Understanding mortgage and refinance rates is key when navigating the Arizona housing market. These rates aren’t set in stone, though. They fluctuate based on factors like 10-year Treasury yields, economic conditions, Federal Reserve policy and inflation.

To help you understand these fluctuations, we summarized the current Arizona mortgage and refinance rates, plus rate trends and tips for getting the best mortgage rates in Arizona. Keeping an eye on current rates can be advantageous whether you want to buy your dream home or refinance your current mortgage. Even a small change in rates can impact your monthly payments and the overall cost of borrowing.

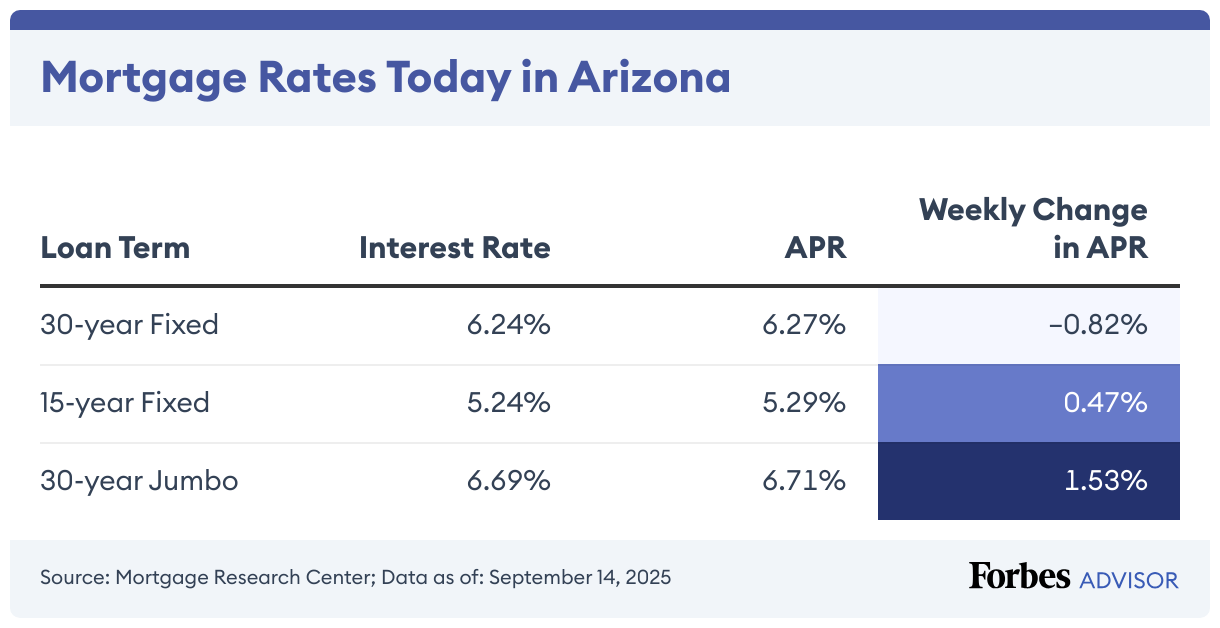

Today’s Mortgage Rates in Arizona

Arizona’s average APR on a 30-year mortgage decreased 0.052 points to 6.272% over the past week, according to data from the Mortgage Research Center. The rate is down 0.564 points over the last 90 days and down 0.26 points over the last 30 days.

The state’s average APR for the benchmark 15-year fixed mortgage increased 0.025 points to 5.29% over the past week. Over the last 90 days, the rate is down 0.57 points; it’s down 0.243 points over the last 30 days.

The average APR for a 30-year jumbo mortgage rose 0.101 points to 6.713% since last week. It’s down 0.408 points over the last 90 days and basically flat over the last 30 days.

30-year fixed-rate mortgage:

- Today. The average APR for the benchmark 30-year fixed mortgage is 6.272%.

- Last week. 6.324%.

15-year fixed-rate mortgage:

- Today. The average APR on a 15-year fixed mortgage is 5.29%.

- Last week. 5.265%.

30-year fixed-rate jumbo mortgage:

- Today. The average APR on the 30-year fixed-rate jumbo mortgage is 6.713%.

- Last week. 6.612%.

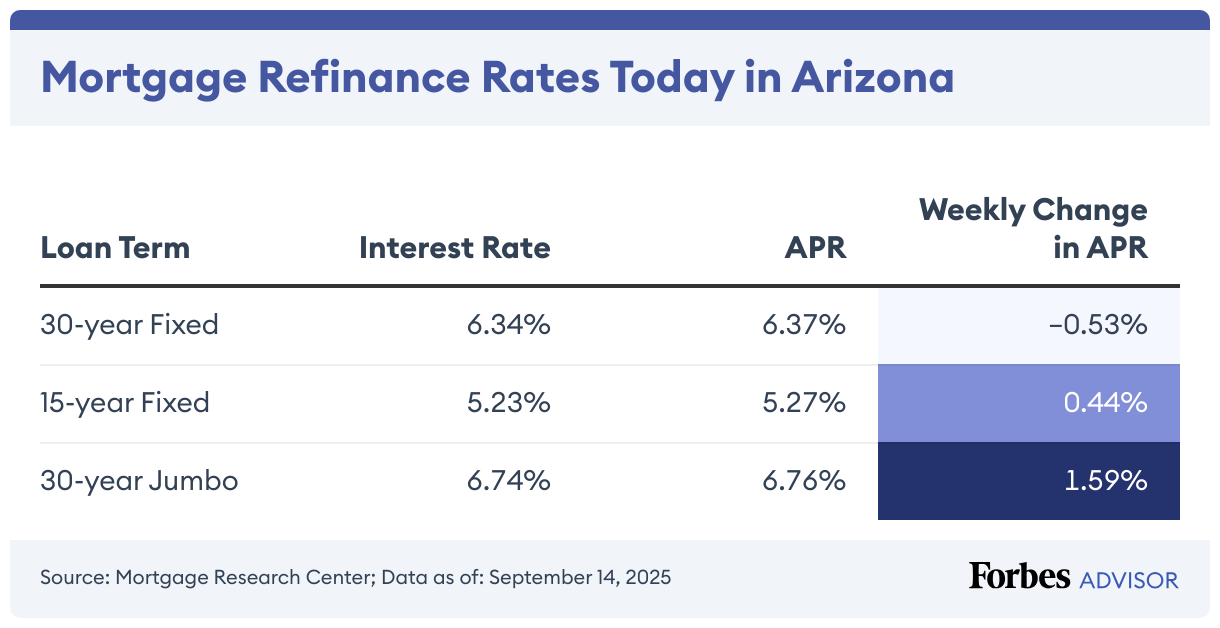

Today’s Refinance Rates in Arizona

Arizona’s average APR for the benchmark 30-year fixed refinance mortgage fell 0.034 points to 6.366% compared to a week ago. The rate is down 0.543 points over the last 90 days and down 0.226 points over the last 30 days.

The average APR in the state on a 15-year refinanced mortgage rose 0.023 points to 5.271% weekly. Over the last 90 days, the rate is down 0.578 points over the last 90 days; it’s down 0.257 points over the last 30 days.

For jumbo 30-year refinanced mortgages, the average APR climbed 0.106 points to 6.759% week-to-week. It’s down 0.435 points over the last 90 days and up 0.035 points over the last 30 days.

30-year fixed-rate refinance mortgage:

- Today. The average APR for the benchmark 30-year fixed mortgage is 6.366%.

- Last week. 6.4%.

15-year fixed-rate refinance mortgage:

- Today. The average APR on a 15-year fixed mortgage is 5.271%.

- Last week. 5.248%.

30-year fixed-rate jumbo refinance mortgage:

- Today. The average APR on the 30-year fixed-rate jumbo mortgage is 6.759%.

- Last week. 6.653%.

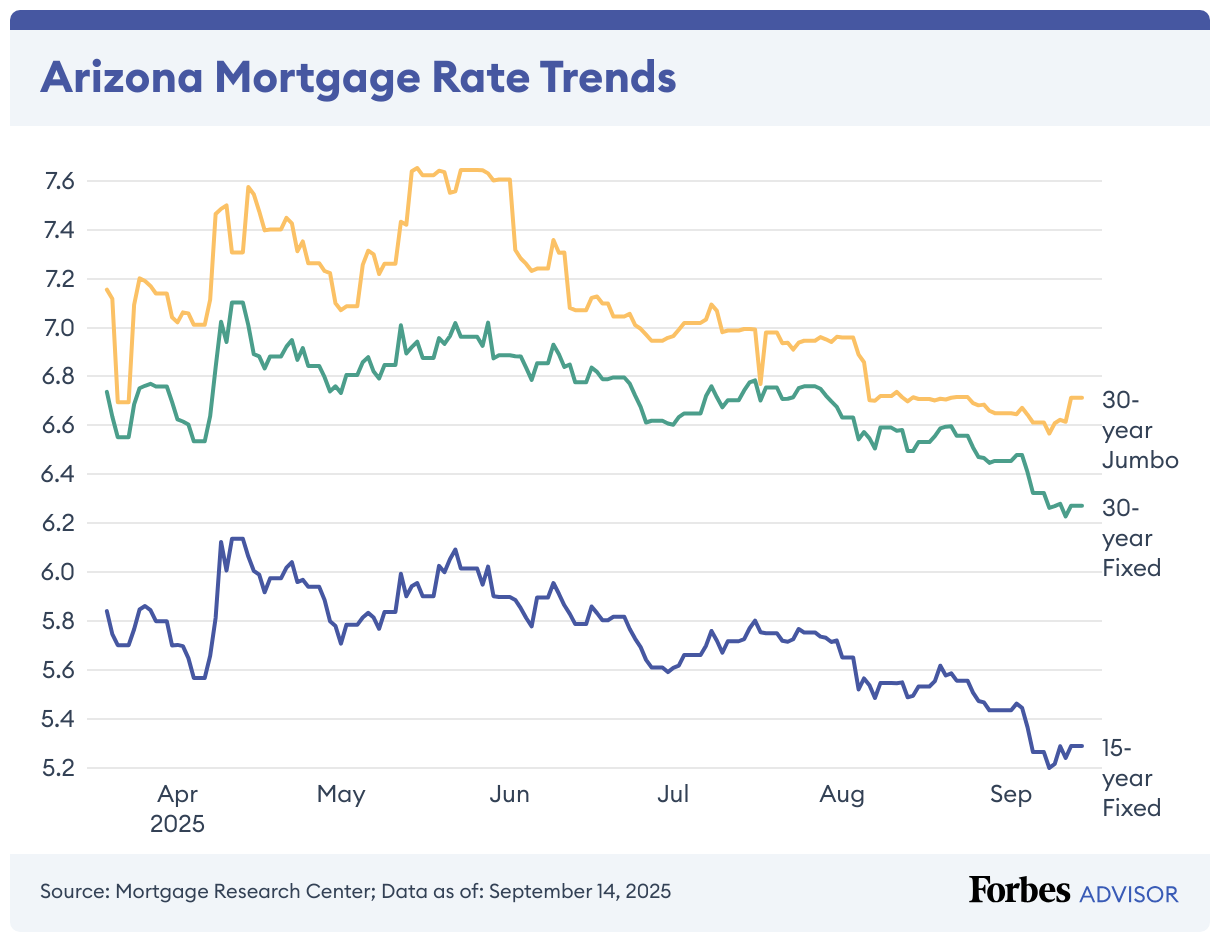

Arizona Mortgage Rate Trends

Understanding the patterns and changes in Arizona mortgage interest rates over time can empower you to make informed decisions about financing when purchasing a new home, refinancing or shopping for a second mortgage. Depending on your qualifications, analyzing Arizona mortgage rate trends may help you save over the life of the loan.

Arizona’s mortgage rates have trended downward over the last three months, as have national rates.

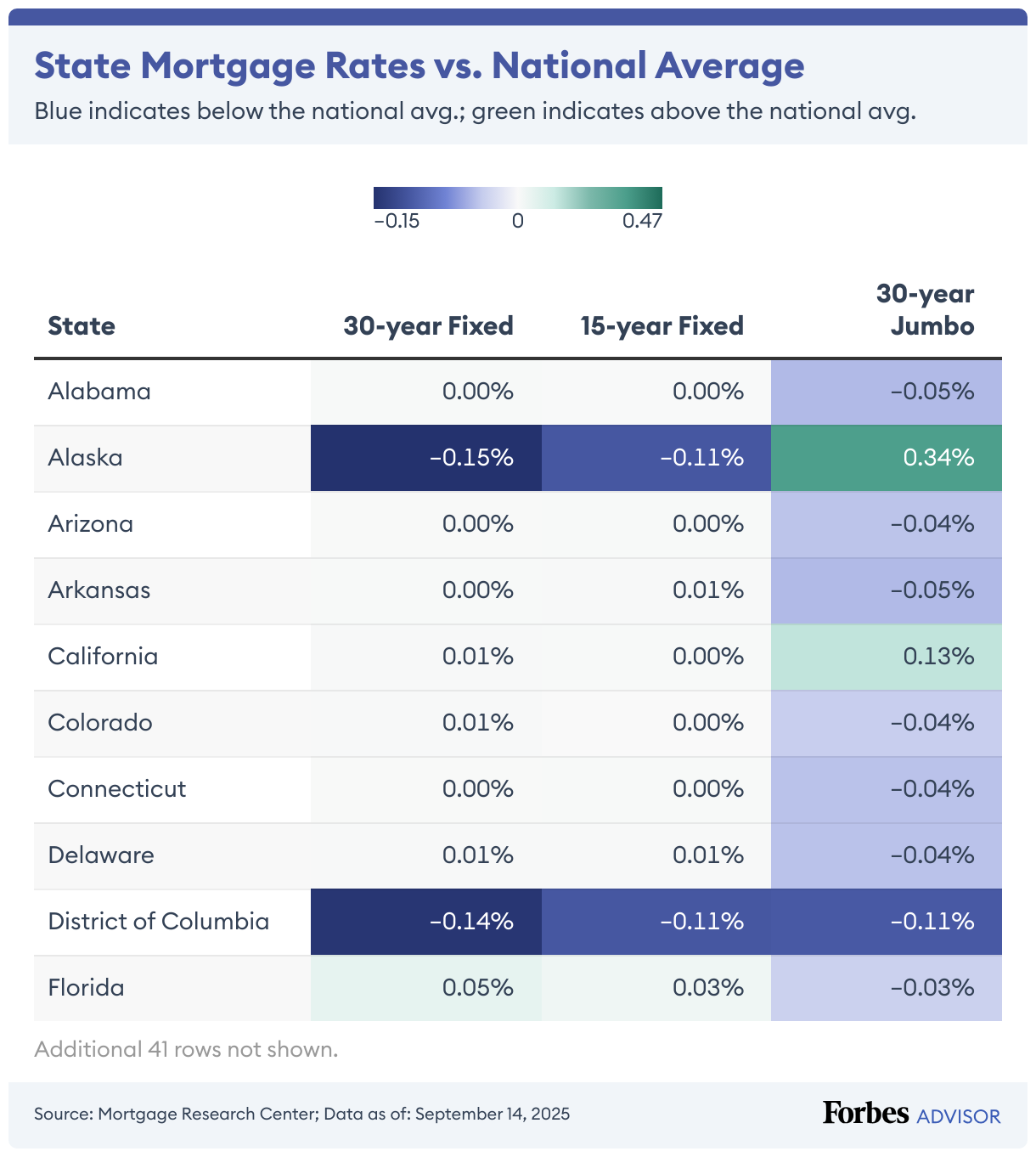

Arizona Mortgage Rates vs. National Mortgage Rates

Although state mortgage rates generally move in line with the national average, there are state-level differences.

Today’s average mortgage rate in Arizona is 6.272%, while the national average rate is 6.275%. That’s -0.003 percentage points lower than the national average.

Arizona’s mortgage refinance rate today is 6.366% versus the national average of 6.371% – 0.005 percentage points lower than the national average.

Use the chart below to explore the differences between states.

Buying a House in Arizona

Buying a home in Arizona can be an exciting adventure. With its diverse landscapes, rich culture and low cost of living, Arizona has something for everyone. Whether you’re looking for a bustling city neighborhood in Phoenix or a quiet rural area, knowing the local real estate market and what’s involved in buying a home is important. Working with a local real estate agent can help you navigate the process and find the perfect home for you. Likewise, staying informed about the market and local rules can simplify and ease your home-buying journey.

How to Get the Best Mortgage Rates in Arizona

Getting the best mortgage rates in Arizona requires planning and research. Interest rates and trends can vary widely across regions, so make sure you understand the current rates in your area. Then, shop around to compare offers from multiple lenders, like banks, credit unions and online mortgage providers.

Maintaining a strong credit score and having a stable financial history can help you qualify for more competitive rates. Likewise, providing a down payment of at least 20% can lower your monthly payments and eliminate the need for private mortgage insurance (PMI). A local mortgage broker or financial advisor who knows the Arizona market can help you navigate the home-buying process more efficiently. By staying informed and proactive, you can find a mortgage rate that best fits your financial situation and home-buying goals.

Find the Best Mortgage Lenders of 2025

Find Competitive Mortgage Rates Near You

Leave a Reply