Understanding current mortgage rates and refinance rates in Arkansas is essential if you’re planning to buy a home or refinance your existing mortgage. These rates directly impact monthly payments and long-term borrowing costs, but they fluctuate based on numerous factors, including market trends, economic conditions and federal policies.

We evaluated the current Arkansas mortgage and refinance rates to help you understand these fluctuations and navigate the Arkansas housing market. Our team also looked at mortgage rate trends and tips for buying a home and finding the best mortgage rates in Arkansas. Keeping an eye on current rates can help you save money on your mortgage and stay within your budget.

Today’s Mortgage Rates in Arkansas

Arkansas’s average APR on a 30-year mortgage climbed 0.089 points to 6.335% over the past week, according to data from the Mortgage Research Center. The rate is down 0.236 points over the last 90 days and basically flat over the last 30 days.

The state’s average APR for the benchmark 15-year fixed mortgage increased 0.125 points to 5.465% over the past week. Over the last 90 days, the rate is down 0.098 points; it’s up 0.072 points over the last 30 days.

The average APR for a 30-year jumbo mortgage increased 0.063 points to 6.768% since last week. It’s down 0.093 points over the last 90 days and up 0.069 points over the last 30 days.

30-year fixed-rate mortgage:

- Today. The average APR for the benchmark 30-year fixed mortgage is 6.335%.

- Last week. 6.246%.

15-year fixed-rate mortgage:

- Today. The average APR on a 15-year fixed mortgage is 5.465%.

- Last week. 5.34%.

30-year fixed-rate jumbo mortgage:

- Today. The average APR on the 30-year fixed-rate jumbo mortgage is 6.768%.

- Last week. 6.705%.

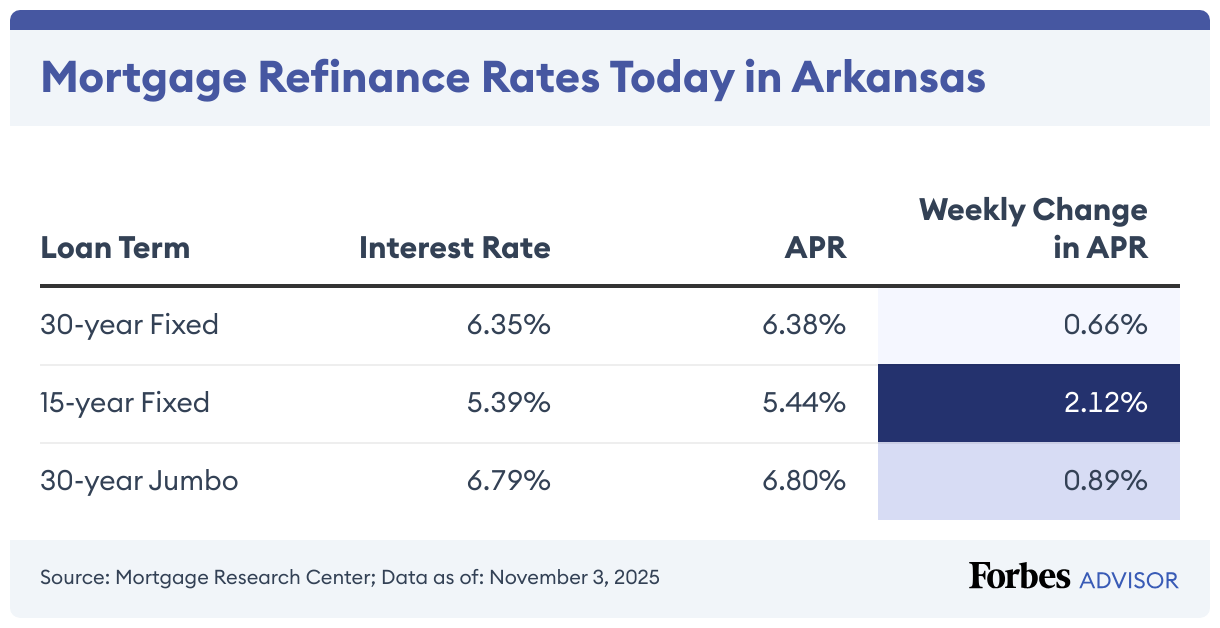

Today’s Refinance Rates in Arkansas

Arkansas’s average APR for the benchmark 30-year fixed refinance mortgage climbed 0.042 points to 6.38% compared to a week ago. The rate is down 0.243 points over the last 90 days and down 0.029 points over the last 30 days.

The average APR in the state on a 15-year refinanced mortgage increased 0.113 points to 5.439% weekly. Over the last 90 days, the rate is down 0.127 points over the last 90 days; it’s up 0.082 points over the last 30 days.

For jumbo 30-year refinanced mortgages, the average APR increased 0.06 points to 6.802% week-to-week. It’s down 0.158 points over the last 90 days and up 0.056 points over the last 30 days.

30-year fixed-rate refinance mortgage:

- Today. The average APR for the benchmark 30-year fixed mortgage is 6.38%.

- Last week. 6.338%.

15-year fixed-rate refinance mortgage:

- Today. The average APR on a 15-year fixed mortgage is 5.439%.

- Last week. 5.326%.

30-year fixed-rate jumbo refinance mortgage:

- Today. The average APR on the 30-year fixed-rate jumbo mortgage is 6.802%.

- Last week. 6.742%.

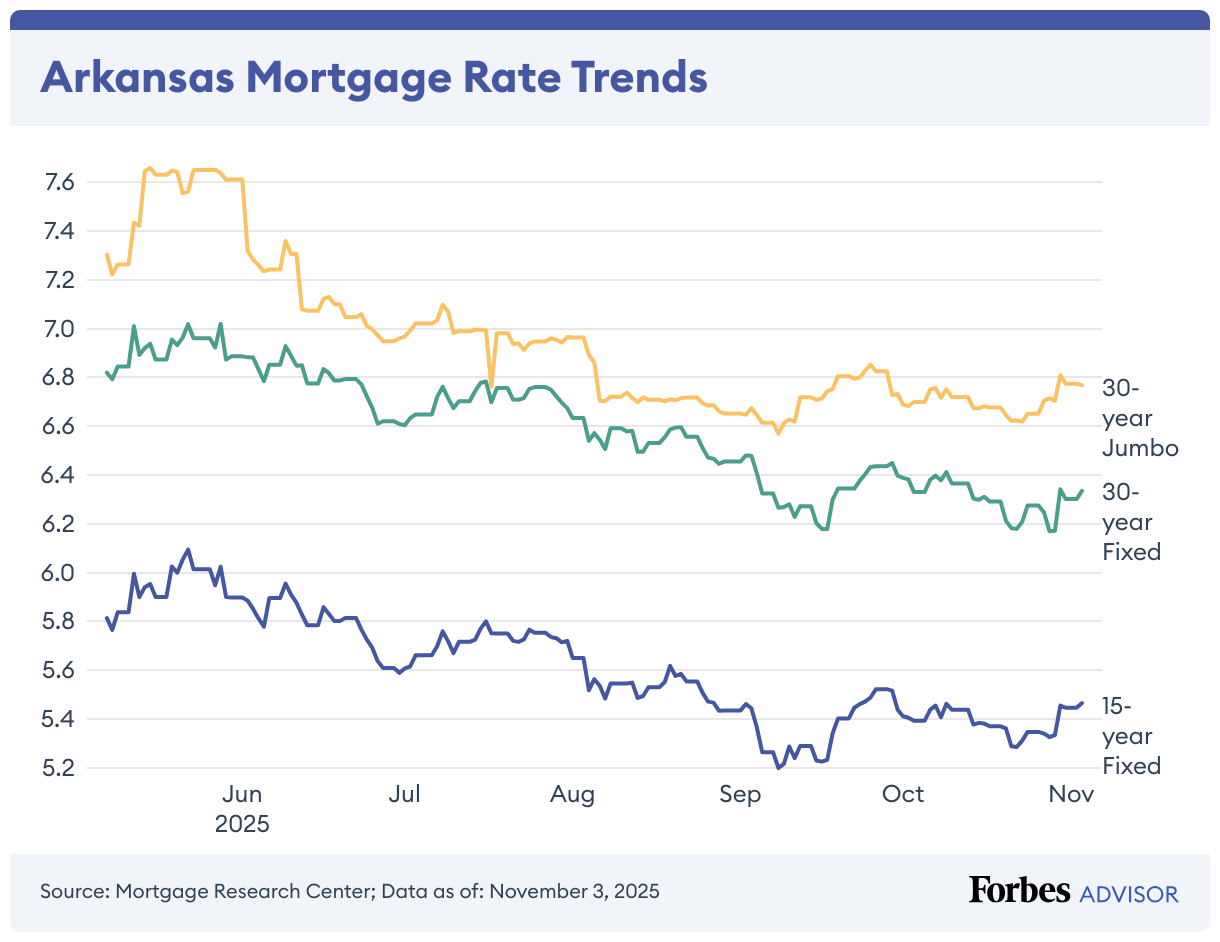

Arkansas Mortgage Rate Trends

Following mortgage rate trends can help you track patterns and changes in the Arkansas housing market over time. By understanding these trends, you can make more informed decisions about when to purchase a home, refinance or lock in a rate for a second mortgage. If you’re well-qualified, analyzing Arkansas mortgage rate trends may help you save money over the life of the loan.

Mortgage rates in Arkansas have trended downward over the last three months, as have national rates.

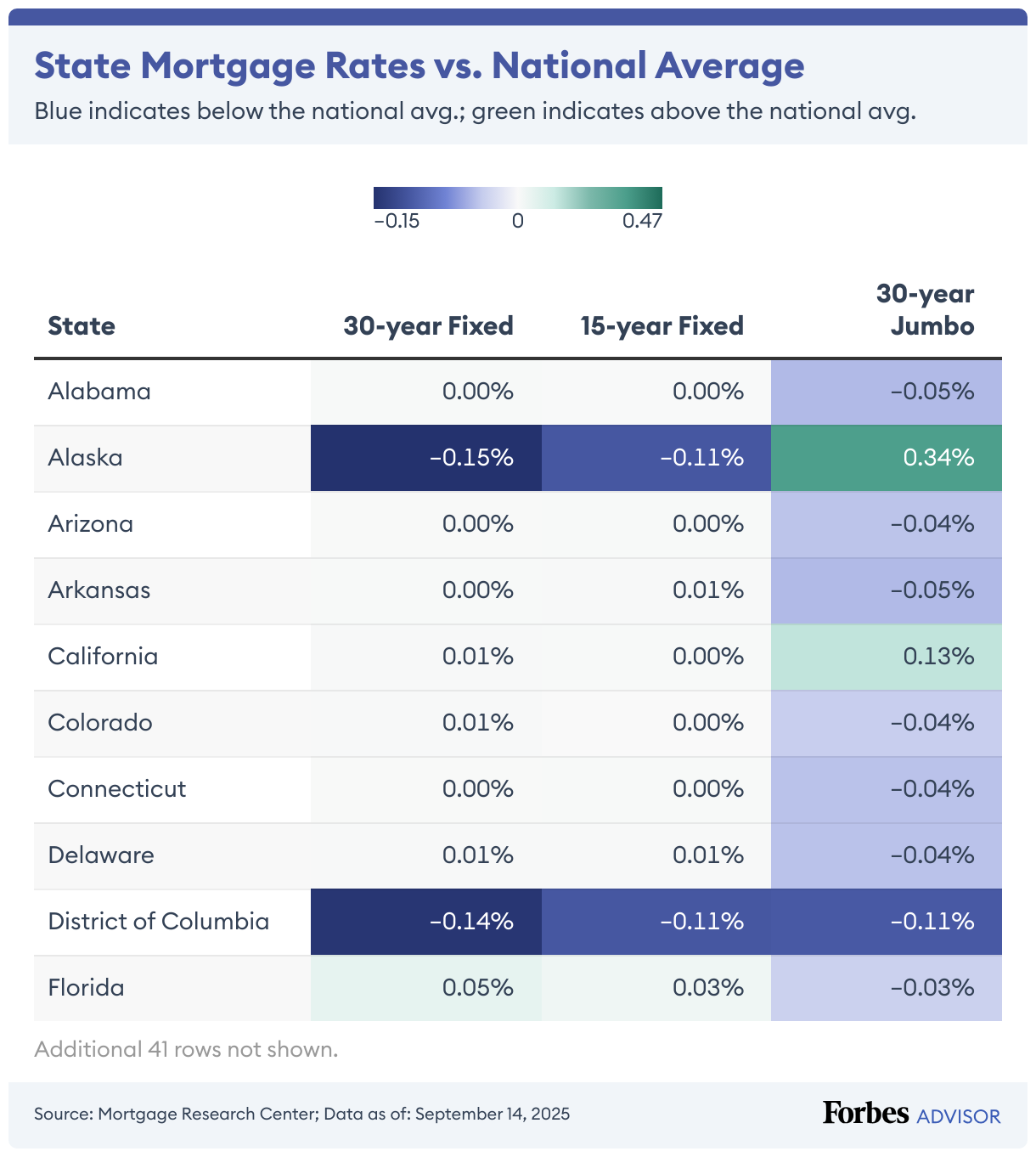

Arkansas Mortgage Rates vs. National Mortgage Rates

State mortgage rates generally move in line with the national average, but there are state-level differences.

Today’s average mortgage rate in Arkansas is 6.335%, while the national average rate is 6.335%.

Arkansas’s mortgage refinance rate today is 6.38% versus the national average of 6.389% – 0.009 percentage points lower than the national average.

Use the chart below to explore the differences between states.

Buying a House in Arkansas

Arkansas offers a unique blend of natural beauty and affordable living that makes it an appealing option for many homebuyers. Whether you prefer city life in Little Rock or outdoor adventures in the Ozarks, the Natural State offers a wide range of options to call home. Partnering with a local agent can make it easier to navigate the real estate market and find a property that meets your lifestyle and budget. By staying informed of Arkansas market conditions and home-buying rules, you can take the next steps with confidence.

How to Get the Best Mortgage Rates in Arkansas

You’ll need to do a bit of planning and research to get the best mortgage rates in Arkansas. Current interest rates and trends can vary widely across different regions, so start by understanding what to expect in your area. Then, shop around to compare offers from multiple lenders, including banks, credit unions and online mortgage providers.

You may also qualify for more favorable rates if you maintain a strong credit score, provide a substantial down payment and demonstrate a stable financial history. Consult with a local mortgage broker or financial advisor who’s familiar with the Arkansas housing market to gain valuable insights and navigate the process more efficiently. By staying informed and proactive, you can find a mortgage rate that best fits your financial situation and home-buying goals.

Find the Best Mortgage Lenders of 2025

Find Competitive Mortgage Rates Near You

Leave a Reply