Featured Partner Offer

/*! purgecss start ignore */.tooltip-tippy{cursor:pointer}.tippy-box>.tippy-arrow:before{border:7px solid transparent;border-top-color:#fff;bottom:-22px;content:””;height:0;left:-5px;position:absolute;width:0}div.tippy-box{max-width:350px!important}.tippy-box[data-theme~=tippy-dark-theme],.tippy-box[data-theme~=tippy-fcc-dark-theme],.tippy-box[data-theme~=tippy-sem-cta-dark-theme],.tippy-box[data-theme~=tippy-wwus-theme]{background-color:#333;border-radius:8px;color:#fcf2ef;font-family:EuclidCircularB,sans-serif;font-size:14px;line-height:20px;padding:16px}.tippy-box[data-theme~=tippy-dark-theme].tippy-box>.tippy-arrow:before,.tippy-box[data-theme~=tippy-fcc-dark-theme].tippy-box>.tippy-arrow:before,.tippy-box[data-theme~=tippy-sem-cta-dark-theme].tippy-box>.tippy-arrow:before,.tippy-box[data-theme~=tippy-wwus-theme].tippy-box>.tippy-arrow:before{border-top-color:#333}.tippy-box[data-theme~=tippy-dark-theme].tippy-box[data-placement~=top].tippy-box>.tippy-arrow:before,.tippy-box[data-theme~=tippy-fcc-dark-theme].tippy-box[data-placement~=top].tippy-box>.tippy-arrow:before,.tippy-box[data-theme~=tippy-sem-cta-dark-theme].tippy-box[data-placement~=top].tippy-box>.tippy-arrow:before,.tippy-box[data-theme~=tippy-wwus-theme].tippy-box[data-placement~=top].tippy-box>.tippy-arrow:before{bottom:-29px;left:-7px}.tippy-box[data-theme~=tippy-dark-theme].tippy-box[data-placement~=bottom].tippy-box>.tippy-arrow:before,.tippy-box[data-theme~=tippy-fcc-dark-theme].tippy-box[data-placement~=bottom].tippy-box>.tippy-arrow:before,.tippy-box[data-theme~=tippy-sem-cta-dark-theme].tippy-box[data-placement~=bottom].tippy-box>.tippy-arrow:before,.tippy-box[data-theme~=tippy-wwus-theme].tippy-box[data-placement~=bottom].tippy-box>.tippy-arrow:before{bottom:136px;left:-7px;transform:rotate(180deg)}.tippy-box[data-theme~=tippy-wwus-theme].tippy-box[data-placement~=top].tippy-box>.tippy-arrow:before{bottom:-28px}.tippy-box[data-theme~=tippy-wwus-theme].tippy-box[data-placement~=bottom].tippy-box>.tippy-arrow{top:0}.tippy-box[data-theme~=tippy-wwus-theme].tippy-box[data-placement~=bottom].tippy-box>.tippy-arrow:before{bottom:215px;top:-13px}.tippy-box[data-theme~=tippy-sem-cta-dark-theme]{max-width:184px!important;padding:8px 12px}.tippy-box[data-theme~=tippy-sem-cta-dark-theme].tippy-box[data-placement~=top].tippy-box>.tippy-arrow:before{bottom:-19px}.tippy-box[data-theme~=tippy-sem-cta-dark-theme].tippy-box[data-placement~=bottom].tippy-box>.tippy-arrow:before{bottom:127px}@media screen and (min-width:768px){.tippy-box[data-theme~=tippy-sem-cta-dark-theme]{max-width:220px!important}.tippy-box[data-theme~=tippy-sem-cta-dark-theme].tippy-box[data-placement~=bottom].tippy-box>.tippy-arrow:before{bottom:108px}}.page-template .tippy-box[data-theme~=tippy-dark-theme],.page-template .tippy-box[data-theme~=tippy-fcc-dark-theme],.page-template .tippy-box[data-theme~=tippy-sem-cta-dark-theme],.page-template .tippy-box[data-theme~=tippy-wwus-theme],.post-template .tippy-box[data-theme~=tippy-dark-theme],.post-template .tippy-box[data-theme~=tippy-fcc-dark-theme],.post-template .tippy-box[data-theme~=tippy-sem-cta-dark-theme],.post-template .tippy-box[data-theme~=tippy-wwus-theme],.post-template-default .tippy-box[data-theme~=tippy-dark-theme],.post-template-default .tippy-box[data-theme~=tippy-fcc-dark-theme],.post-template-default .tippy-box[data-theme~=tippy-sem-cta-dark-theme],.post-template-default .tippy-box[data-theme~=tippy-wwus-theme]{font-family:Georgia,serif}

/*! purgecss end ignore */.card-review-block__content .promo-wrapper,.cc-compare-widget .promo-wrapper,.cc-wrapper .promo-wrapper,.compare-cc-wrapper .promo-wrapper,.compare-section .promo-wrapper,.featured-card-pdpcompare .promo-wrapper,.featured-cc .promo-wrapper{background-color:#cdebfc;color:#000;display:flex;font-family:EuclidCircularB,sans-serif;font-size:14px;font-weight:700;gap:6px;justify-content:center;line-height:22px;padding:8px 10px}@media (min-width:1023px){.card-review-block__content .promo-wrapper,.cc-compare-widget .promo-wrapper,.cc-wrapper .promo-wrapper,.compare-cc-wrapper .promo-wrapper,.compare-section .promo-wrapper,.featured-card-pdpcompare .promo-wrapper,.featured-cc .promo-wrapper{padding:4px 10px}}.card-review-block__content .promo-wrapper .promo-icon,.card-review-block__content .promo-wrapper .promo-text,.card-review-block__content .promo-wrapper .promo-tooltip,.cc-compare-widget .promo-wrapper .promo-icon,.cc-compare-widget .promo-wrapper .promo-text,.cc-compare-widget .promo-wrapper .promo-tooltip,.cc-wrapper .promo-wrapper .promo-icon,.cc-wrapper .promo-wrapper .promo-text,.cc-wrapper .promo-wrapper .promo-tooltip,.compare-cc-wrapper .promo-wrapper .promo-icon,.compare-cc-wrapper .promo-wrapper .promo-text,.compare-cc-wrapper .promo-wrapper .promo-tooltip,.compare-section .promo-wrapper .promo-icon,.compare-section .promo-wrapper .promo-text,.compare-section .promo-wrapper .promo-tooltip,.featured-card-pdpcompare .promo-wrapper .promo-icon,.featured-card-pdpcompare .promo-wrapper .promo-text,.featured-card-pdpcompare .promo-wrapper .promo-tooltip,.featured-cc .promo-wrapper .promo-icon,.featured-cc .promo-wrapper .promo-text,.featured-cc .promo-wrapper .promo-tooltip{align-items:center;display:flex}.card-review-block__content .promo-wrapper .promo-tooltip,.cc-compare-widget .promo-wrapper .promo-tooltip,.cc-wrapper .promo-wrapper .promo-tooltip,.compare-cc-wrapper .promo-wrapper .promo-tooltip,.compare-section .promo-wrapper .promo-tooltip,.featured-card-pdpcompare .promo-wrapper .promo-tooltip,.featured-cc .promo-wrapper .promo-tooltip{height:-moz-fit-content;height:fit-content;margin:auto 0}.cc-compare-widget .promo-wrapper,.compare-cc-wrapper .promo-wrapper,.compare-section .promo-wrapper,.featured-card-pdpcompare .promo-wrapper{border-top-left-radius:8px;border-top-right-radius:8px;padding:8px 10px}.card-review-block__content .promo-wrapper{border-top-left-radius:8px;border-top-right-radius:8px}.card-review-block__content:has(.promo-wrapper) .cc-card{border-radius:0 0 16px 16px;border-top:none}.cc-wrapper .promo-wrapper,.featured-cc .promo-wrapper{margin-top:-15px}.cc-wrapper:has(.promo-wrapper) .cc-wrapper-inner,.featured-cc:has(.promo-wrapper) .cc-wrapper-inner{border-top:none;border-top-left-radius:0;border-top-right-radius:0}.cc-wrapper:has(.promo-wrapper) .cc-wrapper-inner,.cc-wrapper:has(.promo-wrapper).featured-card .cc-wrapper-inner,.featured-cc:has(.promo-wrapper) .cc-wrapper-inner,.featured-cc:has(.promo-wrapper).featured-card .cc-wrapper-inner{border-top:none;margin-top:0}.featured-cc .promo-wrapper{border:4px solid #354e8f;border-width:0 4px}.cc-wrapper .promo-wrapper{border-top-left-radius:8px;border-top-right-radius:8px}.cc-wrapper.featured-card .promo-wrapper{border:4px solid #354e8f;border-top-left-radius:0;border-top-right-radius:0;border-width:0 4px}.widget__pdpcompare:has(.promo-wrapper) .best-top-bg{border-top-left-radius:0;border-top-right-radius:0}.widget__pdpcompare:has(.promo-wrapper) .featured-card-pdpcompare .bonus-lto-wrapper{background:#edf0fc;border-radius:8px 8px 0 0}.compare-cc-wrapper:has(.promo-wrapper) .bonus-lto-wrapper{background:#fff;border-radius:8px 8px 0 0}.compare-cc-wrapper:has(.promo-wrapper) .credit-card-wrapper{border-top:none;border-top-left-radius:0;border-top-right-radius:0;box-shadow:0 12px 12px rgba(24,28,71,.12)}.page-template .card-review-block__content .promo-wrapper .promo-icon,.page-template .card-review-block__content .promo-wrapper .promo-text,.page-template .card-review-block__content .promo-wrapper .promo-tooltip,.page-template .cc-compare-widget .promo-wrapper .promo-icon,.page-template .cc-compare-widget .promo-wrapper .promo-text,.page-template .cc-compare-widget .promo-wrapper .promo-tooltip,.page-template .cc-wrapper .promo-wrapper .promo-icon,.page-template .cc-wrapper .promo-wrapper .promo-text,.page-template .cc-wrapper .promo-wrapper .promo-tooltip,.page-template .compare-cc-wrapper .promo-wrapper .promo-icon,.page-template .compare-cc-wrapper .promo-wrapper .promo-text,.page-template .compare-cc-wrapper .promo-wrapper .promo-tooltip,.page-template .compare-section .promo-wrapper .promo-icon,.page-template .compare-section .promo-wrapper .promo-text,.page-template .compare-section .promo-wrapper .promo-tooltip,.page-template .featured-card-pdpcompare .promo-wrapper .promo-icon,.page-template .featured-card-pdpcompare .promo-wrapper .promo-text,.page-template .featured-card-pdpcompare .promo-wrapper .promo-tooltip,.page-template .featured-cc .promo-wrapper .promo-icon,.page-template .featured-cc .promo-wrapper .promo-text,.page-template .featured-cc .promo-wrapper .promo-tooltip,.post-template .card-review-block__content .promo-wrapper .promo-icon,.post-template .card-review-block__content .promo-wrapper .promo-text,.post-template .card-review-block__content .promo-wrapper .promo-tooltip,.post-template .cc-compare-widget .promo-wrapper .promo-icon,.post-template .cc-compare-widget .promo-wrapper .promo-text,.post-template .cc-compare-widget .promo-wrapper .promo-tooltip,.post-template .cc-wrapper .promo-wrapper .promo-icon,.post-template .cc-wrapper .promo-wrapper .promo-text,.post-template .cc-wrapper .promo-wrapper .promo-tooltip,.post-template .compare-cc-wrapper .promo-wrapper .promo-icon,.post-template .compare-cc-wrapper .promo-wrapper .promo-text,.post-template .compare-cc-wrapper .promo-wrapper .promo-tooltip,.post-template .compare-section .promo-wrapper .promo-icon,.post-template .compare-section .promo-wrapper .promo-text,.post-template .compare-section .promo-wrapper .promo-tooltip,.post-template .featured-card-pdpcompare .promo-wrapper .promo-icon,.post-template .featured-card-pdpcompare .promo-wrapper .promo-text,.post-template .featured-card-pdpcompare .promo-wrapper .promo-tooltip,.post-template .featured-cc .promo-wrapper .promo-icon,.post-template .featured-cc .promo-wrapper .promo-text,.post-template .featured-cc .promo-wrapper .promo-tooltip,.post-template-default .card-review-block__content .promo-wrapper .promo-icon,.post-template-default .card-review-block__content .promo-wrapper .promo-text,.post-template-default .card-review-block__content .promo-wrapper .promo-tooltip,.post-template-default .cc-compare-widget .promo-wrapper .promo-icon,.post-template-default .cc-compare-widget .promo-wrapper .promo-text,.post-template-default .cc-compare-widget .promo-wrapper .promo-tooltip,.post-template-default .cc-wrapper .promo-wrapper .promo-icon,.post-template-default .cc-wrapper .promo-wrapper .promo-text,.post-template-default .cc-wrapper .promo-wrapper .promo-tooltip,.post-template-default .compare-cc-wrapper .promo-wrapper .promo-icon,.post-template-default .compare-cc-wrapper .promo-wrapper .promo-text,.post-template-default .compare-cc-wrapper .promo-wrapper .promo-tooltip,.post-template-default .compare-section .promo-wrapper .promo-icon,.post-template-default .compare-section .promo-wrapper .promo-text,.post-template-default .compare-section .promo-wrapper .promo-tooltip,.post-template-default .featured-card-pdpcompare .promo-wrapper .promo-icon,.post-template-default .featured-card-pdpcompare .promo-wrapper .promo-text,.post-template-default .featured-card-pdpcompare .promo-wrapper .promo-tooltip,.post-template-default .featured-cc .promo-wrapper .promo-icon,.post-template-default .featured-cc .promo-wrapper .promo-text,.post-template-default .featured-cc .promo-wrapper .promo-tooltip{font-family:Work Sans,sans-serif}.page-template .card-review-block__content:has(.promo-wrapper) .cc-wrapper-inner,.page-template .cc-compare-widget:has(.promo-wrapper) .cc-wrapper-inner,.page-template .cc-wrapper:has(.promo-wrapper) .cc-wrapper-inner,.page-template .compare-cc-wrapper:has(.promo-wrapper) .cc-wrapper-inner,.page-template .compare-section:has(.promo-wrapper) .cc-wrapper-inner,.page-template .featured-card-pdpcompare:has(.promo-wrapper) .cc-wrapper-inner,.page-template .featured-cc:has(.promo-wrapper) .cc-wrapper-inner,.post-template .card-review-block__content:has(.promo-wrapper) .cc-wrapper-inner,.post-template .cc-compare-widget:has(.promo-wrapper) .cc-wrapper-inner,.post-template .cc-wrapper:has(.promo-wrapper) .cc-wrapper-inner,.post-template .compare-cc-wrapper:has(.promo-wrapper) .cc-wrapper-inner,.post-template .compare-section:has(.promo-wrapper) .cc-wrapper-inner,.post-template .featured-card-pdpcompare:has(.promo-wrapper) .cc-wrapper-inner,.post-template .featured-cc:has(.promo-wrapper) .cc-wrapper-inner,.post-template-default .card-review-block__content:has(.promo-wrapper) .cc-wrapper-inner,.post-template-default .cc-compare-widget:has(.promo-wrapper) .cc-wrapper-inner,.post-template-default .cc-wrapper:has(.promo-wrapper) .cc-wrapper-inner,.post-template-default .compare-cc-wrapper:has(.promo-wrapper) .cc-wrapper-inner,.post-template-default .compare-section:has(.promo-wrapper) .cc-wrapper-inner,.post-template-default .featured-card-pdpcompare:has(.promo-wrapper) .cc-wrapper-inner,.post-template-default .featured-cc:has(.promo-wrapper) .cc-wrapper-inner{border-top:none}.page-template .card-review-block__content:has(.promo-wrapper) .cc-wrapper-inner,.page-template .card-review-block__content:has(.promo-wrapper).featured-card .cc-wrapper-inner,.page-template .cc-compare-widget:has(.promo-wrapper) .cc-wrapper-inner,.page-template .cc-compare-widget:has(.promo-wrapper).featured-card .cc-wrapper-inner,.page-template .cc-wrapper:has(.promo-wrapper) .cc-wrapper-inner,.page-template .cc-wrapper:has(.promo-wrapper).featured-card .cc-wrapper-inner,.page-template .compare-cc-wrapper:has(.promo-wrapper) .cc-wrapper-inner,.page-template .compare-cc-wrapper:has(.promo-wrapper).featured-card .cc-wrapper-inner,.page-template .compare-section:has(.promo-wrapper) .cc-wrapper-inner,.page-template .compare-section:has(.promo-wrapper).featured-card .cc-wrapper-inner,.page-template .featured-card-pdpcompare:has(.promo-wrapper) .cc-wrapper-inner,.page-template .featured-card-pdpcompare:has(.promo-wrapper).featured-card .cc-wrapper-inner,.page-template .featured-cc:has(.promo-wrapper) .cc-wrapper-inner,.page-template .featured-cc:has(.promo-wrapper).featured-card .cc-wrapper-inner,.post-template .card-review-block__content:has(.promo-wrapper) .cc-wrapper-inner,.post-template .card-review-block__content:has(.promo-wrapper).featured-card .cc-wrapper-inner,.post-template .cc-compare-widget:has(.promo-wrapper) .cc-wrapper-inner,.post-template .cc-compare-widget:has(.promo-wrapper).featured-card .cc-wrapper-inner,.post-template .cc-wrapper:has(.promo-wrapper) .cc-wrapper-inner,.post-template .cc-wrapper:has(.promo-wrapper).featured-card .cc-wrapper-inner,.post-template .compare-cc-wrapper:has(.promo-wrapper) .cc-wrapper-inner,.post-template .compare-cc-wrapper:has(.promo-wrapper).featured-card .cc-wrapper-inner,.post-template .compare-section:has(.promo-wrapper) .cc-wrapper-inner,.post-template .compare-section:has(.promo-wrapper).featured-card .cc-wrapper-inner,.post-template .featured-card-pdpcompare:has(.promo-wrapper) .cc-wrapper-inner,.post-template .featured-card-pdpcompare:has(.promo-wrapper).featured-card .cc-wrapper-inner,.post-template .featured-cc:has(.promo-wrapper) .cc-wrapper-inner,.post-template .featured-cc:has(.promo-wrapper).featured-card .cc-wrapper-inner,.post-template-default .card-review-block__content:has(.promo-wrapper) .cc-wrapper-inner,.post-template-default .card-review-block__content:has(.promo-wrapper).featured-card .cc-wrapper-inner,.post-template-default .cc-compare-widget:has(.promo-wrapper) .cc-wrapper-inner,.post-template-default .cc-compare-widget:has(.promo-wrapper).featured-card .cc-wrapper-inner,.post-template-default .cc-wrapper:has(.promo-wrapper) .cc-wrapper-inner,.post-template-default .cc-wrapper:has(.promo-wrapper).featured-card .cc-wrapper-inner,.post-template-default .compare-cc-wrapper:has(.promo-wrapper) .cc-wrapper-inner,.post-template-default .compare-cc-wrapper:has(.promo-wrapper).featured-card .cc-wrapper-inner,.post-template-default .compare-section:has(.promo-wrapper) .cc-wrapper-inner,.post-template-default .compare-section:has(.promo-wrapper).featured-card .cc-wrapper-inner,.post-template-default .featured-card-pdpcompare:has(.promo-wrapper) .cc-wrapper-inner,.post-template-default .featured-card-pdpcompare:has(.promo-wrapper).featured-card .cc-wrapper-inner,.post-template-default .featured-cc:has(.promo-wrapper) .cc-wrapper-inner,.post-template-default .featured-cc:has(.promo-wrapper).featured-card .cc-wrapper-inner{border-top:none}

Up to 8x Reward Rate

Earn 8x points on all purchases through Chase Travel℠, including The Edit℠ and 4x points on flights and hotels bookedRead More

Welcome Bonus

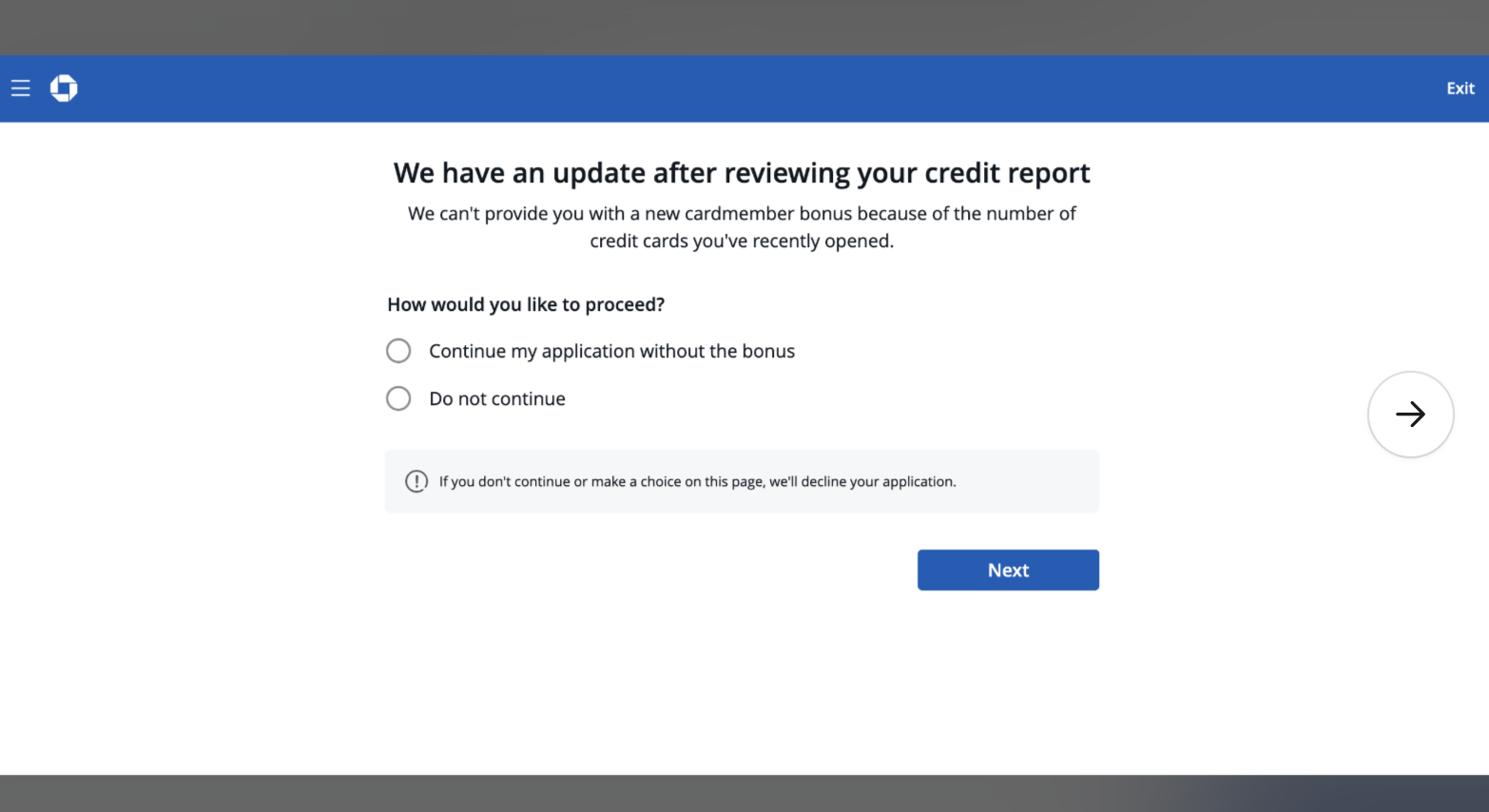

100,000 bonus points + $500 Chase Travel℠ promo credit

Regular APR

20.24% – 28.74% Variable

Credit Score

Excellent (740 and above)

Card Details

- Earn 100,000 bonus points + $500 Chase Travel℠ promo credit after you spend $5,000 on purchases in the first 3 months from account opening.

- Get more than $2,700 in annual value with Sapphire Reserve.

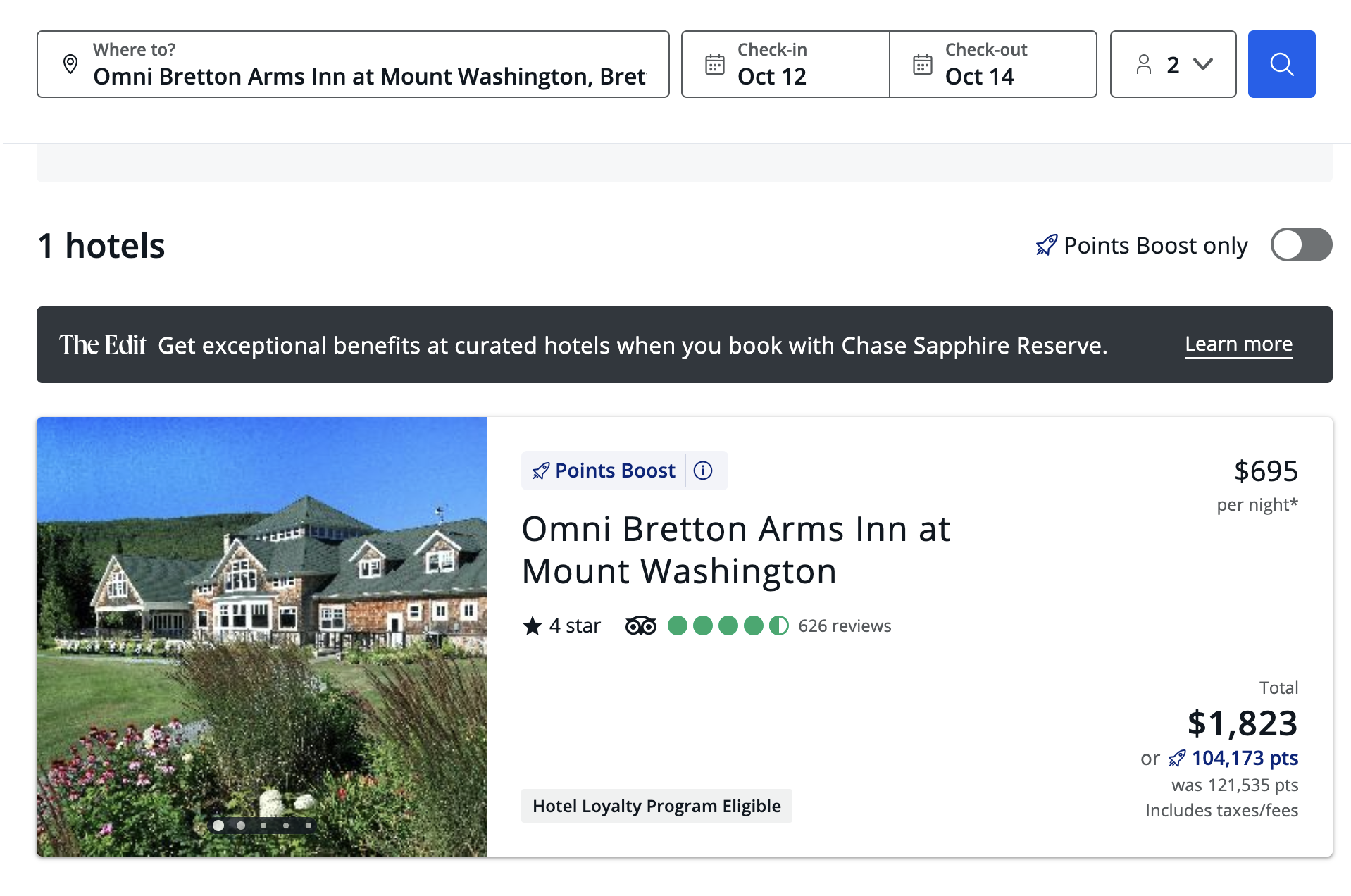

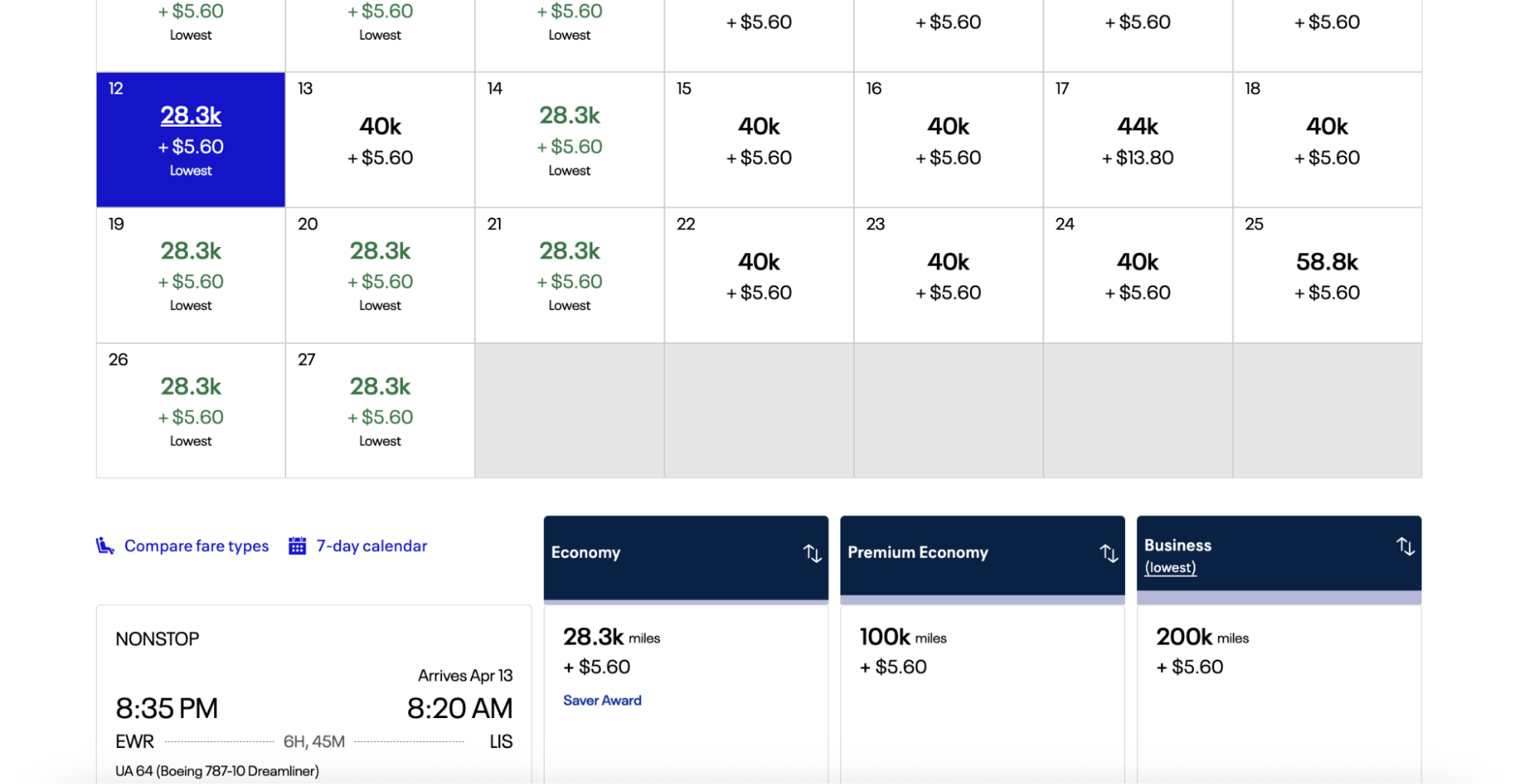

- Earn 8x points on all purchases through Chase Travel℠, including The Edit℠ and 4x points on flights and hotels booked direct. Plus, earn 3x points on dining worldwide & 1x points on all other purchases

- $300 annual travel credit as reimbursement for travel purchases charged to your card each account anniversary year.

- Access over 1,300 airport lounges worldwide with a complimentary Priority Pass

Select membership, plus every Chase Sapphire Lounge® by The Club with two guests. Plus, up to $120 towards Global Entry, NEXUS, or TSA PreCheck® every 4 years

Select membership, plus every Chase Sapphire Lounge® by The Club with two guests. Plus, up to $120 towards Global Entry, NEXUS, or TSA PreCheck® every 4 years - Get up to $150 in statement credits every six months for a maximum of $300 annually for dining at restaurants that are part of Sapphire Reserve Exclusive Tables.

- Count on Trip Cancellation/Interruption Insurance, Auto Rental Coverage, Lost Luggage Insurance, no foreign transaction fees, and more.

- Get complimentary Apple TV+, the exclusive streaming home of Apple Originals. Plus Apple Music – all the music you love, across all your devices. Subscriptions run through 6/22/27 – a value of $250 annually

- Member FDIC

Select membership, plus every Chase Sapphire Lounge® by The Club with two guests. Plus, up to $120 towards Global Entry, NEXUS, or TSA PreCheck® every 4 years

Select membership, plus every Chase Sapphire Lounge® by The Club with two guests. Plus, up to $120 towards Global Entry, NEXUS, or TSA PreCheck® every 4 years

Leave a Reply