Category: Advisor

Best Cash-Back Credit Cards Of 2025

Instead of weeding through rules for earning miles and points, sometimes you want rewards you can easily understand: dollars and cents. To rank the best cash-back credit cards of 2025, we narrowed down more than 400 credit cards to those offering cash-back rewards (or flexible rewards that could be cashed out at 1 cent per […]

CD Rates Today: November 10, 2025 – Earn As Much As 4.94%

Key Takeaways Today’s highest CD rate is 4.94% for a jumbo 6-month CD. CD rates from online banks are commonly twice as high as the national average rates. CD ladders let you leverage high rates without locking up all of your money long-term. The best interest rates on CDs (certificates of deposit) currently top out at 4.94%, […]

Current Mortgage Refinance Rates: November 10, 2025 – Rates Hold Steady

30-year fixed refinance mortgage rates didn’t move at 6.4% today, according to the Mortgage Research Center. Rates averaged 5.41% for a 15-year financed mortgage and 6.06% for a 20-year financed mortgage. Related: Compare Current Refinance Rates !function(){“use strict”;window.addEventListener(“message”,(function(a){if(void 0!==a.data[“datawrapper-height”]){var e=document.querySelectorAll(“iframe”);for(var t in a.data[“datawrapper-height”])for(var r,i=0;r=e[i];i++)if(r.contentWindow===a.source){var d=a.data[“datawrapper-height”][t]+”px”;r.style.height=d}}}))}(); 30-Year Refinance Rates Climb 0.96% Currently, the average rate for […]

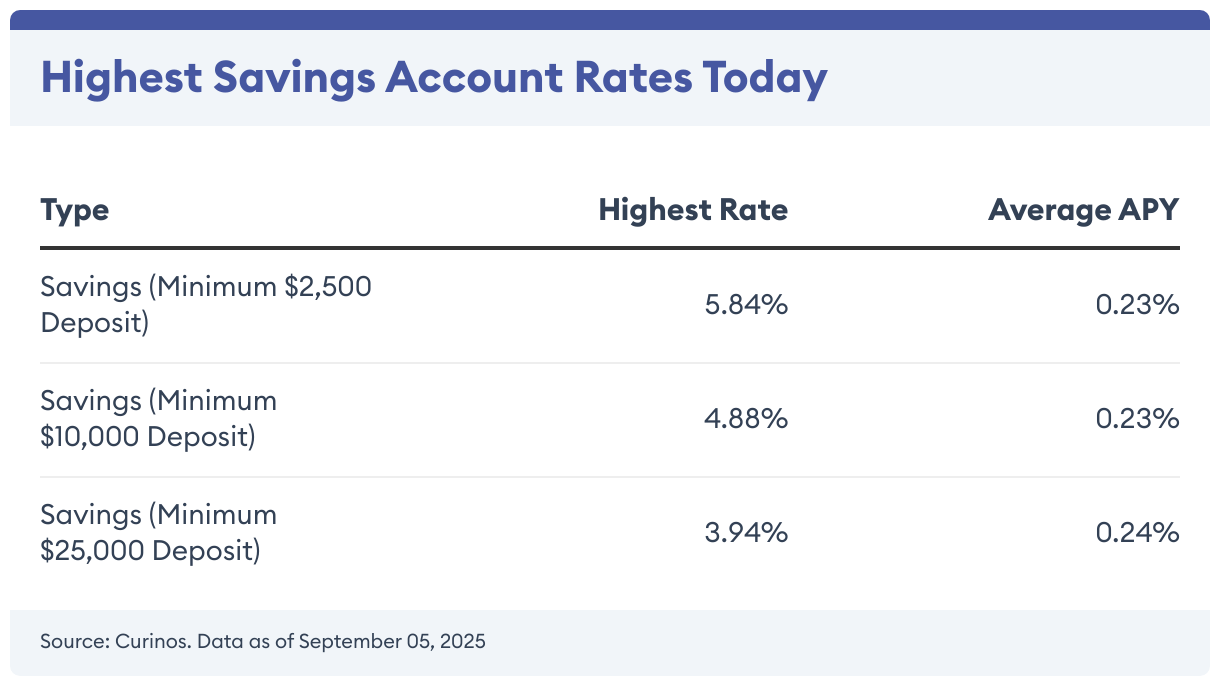

High-Yield Savings Account Rates Today: November 10, 2025 – Rates Are Steady

Key Takeaways Savings account yields are much higher than a few years ago Top rates may fall if the Federal Reserve cuts interest rates Online banks tend to offer the best yields available Rates on savings accounts are relatively unchanged versus last week. You can now earn as much as 5.84% on your savings. In the market for an […]

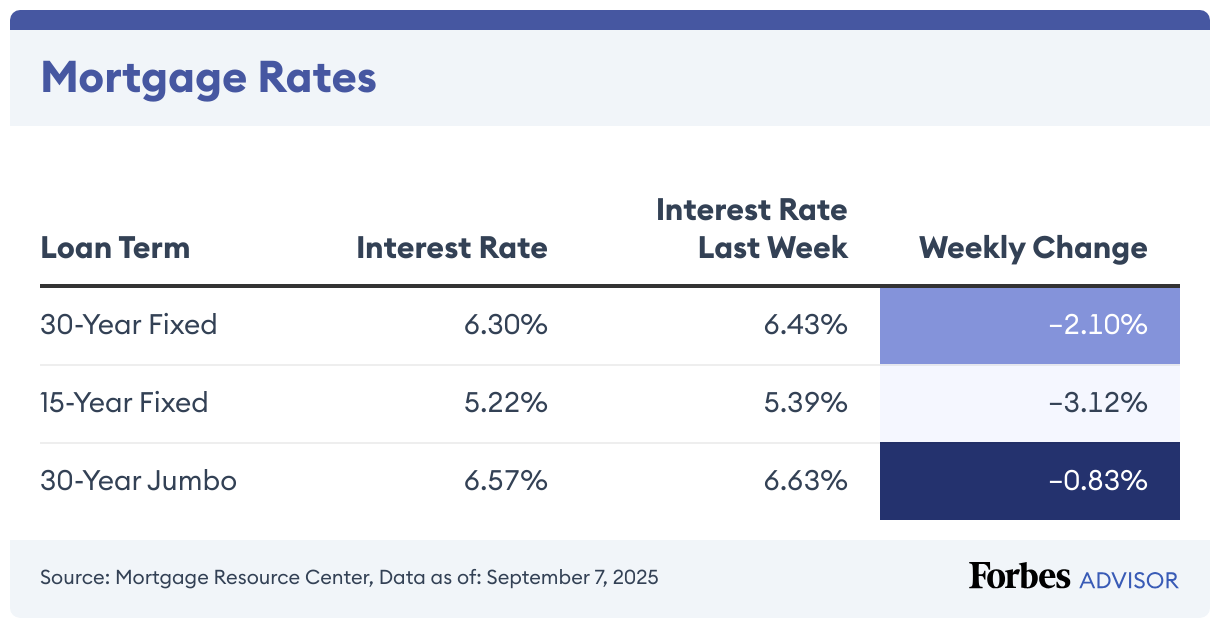

Mortgage Rates Today: November 10, 2025 – Rates Stand Still

The current average mortgage rate on a 30-year fixed mortgage is 6.32% with an APR of 6.34%, according to the Mortgage Research Center. The 15-year fixed mortgage has an average rate of 5.45% with an APR of 5.49%. On a 30-year jumbo mortgage, the average rate is 6.68% with an APR of 6.70%. 30-Year Mortgage Rates Climb 0.64% Today, the average rate on a 30-year mortgage […]

Current HELOC & Home Equity Loan Rates: November 10, 2025

Home equity loans and home equity lines of credit (HELOCs) allow homeowners to tap into the value of their homes. A home equity loan is a fixed-rate, lump-sum loan that allows homeowners to borrow up to 85% of their home’s value and pay that amount back in monthly installments. A home equity line of credit is a variable-rate second mortgage that […]

Money Market Interest Rates Today: November 10, 2025 – Earn Up To 4.22%

Key Takeaways The highest money market account rate available today is 4.22% Changes from the Fed or your bank can quickly change money market rates Online banks typically offer the most competitive yields on the market Current Money Market Rates The current average money market rate is 0.5%, while the highest rate is up to […]

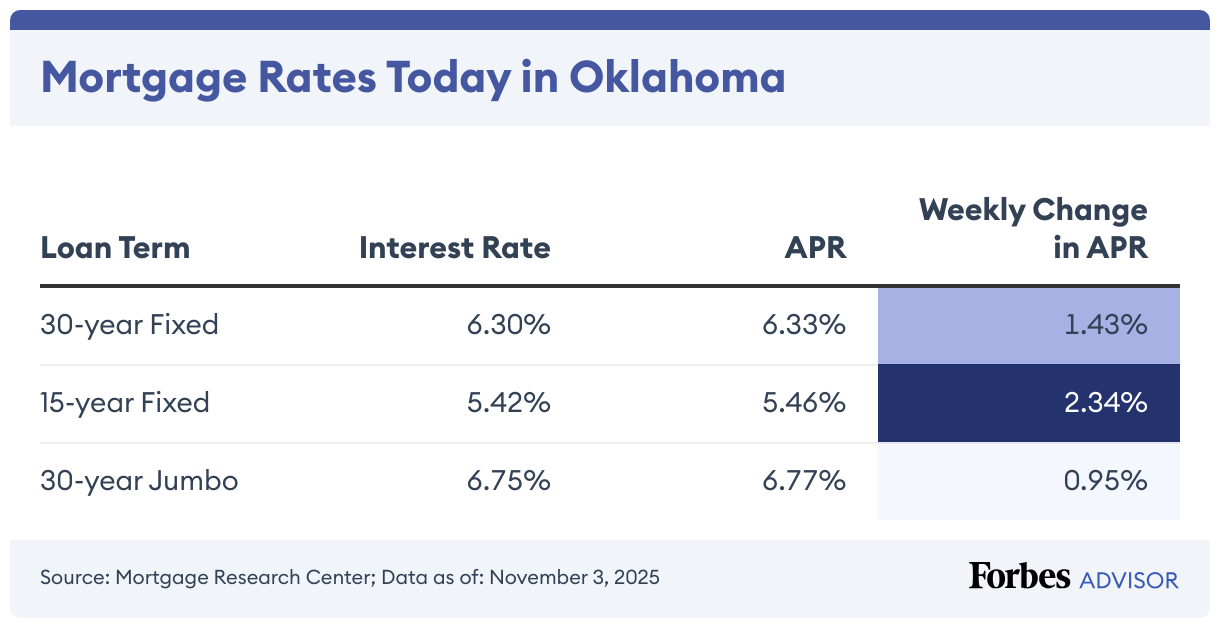

Current Oklahoma Mortgage And Refinance Rates

Whether you’re searching for a new home or planning to refinance, understanding mortgage and refinance rates is essential to navigating Oklahoma’s housing market. That said, interest rates aren’t set in stone, and they fluctuate based on economic factors, like 10-year Treasury yields, market conditions, inflation and Federal Reserve policy. We summarized the current Oklahoma mortgage and refinance rates to help you understand these […]

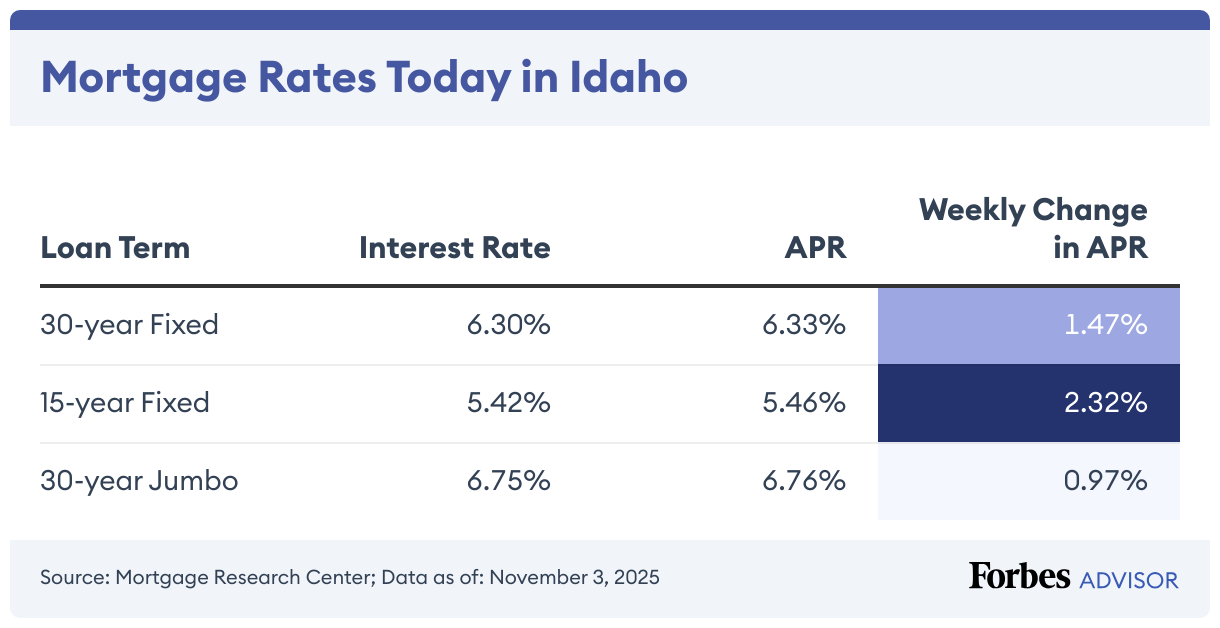

Current Idaho Mortgage And Refinance Rates

Whether you’re searching for a new home or planning to refinance, understanding mortgage and refinance rates is essential to navigating Idaho’s housing market. That said, interest rates aren’t set in stone, and they fluctuate based on economic factors, like 10-year Treasury yields, market conditions, inflation and Federal Reserve policy. We summarized the current Idaho mortgage and refinance rates to help you understand these […]

Current Nebraska Mortgage And Refinance Rates

Understanding current mortgage rates and refinance rates in Nebraska is essential if you’re planning to buy a home or refinance your existing mortgage. These rates directly impact monthly payments and long-term borrowing costs, but they fluctuate based on numerous factors, including market trends, economic conditions and federal policies. We evaluated the current Nebraska mortgage and […]