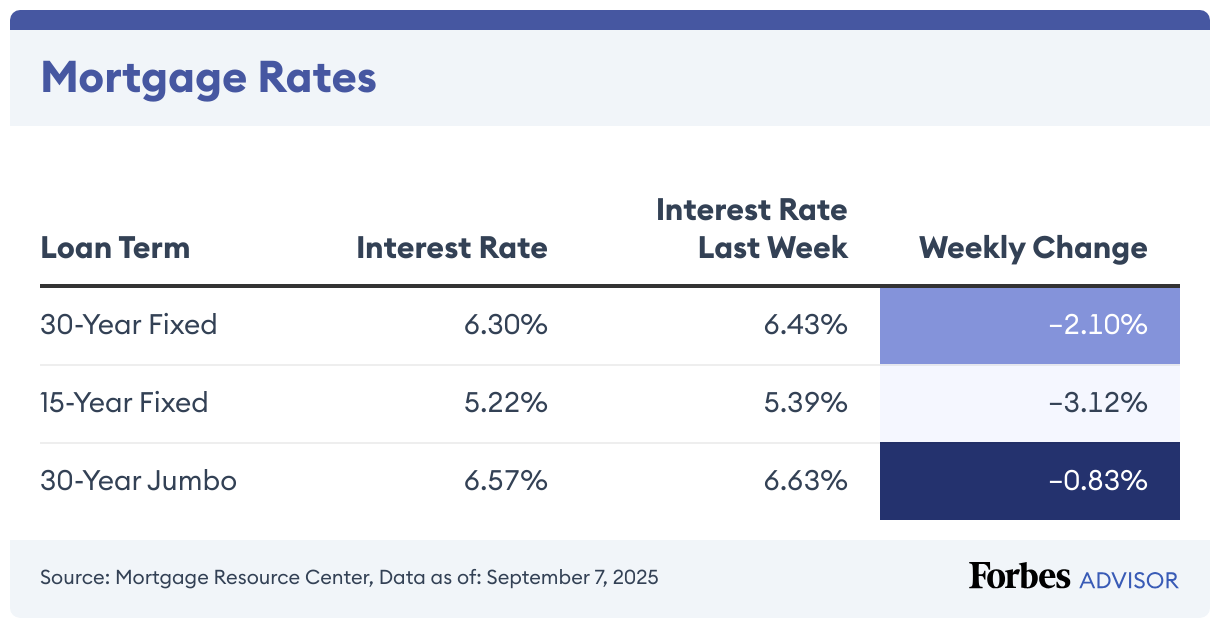

The current average mortgage rate on a 30-year fixed mortgage is 6.41%, according to the Mortgage Research Center. The average rate on a 15-year mortgage is 5.48%, while the average rate on a 30-year jumbo mortgage is 6.77%.

30-Year Mortgage Rates Climb 1.46%

Today’s 30-year mortgage—the most popular mortgage product—is 6.41%, up 1.46% from a week earlier.

The interest rate is just one fee included in your mortgage. You’ll also pay lender fees, which differ from lender to lender. Both interest rate and lender fees are captured in the APR. This week the APR on a 30-year fixed-rate mortgage is 6.44%. Last week, the APR was 6.35%.

Let’s say your home loan is $100,000 and you have a 30-year, fixed-rate mortgage with the current rate of 6.41%, your monthly payment will be about $626, including principal and interest (taxes and fees not included), the Forbes Advisor mortgage calculator shows. That’s around $126,102 in total interest over the life of the loan.

15-Year Mortgage Rates Climb 2.13%

Today, the 15-year mortgage rate jumped up to 5.48%, higher than it was yesterday. Last week, it was 5.36%.

The APR on a 15-year fixed is 5.53%. It was 5.41% this time last week.

A 15-year fixed-rate mortgage of $100,000 with today’s interest rate of 5.48% will cost $816 per month in principal and interest. Over the life of the loan, you would pay $47,333 in total interest.

Jumbo Mortgage Rates Climb 0.58%

The average interest rate on the 30-year fixed-rate jumbo mortgage (mortgages above 2025’s conforming loan limit of $806,500 in most areas) jumped up to 6.77%. Last week, the average rate was 6.73%.

Borrowers with a 30-year fixed-rate jumbo mortgage with today’s interest rate of 6.77% will pay $650 per month in principal and interest per $100,000. That means you’d pay approximately $134,381 in total interest over the life of the loan.

Mortgage Rate Trends in 2025

After reaching highs in 2024, the average 30-year fixed mortgage rate has remained in the mid-to-high 6% range since late January 2025. The 15-year fixed mortgage rate has hovered between the low-6% and high-5% range.

While interest rates have fallen somewhat since mid-January 2025, experts don’t expect them to drop significantly anytime soon.

!function(){“use strict”;window.addEventListener(“message”,function(a){if(void 0!==a.data[“datawrapper-height”]){var e=document.querySelectorAll(“iframe”);for(var t in a.data[“datawrapper-height”])for(var r,i=0;r=e[i];i++)if(r.contentWindow===a.source){var d=a.data[“datawrapper-height”][t]+”px”;r.style.height=d}}})}();

When Will Mortgage Rates Go Down?

Various economic factors influence mortgage rates, making it challenging to forecast when rates will drop.

The Federal Reserve’s decisions significantly impact mortgage rates. In response to inflation or an economic downturn, the Fed may lower its federal funds rate, prompting lenders to reduce mortgage rates.

Mortgage rates also track U.S. Treasury bond yields. If bond yields drop, mortgage rates typically follow suit.

Finally, global events that cause financial disruptions can affect mortgage rates. For example, the Covid-19 pandemic led to record-low interest rates when the Fed cut rates.

While a significant decrease in mortgage rates is unlikely in the near future, they may start to decline if inflation eases or the economy weakens.

What Affects Mortgage Rates?

The Federal Reserve’s restrictive monetary policy – including its interest rate hikes, which it’s using to restrain inflation – is the primary factor that’s pushing long-term mortgage rates higher. The state of the economy and housing market also affects mortgage rates. As for what interest rate the lender might offer you, this depends on your debt-to-income (DTI) ratio and credit score, both of which indicate your risk as a borrower.

Related: Mortgage Rates Forecast And Trends

How To Compare Mortgage Rates

Shop around and talk to various lenders to get a sense of each company’s mortgage loan offerings and services. Don’t go with the first lender quote you receive; instead, compare the best mortgage rate quotes to get a deal. In particular, consider what fees they charge, what fees they’re willing to waive and what closing assistance they might provide. Make sure any special offers or discounts don’t come at the cost of a higher mortgage rate.

Be sure to apply with each lender within a 45-day window. During this window, you can have multiple lenders pull your credit history without additional impact on your credit score.

Is This a Good Time To Buy a House?

Mortgage rates remain elevated, and the nation’s housing supply remains limited. The low inventory is preventing house prices from dropping. Meanwhile, the combination of high mortgage rates and appreciated home values will continue to present an obstacle for many prospective homebuyers seeking affordable housing.

Find the Best Mortgage Lenders of 2025

How Are Mortgage Rates Determined?

Mortgage interest rates are determined by several factors, including some that borrowers can’t control:

- Federal Reserve. The Fed rate hikes and decreases adjust the federal funds rate, which helps determine the benchmark interest rate that banks lend money at. As a result, mortgage rates tend to move in the same direction with the Fed’s rate decision.

- Bond market. Mortgages are also loosely connected to long-term bond yields as investors look for income-producing assets—specifically, the 10-year U.S. Treasury Bond. Home loan rates tend to increase as bond prices decrease, and vice versa.

- Economic health. Rates can increase during a strong economy when consumer demand is higher and unemployment levels are lower. Anticipate lower rates as the economy weakens and there is less demand for mortgages.

- Inflation. Banks and lenders may increase rates during inflationary periods to slow the rate of inflation. Additionally, inflation makes goods and services more expensive, reducing the dollar’s purchasing power.

While the above factors set the base interest rate for new mortgages, there are several areas that borrowers can focus on to get a lower rate:

- Credit score. Applicants with a credit score of 670 or above tend to have an easier time qualifying for a better interest rate. Typically, most lenders require a minimum score of 620 to qualify for a conventional mortgage.

- Debt-to-income (DTI) ratio. Lenders may issue mortgages to borrowers with a DTI of 50% or less. However, applying with a DTI below 43% is recommended.

- Loan-to-value (LTV) ratio. Conventional home loans charge private mortgage insurance when your LTV exceeds 80% of the appraisal value, meaning you need to put at least 20% down to avoid higher rates. Additionally, FHA mortgage insurance premiums expire after the first 11 years when you put at least 10% down.

- Loan term. Longer-term loans such as a 30-year or 20-year mortgage tend to charge higher rates than a 15-year loan term. However, your monthly payment can be more affordable over a longer term.

- Residence type. Interest rates for a primary residence can be lower than a second home or an investment property. This is because the lender of your primary mortgage receives compensation first in the event of foreclosure.

What Type of Mortgage Is Best for You?

As you compare lenders, consider getting rate quotes for several loan programs. In addition to comparing rates and fees, these programs can have flexible down payment and credit requirements that make qualifying easier.

Conventional mortgages are likely to offer competitive rates when you have a credit score between 670 and 850, although it’s possible to qualify with a minimum score of 620. This home loan type also doesn’t require annual fees when you have at least 20% equity and waive PMI.

Several government-backed programs are better when you want to make little or no down payment:

- FHA loans. Borrowers with a credit score above 580 only need to put 3.5% down and applicants with credit scores ranging from 500 to 579 are only required to make a 10% down payment with FHA loans.

- VA loans. Servicemembers, veterans and qualifying spouses don’t need to make a down payment when the sales price is less than the home’s appraisal value. VA loan credit requirements vary by lender.

- USDA loans. Applicants in eligible rural areas can buy or build a home with no money down using a USDA loan. Moderate-income borrowers can qualify for a 30-year fixed-rate term through the Guaranteed Loan Program. Further, buyers with a very low or low income can receive a 33-year term and payment assistance is available through the agency’s Direct Loans program. Credit requirements differ by lender.

Frequently Asked Questions (FAQs)

How do you get a lower mortgage interest rate?

Comparing lenders and loan programs is an excellent start. Borrowers should also strive for a good or excellent credit score between 670 and 850 and a debt-to-income ratio of 43% or less.

Further, making a minimum down payment of 20% on conventional mortgages can help you automatically waive private mortgage insurance premiums, which increases your borrowing costs. Buying discount points or lender credits can also reduce your interest rate.

Will interest rates ever go back to 3%?

The Federal Reserve’s efforts to stabilize the economy during the Covid-19 pandemic drove the historically low rates. As the economy recovers, the unemployment rate decreases and inflation is controlled, rates may dip below current levels, but they’re unlikely to fall as low as 3% again anytime soon.

Should I choose a fixed- or adjustable-rate mortgage?

Choosing between a fixed- or adjustable-rate mortgage (ARM) depends on your financial situation. A fixed-rate mortgage suits those who want consistent monthly payments throughout the loan term without worrying about fluctuations in their rate or payments in response to market changes. If mortgage rates are low, securing a fixed rate can save you money in the long run.

An ARM, on the other hand, may appeal to those who want a lower initial rate and monthly payment. However, you also run the risk of ending up with higher payments if your rate fluctuates. If you expect your income to rise, you may feel confident handling these potential payment increases. These mortgages can also work well for those who plan to live in a home for only a few years, as you might sell or move before the rate adjusts.

Leave a Reply