Category: Advisor

Here Are Today’s Mortgage Refinance Rates: November 17, 2025 – Rates Don’t Budge

30-year fixed refinance mortgage rates remained unchanged at 6.43% today, according to the Mortgage Research Center. For 15-year fixed refinance mortgages, the average rate is 5.42%, and for 20-year mortgages, the average is 6.12%. Related: Compare Current Refinance Rates !function(){“use strict”;window.addEventListener(“message”,(function(a){if(void 0!==a.data[“datawrapper-height”]){var e=document.querySelectorAll(“iframe”);for(var t in a.data[“datawrapper-height”])for(var r,i=0;r=e[i];i++)if(r.contentWindow===a.source){var d=a.data[“datawrapper-height”][t]+”px”;r.style.height=d}}}))}(); 30-Year Refinance Rates Climb 0.41% Currently, the […]

Today’s HELOC & Home Equity Loan Rates: November 17, 2025

Home equity loans and home equity lines of credit (HELOCs) allow homeowners to tap into the value of their homes. A home equity loan is a fixed-rate, lump-sum loan that allows homeowners to borrow up to 85% of their home’s value and pay that amount back in monthly installments. A home equity line of credit […]

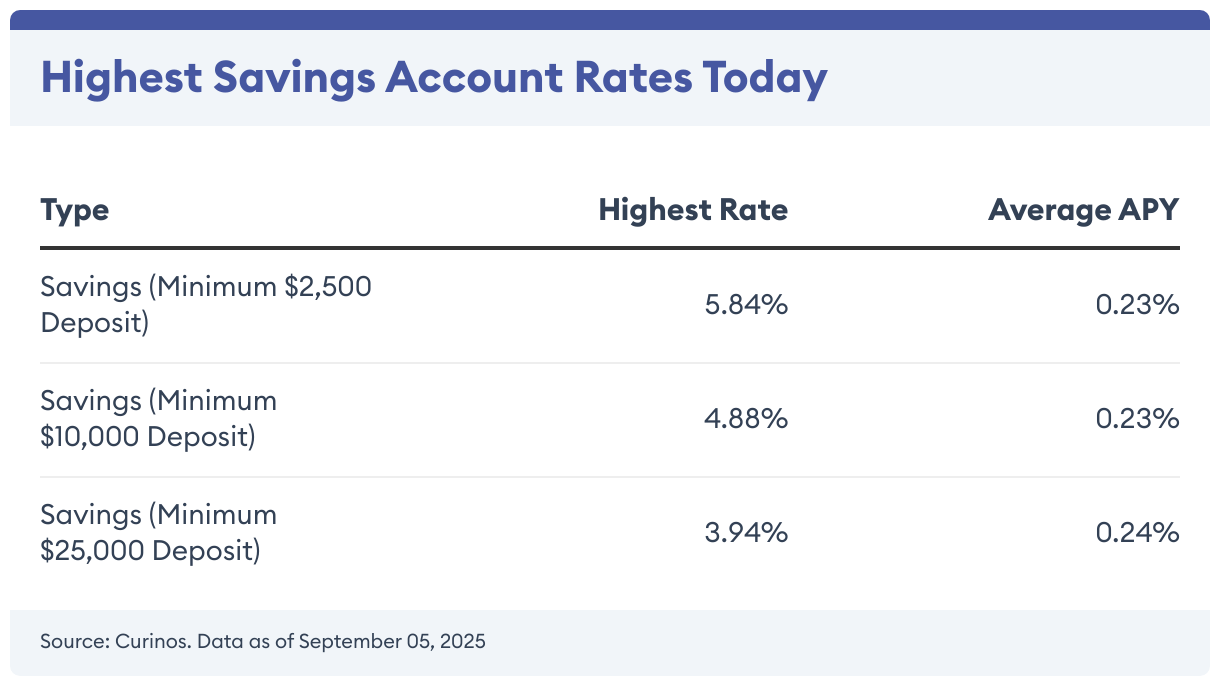

High-Yield Savings Account Rates Today: November 17, 2025 – Rates Are Steady

Key Takeaways Savings account yields are much higher than a few years ago Top rates may fall if the Federal Reserve cuts interest rates Online banks tend to offer the best yields available Rates on savings accounts are about the same versus last week. You can now earn as much as 5.84% on your savings. […]

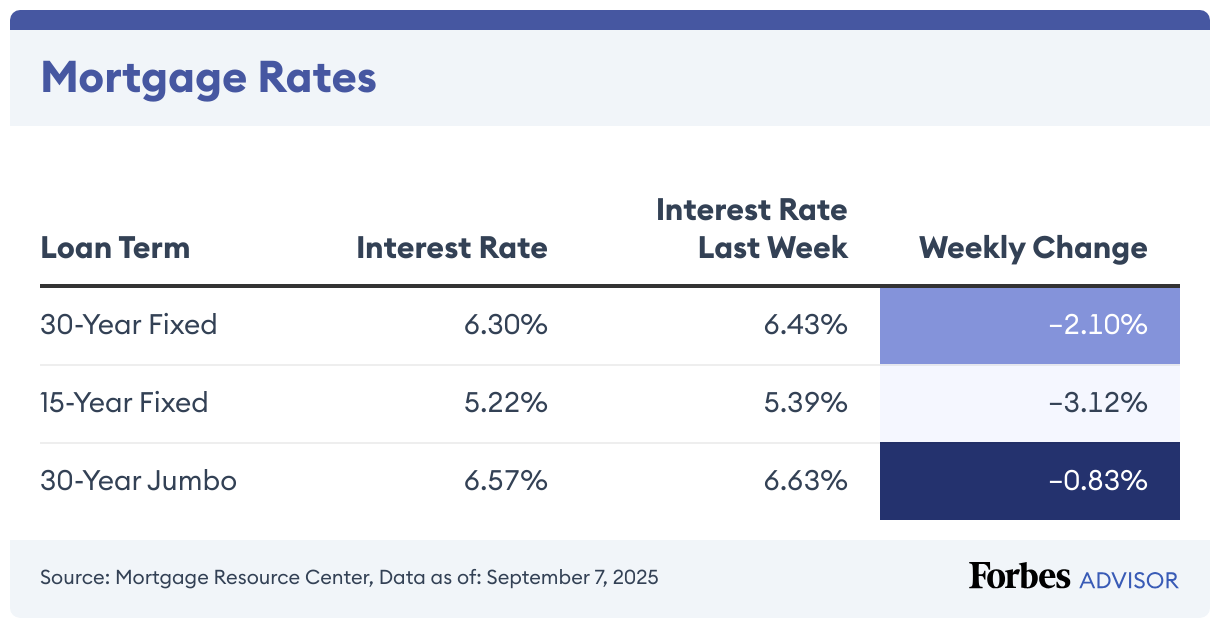

Mortgage Rates Today: November 17, 2025 – Rates Stand Still

Today, the mortgage interest rate on a 30-year fixed mortgage is 6.37%, according to the Mortgage Research Center, while the average rate on a 15-year mortgage is 5.45%. On a 30-year jumbo mortgage, the average rate is 6.74%. 30-Year Mortgage Rates Climb 0.81% Today’s average rate on a 30-year mortgage (fixed-rate) remained at 6.37% from […]

Launching Your Small Business: Practical Solutions To Early Challenges

Launching a small business is exciting, but it can also become overwhelming if you’re not sure where to start. From deciding whether to register as an S Corp or LLC to managing cash flow and finding the right talent, the early stages of starting a business might take some figuring out. But having the right […]

RIP To My Favorite T-Mobile Credit Card Hack

For the past couple of years, I’ve been using this credit card hack to earn rewards, receive free cellphone protection and get T-Mobile’s autopay discount every month. The steps involved weren’t advertised anywhere, but they’d dependably worked for me month after month. Unfortunately, like most good things, this credit card cheat code couldn’t stay in […]

High-Yield Savings Account Rates Today: November 11, 2025 – Rates Are Steady

Key Takeaways Savings account yields are much higher than a few years ago Top rates may fall if the Federal Reserve cuts interest rates Online banks tend to offer the best yields available Rates on savings accounts are relatively unchanged since last week. You can now earn as much as 5.84% on your savings. Shopping […]

Mortgage Rates Today: November 11, 2025 – Rates Hold Firm

The current average mortgage rate on a 30-year fixed mortgage is 6.31% with an APR of 6.34%, according to the Mortgage Research Center. The 15-year fixed mortgage has an average rate of 5.42% with an APR of 5.46%. On a 30-year jumbo mortgage, the average rate is 6.68% with an APR of 6.70%. 30-Year Mortgage Rates Climb […]

Today’s Top Money Market Account Rates For November 11, 2025 – Rates Hit 4.22%

Key Takeaways The highest money market account rate available today is 4.22% Changes from the Fed or your bank can quickly change money market rates Online banks typically offer the most competitive yields on the market Current Money Market Rates Right now, the average money market rate sits at 0.5%, but the best rate today […]

Current HELOC & Home Equity Loan Rates: November 11, 2025

Home equity loans and home equity lines of credit (HELOCs) allow homeowners to tap into the value of their homes. A home equity loan is a fixed-rate, lump-sum loan that allows homeowners to borrow up to 85% of their home’s value and pay that amount back in monthly installments. A home equity line of credit […]