Category: Advisor

Money Market Interest Rates Today: December 2, 2025 – Rates At 4.22%

Key Takeaways The highest money market account rate available today is 4.22% Changes from the Fed or your bank can quickly change money market rates Online banks typically offer the most competitive yields on the market Current Money Market Rates As of today, the highest money market rate is 4.22%, compared to a national average […]

Today’s HELOC & Home Equity Loan Rates: December 2, 2025

Home equity loans and home equity lines of credit (HELOCs) allow homeowners to tap into the value of their homes. A home equity loan is a fixed-rate, lump-sum loan that allows homeowners to borrow up to 85% of their home’s value and pay that amount back in monthly installments. A home equity line of credit […]

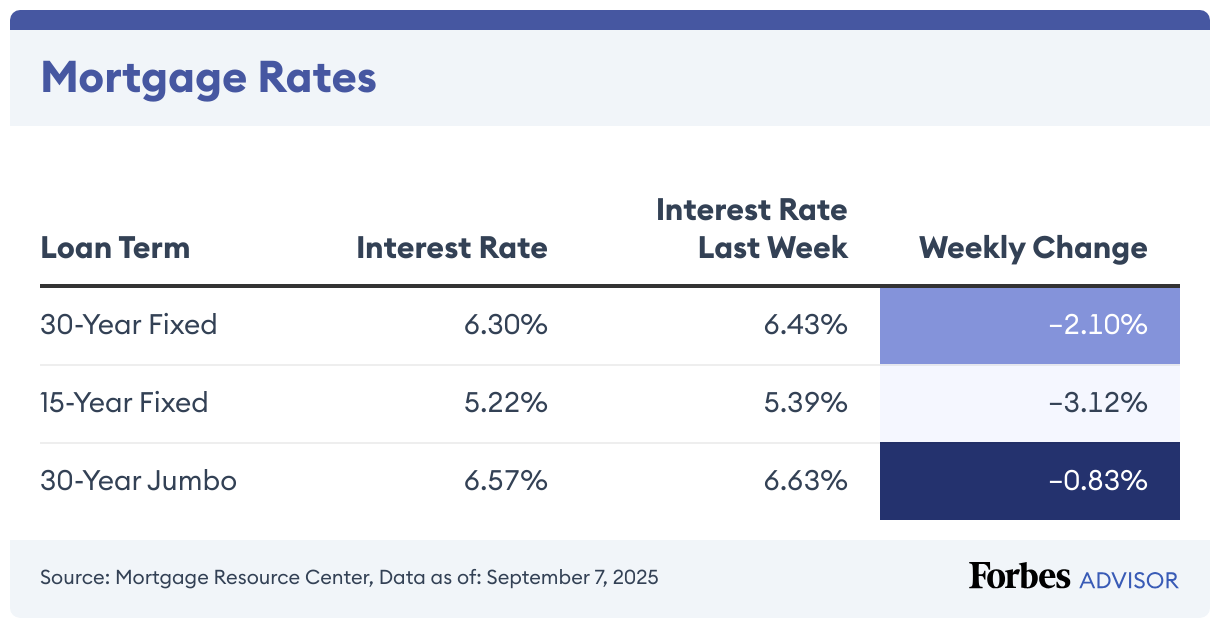

Mortgage Rates Today: December 2, 2025 – Rates Hold Steady

The current average mortgage rate on a 30-year fixed mortgage is 6.25%, according to the Mortgage Research Center. The average rate on a 15-year mortgage is 5.38%, while the average rate on a 30-year jumbo mortgage is 6.79%. 30-Year Mortgage Rates Climb 0.03% Today’s average rate on a 30-year, fixed-rate mortgage is 6.25%, which is 0.03% higher than last week. […]

Today’s Mortgage Refinance Rates: December 2, 2025 – Rates Move Up

The rate on a 30-year fixed refinance rose to 6.35% today, according to the Mortgage Research Center. Rates averaged 5.36% for a 15-year financed mortgage and 6.06% for a 20-year financed mortgage. Related: Compare Current Refinance Rates !function(){“use strict”;window.addEventListener(“message”,(function(a){if(void 0!==a.data[“datawrapper-height”]){var e=document.querySelectorAll(“iframe”);for(var t in a.data[“datawrapper-height”])for(var r,i=0;r=e[i];i++)if(r.contentWindow===a.source){var d=a.data[“datawrapper-height”][t]+”px”;r.style.height=d}}}))}(); 30-Year Fixed-Rate Mortgage Refinance Rates Climb 0.13% At 6.35%, […]

Private Student Loan Rates: December 1, 2025—Loan Rates Move Down

The average interest rate on 10-year fixed-rate private student loans moved down last week. For many borrowers, that means rates continue to be low enough to make private student loans a decent option, especially if you have good credit. /*! purgecss start ignore */.tns-outer{padding:0!important}.tns-outer [hidden]{display:none!important}.tns-outer [aria-controls],.tns-outer [data-action]{cursor:pointer}.tns-slider{transition:all 0s}.tns-slider>.tns-item{box-sizing:border-box}.tns-horizontal.tns-subpixel{white-space:nowrap}.tns-horizontal.tns-subpixel>.tns-item{display:inline-block;vertical-align:top;white-space:normal}.tns-horizontal.tns-no-subpixel:after{clear:both;content:””;display:table}.tns-horizontal.tns-no-subpixel>.tns-item{float:left}.tns-horizontal.tns-carousel.tns-no-subpixel>.tns-item{margin-right:-100%}.tns-gallery,.tns-no-calc{left:0;position:relative}.tns-gallery{min-height:1px}.tns-gallery>.tns-item{left:-100%;position:absolute;transition:transform 0s,opacity 0s}.tns-gallery>.tns-slide-active{left:auto!important;position:relative}.tns-gallery>.tns-moving{transition:all .25s}.tns-autowidth{display:inline-block}.tns-lazy-img{opacity:.6;transition:opacity .6s}.tns-lazy-img.tns-complete{opacity:1}.tns-ah{transition:height 0s}.tns-ovh{overflow:hidden}.tns-visually-hidden{left:-10000em;position:absolute}.tns-transparent{opacity:0;visibility:hidden}.tns-fadeIn{filter:alpha(opacity=100);opacity:1;z-index:0}.tns-fadeOut,.tns-normal{filter:alpha(opacity=0);opacity:0;z-index:-1}.tns-vpfix{white-space:nowrap}.tns-vpfix>div,.tns-vpfix>li{display:inline-block}.tns-t-subp2{height:10px;margin:0 auto;overflow:hidden;position:relative;width:310px}.tns-t-ct{position:absolute;right:0;width:2333.3333333%;width:2333.33333%;width:2333.3333333333%}.tns-t-ct:after{clear:both;content:””;display:table}.tns-t-ct>div{float:left;height:10px;width:1.4285714%;width:1.42857%;width:1.4285714286%} /*! […]

Here Are Today’s Mortgage Refinance Rates: December 1, 2025 – Rates Hold Steady

30-year fixed refinance mortgage rates didn’t budge at 6.24% today, according to the Mortgage Research Center. Rates averaged 5.28% for a 15-year financed mortgage and 6.06% for a 20-year financed mortgage. Related: Compare Current Refinance Rates !function(){“use strict”;window.addEventListener(“message”,(function(a){if(void 0!==a.data[“datawrapper-height”]){var e=document.querySelectorAll(“iframe”);for(var t in a.data[“datawrapper-height”])for(var r,i=0;r=e[i];i++)if(r.contentWindow===a.source){var d=a.data[“datawrapper-height”][t]+”px”;r.style.height=d}}}))}(); 30-Year Refinance Rates Drop 2.12% The current 30-year, fixed-rate mortgage […]

Mortgage Rates Today: December 1, 2025 – Rates Hold Firm

Today’s average mortgage rate on a 30-year fixed-rate mortgage is 6.19%, down 1.45% from the previous week, according to the Mortgage Research Center. Borrowers may be able to save on interest costs by going with a 15-year fixed mortgage, which will typically have a lower rate than a 30-year, fixed-rate home loan. The average APR on a 15-year fixed mortgage […]

QuickBooks Payroll Review: Features, Pros And Cons

If you’re on the search for a new payroll solution for your business, QuickBooks Payroll may have come up as an option. But I’m going to be frank—unless you’re already using QuickBooks in some capacity, I don’t think this is the best payroll software. It’s expensive, has relatively basic features and lacks the tools that […]

Mortgage Refinance Rates Today: November 26, 2025 – Rates Dip

The rate on a 30-year fixed refinance slipped to 6.27% today, according to the Mortgage Research Center. Rates averaged 5.33% for a 15-year financed mortgage and 6.02% for a 20-year financed mortgage. Related: Compare Current Refinance Rates !function(){“use strict”;window.addEventListener(“message”,(function(a){if(void 0!==a.data[“datawrapper-height”]){var e=document.querySelectorAll(“iframe”);for(var t in a.data[“datawrapper-height”])for(var r,i=0;r=e[i];i++)if(r.contentWindow===a.source){var d=a.data[“datawrapper-height”][t]+”px”;r.style.height=d}}}))}(); 30-Year Refinance Rates Drop 2.50% At 6.27%, the average rate on a 30-year fixed-rate mortgage […]

Current HELOC & Home Equity Loan Rates: November 26, 2025

Home equity loans and home equity lines of credit (HELOCs) allow homeowners to tap into the value of their homes. A home equity loan is a fixed-rate, lump-sum loan that allows homeowners to borrow up to 85% of their home’s value and pay that amount back in monthly installments. A home equity line of credit […]