Category: Advisor

High-Yield Savings Account Rates Today: September 29, 2025 – Rates Are Steady

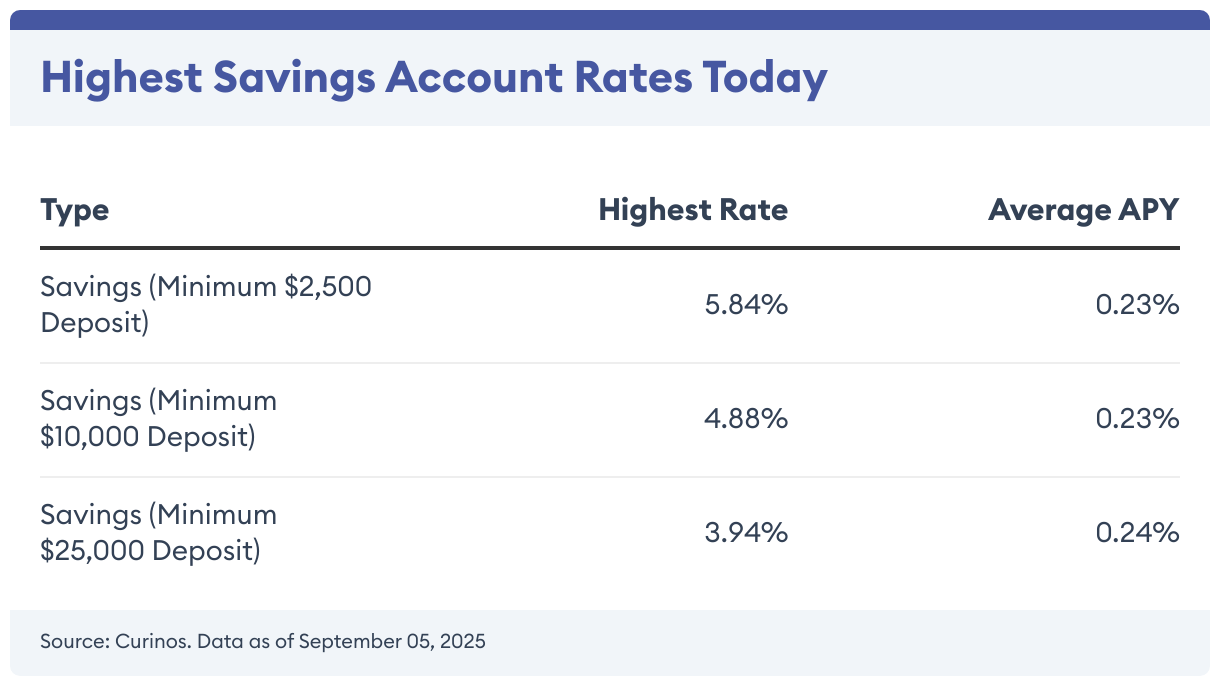

Key Takeaways Savings account yields are much higher than a few years ago Top rates may fall if the Federal Reserve cuts interest rates Online banks tend to offer the best yields available Rates on savings accounts have held steady versus last week. You can now earn as much as 5.50% on your savings. Shopping […]

Current Mortgage Refinance Rates: September 29, 2025 – Rates Remain Unchanged

30-year fixed refinance mortgage rates didn’t move at 6.49% today, according to the Mortgage Research Center. The average rate on a 15-year mortgage refinance is 5.46%. On a 20-year mortgage refinance, the average rate is 6.15%. Related: Compare Current Refinance Rates !function(){“use strict”;window.addEventListener(“message”,(function(a){if(void 0!==a.data[“datawrapper-height”]){var e=document.querySelectorAll(“iframe”);for(var t in a.data[“datawrapper-height”])for(var r,i=0;r=e[i];i++)if(r.contentWindow===a.source){var d=a.data[“datawrapper-height”][t]+”px”;r.style.height=d}}}))}(); 30-Year Refinance Rates Climb 1.38% […]

Best Online Sports Management Degrees Of 2025

The sports industry offers exciting career prospects for sports fans and business professionals alike, but multiple paths can lead you to different aspects of this field. To help you make the right decision about which of the best online sports management degrees is right for you, Forbes Advisor reviewed nearly 160 schools offering sport management […]

Amazon, Chase And Bank Of America Credit Cards Can Help You Slash Halloween Spending This Year

Pumpkin spice isn’t the only thing everywhere this fall—so is consumer spending. According to the National Retail Federation, Americans are gearing up for a record-breaking Halloween, with total spending expected to reach an all-time high of $13.1 billion this year. That includes everything from candy and costumes to decorations and last-minute party supplies, and all […]

Costco Is Having Another Great Quarter: How To Get In On The Stock

Costco isn’t just an affordable place to shop; it’s also a strong place to invest. The company’s latest quarterly earnings beat expectations. Here’s how you can start putting your money where you eat. Peak Performer Costco has clearly nailed down a winning business model. In an unsurprising Q4 earnings report, the company performed steadily, increasing […]

Rising Drug Tariffs Loom: UnitedHealthcare And Cigna Plans To Check In Medicare Open Enrollment

Starting October 1, the U.S. is taking a hard stance on pharmaceutical manufacturing: Imported brand-name, patented drugs will face a 100% tariff unless the companies behind them are already building plants in America. The White House says the move is about strengthening supply chains, but there’s a more immediate concern for consumers—higher prescription prices could […]

Stagecoach Is A Must-Go For Country Music Fans: Your Amex Card Can Get You First Access

Country music fans, it’s time to bust out the festival fits. Goldenvoice, the creator of the Coachella Music Festival, has announced next year’s Stagecoach lineup. Here’s how you can get first dibs on presale tickets with your American Express credit card. Giddy Up Coachella-lite for country lovers, Stagecoach takes place on the same festival grounds […]

CD Rates Today: September 23, 2025 – Rates Fall

Key Takeaways Today’s highest CD rate is 4.94% for a jumbo 6-month CD. CD rates from online banks are commonly twice as high as the national average rates. CD ladders let you leverage high rates without locking up all of your money long-term. The best interest rates on CDs (certificates of deposit) currently top out […]

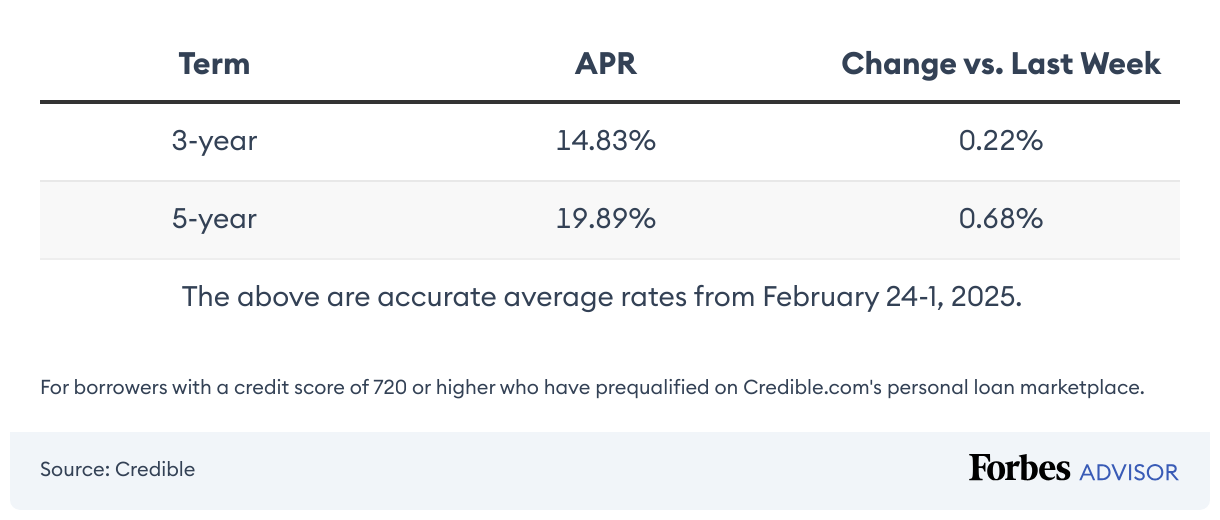

This Week’s Personal Loan Rates: September 23, 2025—Rates Inch Down Again

Rates on personal loans dropped last week. This means if you’re in the market for a personal loan, whether to finance a project or major purchase, you can grab a worthwhile interest rate, so long as you’re a qualified borrower. From September 15 to September 20, the average fixed rate on a three-year personal loan […]

Money Market Interest Rates Today: September 23, 2025 – Rates At 4.35%

Key Takeaways The highest money market account rate available today is 4.35% Changes from the Fed or your bank can quickly change money market rates Online banks typically offer the most competitive yields on the market Current Money Market Rates As of today, the highest money market rate is 4.35%, compared to a national average […]