Last week, personal loan rates increased. However, it’s still possible for highly qualified borrowers to pick up a reasonable interest rate on a personal loan. If you’re interested in financing a major purchase or project, it’s a good time to shop for a loan.

From May 26 to May 31, the average fixed rate on a three-year personal loan was 13.93% for borrowers with a credit score of at least 720 who prequalified on Credible.com’s personal loan marketplace. The rate was 12.99% the previous week, according to Credible.com. The average rate on a five-year personal loan fell 1.01 percentage points last week to 18.71% from 19.72%.

Remember, well-qualified borrowers may be offered rates well below average. The rate you’ll actually receive depends on several factors, like your credit profile and the loan terms you choose.

These rates are accurate as of May 31, 2025, and based on the three-year fixed rate.

Related: Best Personal Loans

Current Personal Loan Interest Rates for June 3, 2025

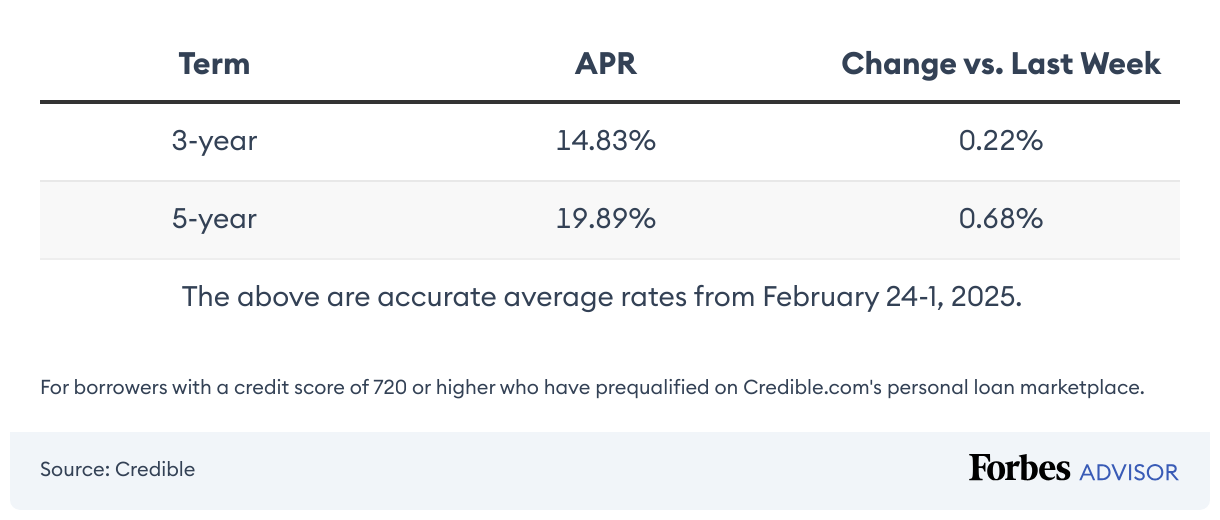

Personal loan rates fluctuate frequently, and each lender determines and sets different rates. While your rate isn’t guaranteed until you sign your loan agreement, you can get an idea of average lender rates below.

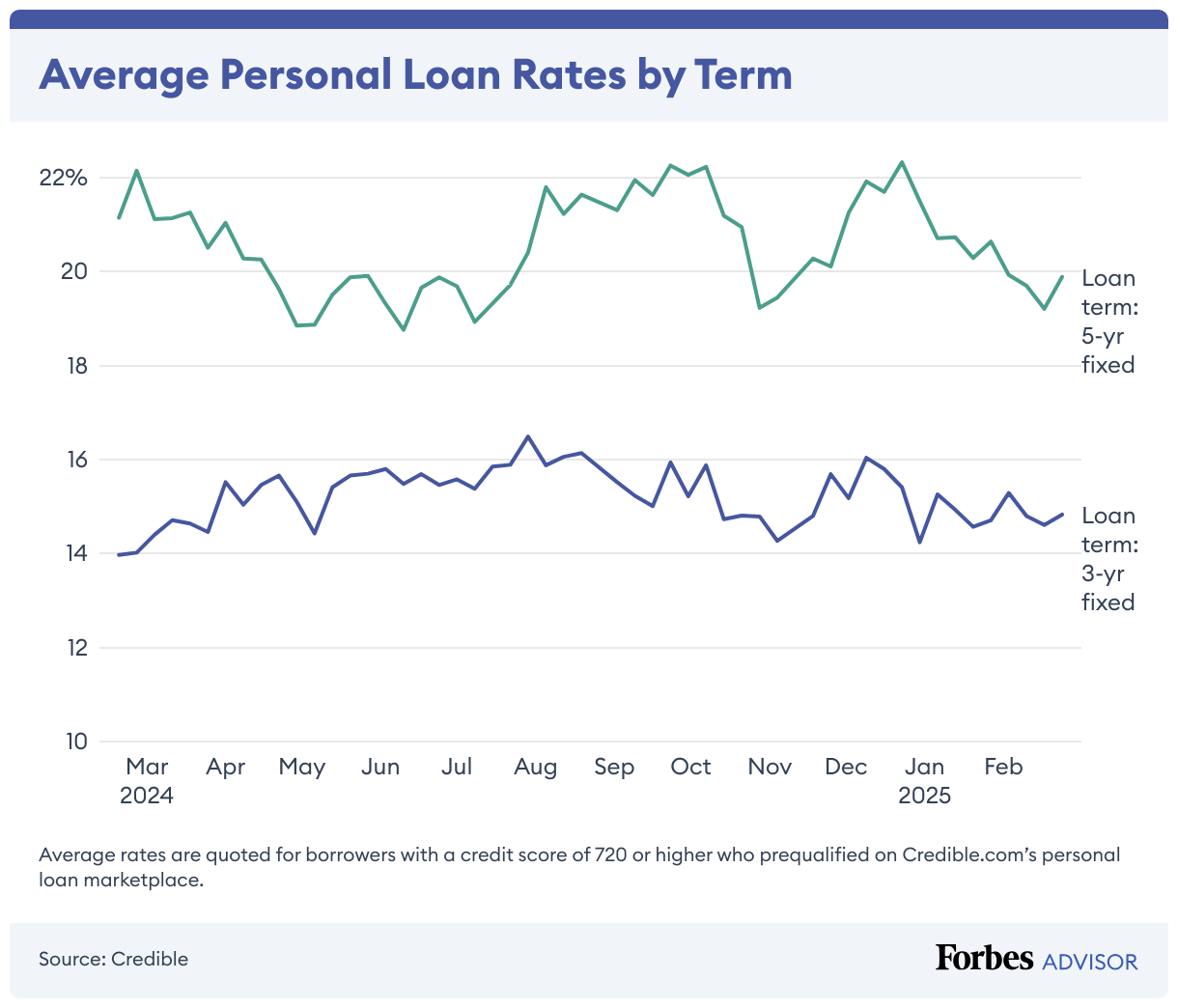

Personal Loan Rate Trends Over Time

The table below compares personal loan rates for three- and five-year terms to help you understand rate trends. Lenders typically consider your loan term and credit history to determine your interest rate.

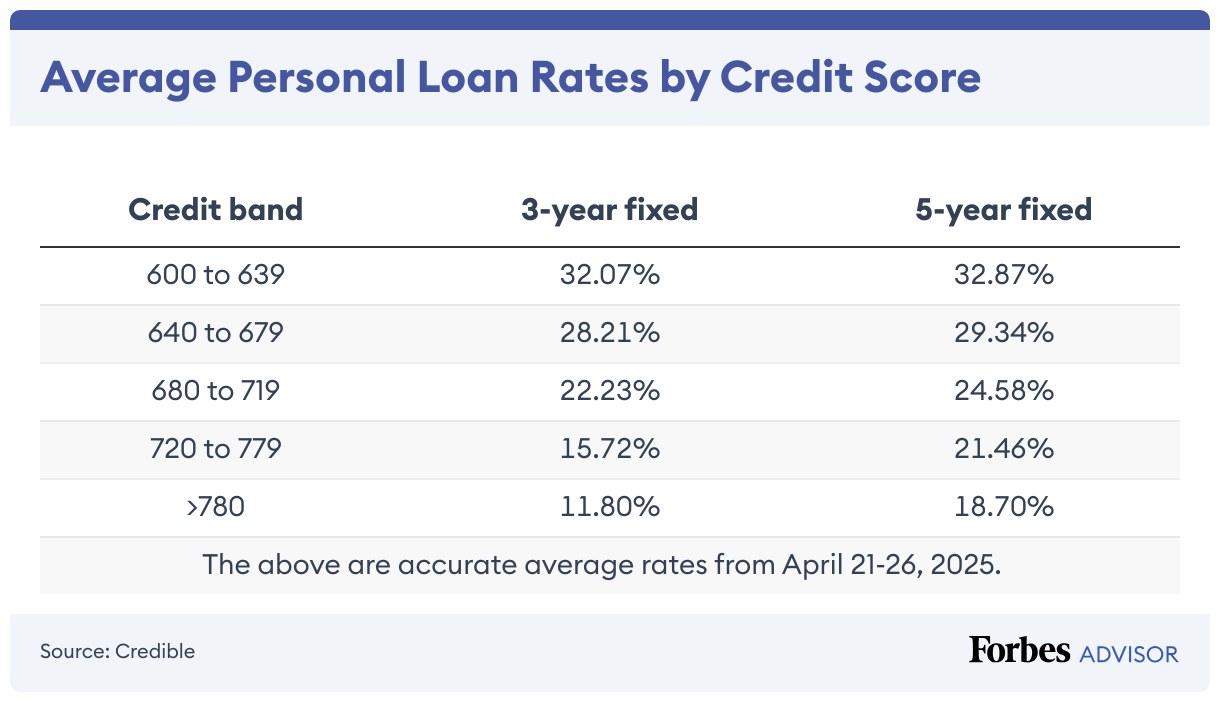

Personal Loan Rates by Credit Score

Your credit score plays a major role in the interest rate a lender offers for a personal loan. Lenders use your credit profile and other factors to evaluate your risk as a borrower. In general, the higher your credit score, the lower the interest rate you’ll receive.

The table below compares average personal loan interest rates by credit score, showing how much your score can affect your rate and how much you could save over time.

Get the Lowest Personal Loan Rates

Each lender sets its personal loan rates, so we recommend using these steps to land the best rates:

- Prequalify with multiple lenders. Prequalifying for a personal loan lets you check your eligibility and potential rates without impacting your credit score. While this doesn’t guarantee you’ll receive a loan, it can allow you to compare possible amounts and terms between lenders.

- Review your offers. Once you’ve seen if you prequalify, review and compare offers to find the best option. Consider the interest rate, loan amount, repayment terms and any fees. Depending on your financial situation, you also might want to consider lenders who don’t charge late payment fees or prepayment penalties.

- Apply. Once you’ve selected a lender, submit an application online or in person. Gather your documentation, including bank statements, pay stubs and identification. This requires a hard credit check that temporarily drops your score by a few points.

Related: 5 Personal Loan Requirements To Know Before Applying

Should I Get a Personal Loan?

We recommend you get a personal loan only when it’s necessary. If you’re considering a personal loan, these steps can help you understand if it’s the right choice:

- Identify why you need funds. Before taking out a personal loan, understand how you would use the funds. Some common personal loan uses include home improvement, debt consolidation and covering emergency expenses. It’s best to avoid using personal loans for nonessential expenses that you could potentially save up for, like vacations and holiday gifts.

- Determine how much financing you need. Once you identify why you need the funds, calculate how much you need to cover your costs. This amount will typically inform you of the loan amount you need or if you can use an alternative.

- Consider personal loan alternatives. If you only need to borrow a small amount of money, such as under $2,000, consider alternative options such as a payday alternative loan (PAL) or a buy now, pay later service.

- Find a lender that fits your needs. If you can’t find an alternative that fits your needs, find a personal loan lender that provides sufficient financing.

Pro Tip

In some cases, getting a personal loan may not be the best decision. For example, we don’t recommend a personal loan if you can’t afford the monthly payments or if you can wait to save up the money you need.

Where Can You Get a Personal Loan?

Personal loans are available through a variety of institutions, which should help you find a lender that meets your needs. Your credit profile and financing needs typically determine the best lender for you. You can get personal loans from:

- Banks: Best for in-person banking or if you have an existing banking relationship.

- Credit unions: Best for existing credit union members or those who meet a local credit union’s eligibility requirements.

- Online lenders: Best for an online-only experience with flexible requirements.

Frequently Asked Questions (FAQs)

Why is my APR so high with good credit?

While borrowers with strong credit typically get more favorable interest rates, lenders also rely on current market conditions to set interest rates. If you have good credit but your annual percentage rate (APR) is high, it may mean interest rates are generally high. That said, it can also mean your income isn’t high enough to qualify for lower rates or your debt-to-income ratio (DTI) is too high.

Is a 7% interest rate high for a personal loan?

Whether an interest rate is high depends on several factors, including current market conditions and your credit profile. Based on current average personal loan interest rates, a 7% interest rate would be considered competitive.

Leave a Reply