Rates on personal loans declined last week, giving qualified borrowers a chance to secure a reasonable interest rate and finance a project, purchase or even unexpected bills.

From May 12 to May 17, the average fixed interest rate on a three-year personal loan was 14.20% for borrowers with a credit score of at least 720 who prequalified on Credible.com’s personal loan marketplace. That’s down 1.07 percentage points from the previous week, according to Credible.com. The average rate on five-year personal loans fell last week from 20.37% to 19.70%.

The rate you’ll actually receive depends on several factors, including your credit profile and the loans available through your chosen lender. Borrowers with the highest credit scores are likely to receive rates significantly lower than average.

These rates are accurate as of May 17, 2025, and based on the three-year fixed rate.

Related: Best Personal Loans

Current Personal Loan Interest Rates for May 20, 2025

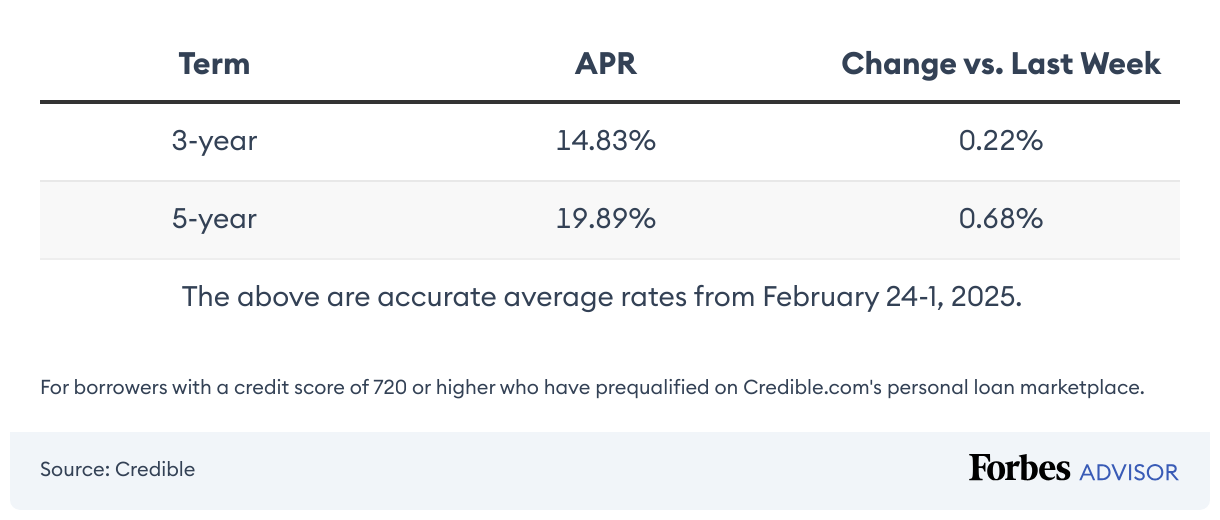

Personal loan rates fluctuate frequently, and each lender determines and sets different rates. While your rate isn’t guaranteed until you sign your loan agreement, you can get an idea of average lender rates below.

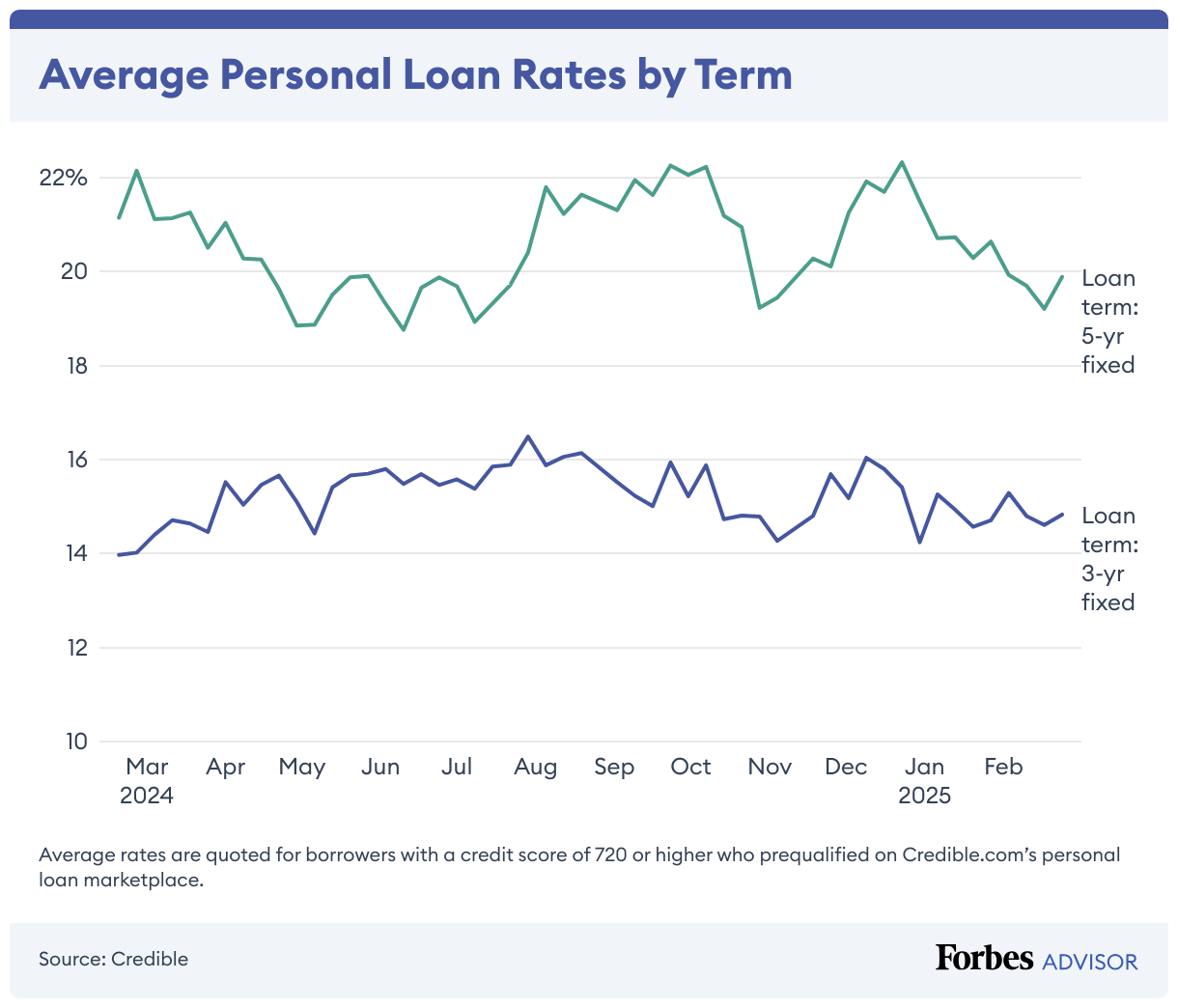

Personal Loan Rate Trends Over Time

The table below compares personal loan rates for three- and five-year terms to help you understand rate trends. Lenders typically consider your loan term and credit history to determine your interest rate.

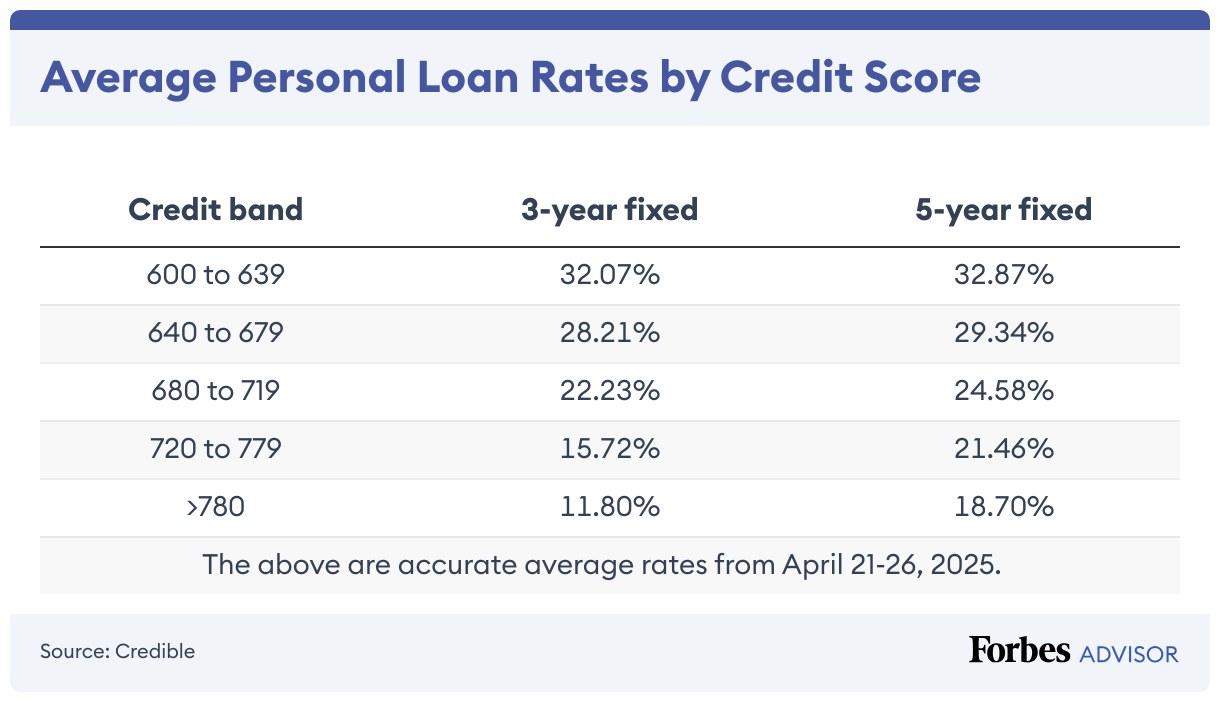

Personal Loan Rates by Credit Score

Your credit score plays a major role in the interest rate a lender offers for a personal loan. Lenders use your credit profile and other factors to evaluate your risk as a borrower. In general, the higher your credit score, the lower the interest rate you’ll receive.

The table below compares average personal loan interest rates by credit score, showing how much your score can affect your rate and how much you could save over time.

How To Get the Best Personal Loan Rates

Since each lender sets its own personal loan rates, use these three simple steps to compare personal loan interest rates:

- Prequalify. Prequalifying with multiple lenders lets you find and compare potential personal loan interest rates. You’ll see terms and amounts you may be eligible for without impacting your credit score. It’s not an offer of credit, however, and your loan isn’t guaranteed until you submit a formal application and sign your loan agreement, which will affect your score.

- Review your offers. After prequalification, review and compare your offers. In some cases, the lowest rates may be the cheapest loan option since origination and other fees can increase your cost of borrowing. Comparing all of the loan features can help you find the best option for your situation.

- Submit an application. After you’ve compared choices, collect all necessary documentation, including your bank statements, W-2s and photo identification. Submitting an application results in a hard credit inquiry, which temporarily dings your credit score.

Related: 5 Personal Loan Requirements To Know Before Applying

Should I Get a Personal Loan?

We recommend you get a personal loan only when it’s necessary. If you’re considering a personal loan, these steps can help you understand if it’s the right choice:

- Identify why you need funds. Before taking out a personal loan, understand how you would use the funds. Some common personal loan uses include home improvement, debt consolidation and covering emergency expenses. It’s best to avoid using personal loans for nonessential expenses that you could potentially save up for, like vacations and holiday gifts.

- Determine how much financing you need. Once you identify why you need the funds, calculate how much you need to cover your costs. This amount will typically inform you of the loan amount you need or if you can use an alternative.

- Consider personal loan alternatives. If you only need to borrow a small amount of money, such as under $2,000, consider alternative options such as a payday alternative loan (PAL) or a buy now, pay later service.

- Find a lender that fits your needs. If you can’t find an alternative that fits your needs, find a personal loan lender that provides sufficient financing.

Pro Tip

In some cases, getting a personal loan may not be the best decision. For example, we don’t recommend a personal loan if you can’t afford the monthly payments or if you can wait to save up the money you need.

Where To Get a Personal Loan

Personal loans are available through a variety of institutions, which should help you find a lender that meets your needs. Your credit profile and financing needs typically determine the best lender for you. You can get personal loans from:

- Banks: Best for in-person banking or if you have an existing banking relationship.

- Credit unions: Best for existing credit union members or those who meet a local credit union’s eligibility requirements.

- Online lenders: Best for an online-only experience with flexible requirements.

Frequently Asked Questions (FAQs)

Why is my APR so high with good credit?

While borrowers with strong credit typically get more favorable interest rates, lenders also rely on current market conditions to set interest rates. If you have good credit but your annual percentage rate (APR) is high, it may mean interest rates are generally high. That said, it can also mean your income isn’t high enough to qualify for lower rates or your debt-to-income ratio (DTI) is too high.

Why is interest on personal loans so high?

High personal loan interest rates are a result of current market conditions and/or low credit scores. Lenders set their interest rates based on the economy and your credit profile. If you want to get the lowest rates possible, work on improving your credit score and debt-to-income (DTI) ratio before applying.

Leave a Reply