Category: Advisor

Today’s Top Money Market Account Rates For October 28, 2025 – Rates Hit 4.22%

Key Takeaways The highest money market account rate available today is 4.22% Changes from the Fed or your bank can quickly change money market rates Online banks typically offer the most competitive yields on the market Current Money Market Rates The current average money market rate is 0.51%, while the highest rate is up to […]

CD Rates Today: October 28, 2025 – Rates As High As 4.94%

Key Takeaways Today’s highest CD rate is 4.94% for a jumbo 6-month CD. CD rates from online banks are commonly twice as high as the national average rates. CD ladders let you leverage high rates without locking up all of your money long-term. The best interest rates on CDs—certificates of deposit—range as high as 4.94% […]

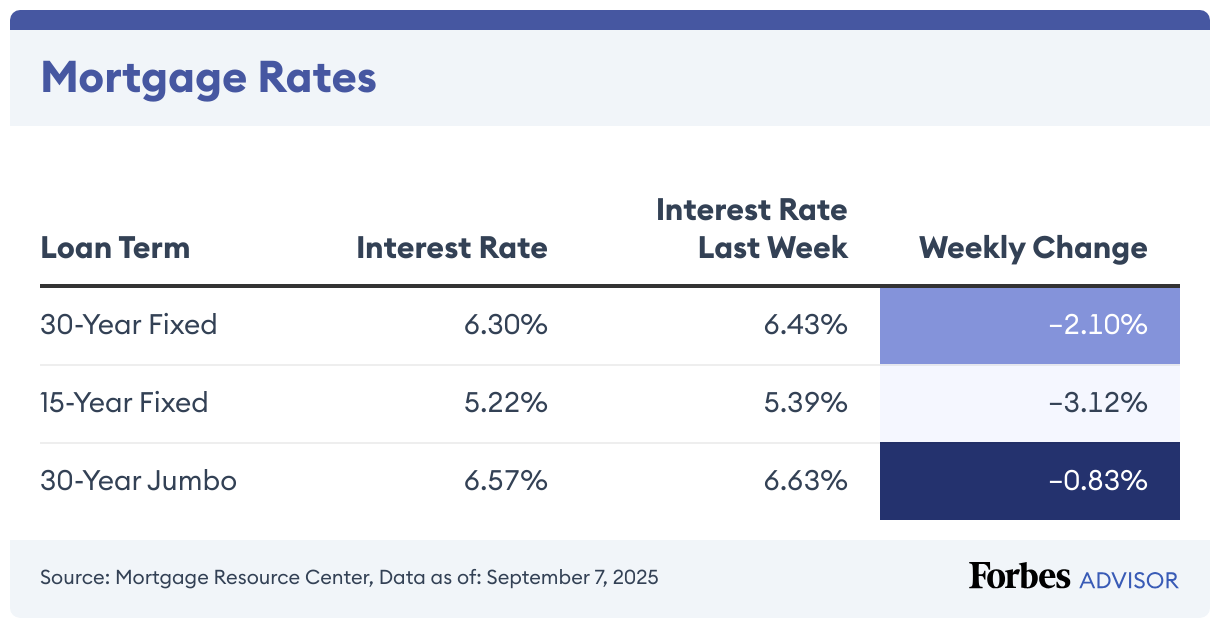

Mortgage Rates Today: October 28, 2025 – Rates Stand Still

Currently, the average interest rate on a 30-year fixed mortgage is 6.22%, compared to 6.19% a week ago, according to the Mortgage Research Center. For borrowers who want to pay off their home faster, the average rate on a 15-year fixed mortgage is 5.30%, down 0.38% from the previous week. If you’re thinking about refinancing […]

Latest HELOC & Home Equity Loan Rates: October 28, 2025

Home equity loans and home equity lines of credit (HELOCs) allow homeowners to tap into the value of their homes. A home equity loan is a fixed-rate, lump-sum loan that allows homeowners to borrow up to 85% of their home’s value and pay that amount back in monthly installments. A home equity line of credit […]

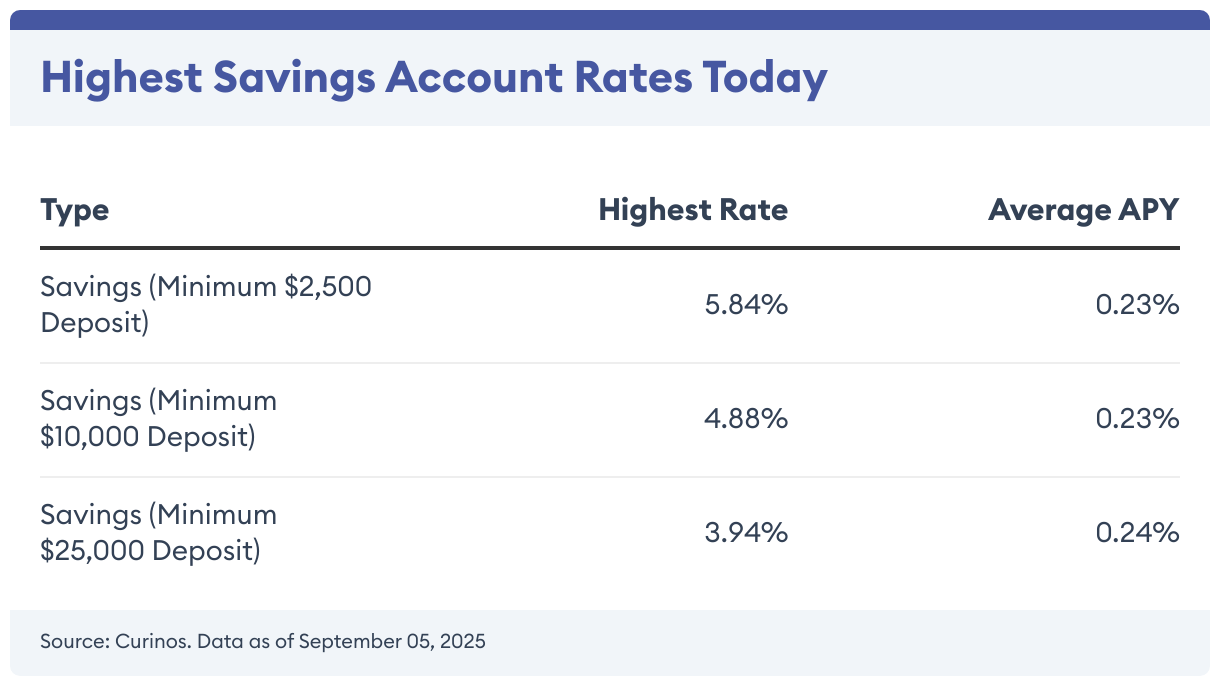

High-Yield Savings Account Rates Today: October 28, 2025 – Rates Are Steady

Key Takeaways Savings account yields are much higher than a few years ago Top rates may fall if the Federal Reserve cuts interest rates Online banks tend to offer the best yields available Rates on savings accounts are about the same from last week. You can now earn as much as 4.50% on your savings. […]

Limited-Time World Of Hyatt Credit Card Offers Add 60,000 Points And A Faster Path To Elite Status

If you frequently stay at Hyatt properties, you may find new value in The World of Hyatt Credit Card*. For a limited time, new cardholders can earn 30,000 bonus points after spending $3,000 on purchases in the first 3 months from account opening, plus up to 30,000 bonus points by earning 2 points total per […]

Best Credit Cards For Cruises Of 2025

Navigating the waters of cruise credit cards isn’t always smooth sailing. While cruise-branded cards might seem appealing, they often have stingy rewards and inflexible benefits. To find the best credit cards for cruises, we focused on options that reward spending broadly, offer valuable redemptions and include perks like travel insurance, no foreign transaction fees and […]

Delta SkyMiles Platinum Business American Express Card Review 2025

The Delta SkyMiles® Platinum Business American Express Card (terms apply, see rates & fees) is ideal for business travelers who frequently fly (or can fly) Delta. The card’s annual Companion Certificate alone can make up for its annual fee, and the free checked bag and 15% off award travel discounts seal the deal.

Latest HELOC & Home Equity Loan Rates: October 27, 2025

Home equity loans and home equity lines of credit (HELOCs) allow homeowners to tap into the value of their homes. A home equity loan is a fixed-rate, lump-sum loan that allows homeowners to borrow up to 85% of their home’s value and pay that amount back in monthly installments. A home equity line of credit […]

High-Yield Savings Account Rates Today: October 27, 2025 – Rates Are Steady

Key Takeaways Savings account yields are much higher than a few years ago Top rates may fall if the Federal Reserve cuts interest rates Online banks tend to offer the best yields available Rates on savings accounts have held steady versus a week ago. You can now earn up to 5.50% on your savings. Searching […]