-to-income (DTI) ratio below 43%, which implies less risk of being unable to afford the monthly mortgage payment.

Further, making a minimum 20% down payment can help you avoid private mortgage insurance (PMI) on conventional home loans. If you can afford the larger monthly payment, 15-year home loans have lower rates than a 30-year term.

Frequently Asked Questions (FAQs)

What is a good mortgage rate?

Average 30-year fixed mortgage rates land in the mid-6% range, so any rate at or below this range would be considered a good rate. However, several factors impact mortgage rates, including the repayment term, loan type and borrower’s credit score, so if you are considering applying for a mortgage, it’s a good idea to compare rates from several lenders to find the best rate for your situation.

How often do mortgage rates change?

Lenders adjust mortgage rates daily based on economic conditions, inflation, bond market movements and Federal Reserve actions.

If you’re shopping around for a mortgage, remember that you might be able to lock in a rate for 30 up to 120 days, depending on the lender. Note that some lenders charge a fee to lock your rate while others offer the service for free.

What determines your interest rate?

National average interest rates depend on economic and market conditions, including the bond market, inflation, the economy and Federal Reserve decisions.

Lenders set rates based on the loan type and term. In general, shorter terms tend to come with lower rates. Additionally, making a larger down payment signals less risk to the lender, which could get you a better rate.

Other factors that can impact your rate include your credit score, debt-to-income (DTI) ratio, income and property location.

Leave a Reply